Securing health policy coverage is essential for a successful application and visa approval when applying for a Colombian visa. Choosing 1, 2 or 3 years of health policy coverage that meets the regulatory criteria set by the Ministry of Foreign Affairs ensures you have the best coverage during your stay in Colombia, allowing you to relax and enjoy your time without hassle.

Opting for shorter policies increases the risk of your visa’s validity being limited, potentially requiring multiple renewals and complicating your immigration process. In this blog, we will confidently outline the benefits of a 1, 2-year, or 3-year health policy, detail the necessary coverages and conditions that align with visa requirements, and guide you on securing this vital coverage effectively.

What is Travel Health Coverage for Colombian Visa Applications?

A travel health policy for a Colombian visa application is an essential requirement set by the Colombian government for foreign nationals applying for various visa types, including the Digital Nomad Visa, Student Visa, Retirement Visa, Investor Visa, Annuity/Rentist Visa, Medical Treatment Visa, Tourist Visa, and others within the Migrant and Visitor visa categories.

This coverage guarantees that foreign visitors to Colombia have reliable access to medical services throughout their stay. The Colombian government mandates international travel health policy to ensure that foreign nationals are adequately protected, especially in cases where the public health system may not provide full coverage, following stipulations outlined in Resolution 5477 of 2022.

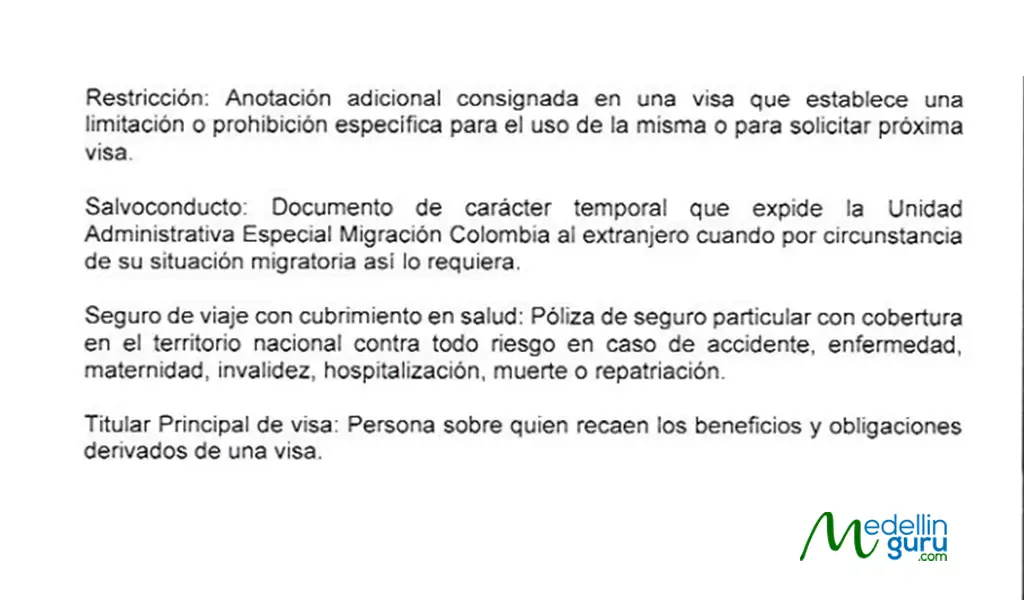

Travel health policy with health coverage: Private health policy with nationwide coverage against all risks in case of accident, illness, maternity, disability, hospitalization, death, or repatriation.

Chapter 1, Article 3, Definition in Resolution 5477 of 2022

What if my visa category doesn’t list the health policy requirement?

While a health policy is mandatory for Visitor (V-Type) visas and some Migrant (M-Type) visas (such as Retirement Visa and Investment Visa), it is highly recommended for all M-Visa applicants. Although not explicitly required for every Migrant Visa, securing comprehensive coverage demonstrates foresight and responsibility, which can be viewed favorably during the application process, increasing the chances of receiving an approval for an extended time that matches your health policy coverage, whether you acquire coverage for up to 1, 2, or even 3 years.

Furthermore, given the unpredictable nature of living abroad, an EG Assist policy is a crucial safeguard, offering peace of mind for you and your family throughout your stay, making it a wise and commercial decision regardless of any mandatory regulations.

Also, navigating the Colombian visa process can be complex, but that’s why Medellin Guru recommends our expert partner, expatgroup.co, for receiving expert assistance in migratory, legal, and health policy needs and ensuring applicants meet all requirements, including the essential travel health policy mandated by the Colombian government. For a smooth and successful visa application experience, you should contact expatgroup.co for comprehensive support. Reach out today to start your journey!

What Makes Colombia's Healthcare Attractive to Expats for Purchasing the 1, 2 or 3-year Visa Health Policy?

The Colombian healthcare system is renowned as one of the premier medical providers for expatriates, consistently ranking among the best in Latin America. This exceptional reputation ensures that travel health policy coverage is backed by partnerships with the country’s finest hospitals, delivering top-notch care and support. When it comes to securing the ideal health policy, you can confidently choose options that even include two years of comprehensive coverage, resting assured during your stay in Colombia, you’ll have access to outstanding medical services tailored to your needs.

The Best Healthcare System in Latin America.

The World Health Organization (WHO) ranks Colombia’s healthcare system at an impressive #22 out of 191 countries, making it the top system in Latin America. This achievement highlights Colombia’s exceptional healthcare standards, surpassing many wealthier nations, including the United States (#37), Germany (#25), Canada (#30), and Australia (#32).

Affordable Cost of Healthcare

Colombia offers access to world-class healthcare at significantly lower costs than the U.S. and Europe. Healthcare expenses in Colombia can be from 50% to over 70% cheaper than those in the United States. Medical assistance in Colombia is also relatively affordable compared to its counterparts in the U.S. and Europe.

Due to these lower costs, Colombia is witnessing a steady increase in medical tourism each year, with foreigners traveling for various services, including dental care, eye surgery, cosmetic surgery, and other procedures. Many hospitals in Colombia accommodate this influx of medical tourists by employing bilingual staff and becoming ready to provide excellent healthcare services.

Best Hospitals in Latin America

Many believe that the Colombian healthcare system lacks efficiency. However, Colombia stands out as one of the countries with the best medical centers in Latin America. The country has 11 hospitals and clinics on the ranking, of which 2 are in the top 10, according to the 2023 ranking by América Economía. The ranking is based on the quality index of these entities, considering key dimensions such as patient safety, human talent, research, capacity, management, efficiency, dignity, experience, technology, telemedicine, and prestige.

Among the top five in Latin America related to Colombia are: Fundación Cardioinfantil - La Cardio (position 3), Clínica Imbanaco (position 5), Clínica Somer (position11), Hospital Universitario de San Vicente Fundación (position 14) and Clínica Las Américas Auna (position 17).

Colombia has 18 of the best hospitals in Latin Anerica

Colombia has 18 of the Best Hospitals in Latin America

Colombia has the best healthcare system in Latin America with 18 top hospitals, 6 of which are located in Medellín.

Read MoreSimilarly, within the framework of the 4th Health Tech Summit Chile held in December 2024, an event that brought together experts and leaders from the healthcare sector to discuss the latest advancements in medical technology and its impact on improving care in hospitals and clinics across Latin America, the results of the second edition of the Latam Business Conference (LBC) ranking were presented.

The Latam Best Hospitals Ranking 2024, created by LBC, evaluates regional healthcare quality by analyzing seven key dimensions, including patient safety and hospital capacity. Its second edition assessed 36 public and private hospitals from eight countries—Brazil, Colombia, Chile, Ecuador, Mexico, Panama, Peru, and Argentina.

In this ranking, Colombia has held historic positions, establishing itself as the country with the highest number of institutions in the ranking, with a total of 11 recognized hospitals, reflecting the commitment of these institutions to provide high-quality health services and reaffirming Colombia’s leadership in the region in safety, innovation, and patient experience.

Also, the prestigious magazines Newsweek and Statista have presented Latin America’s Top Private Hospitals 2025 for the first time. This list highlights hospitals that provide exceptional care in various procedures, including knee surgeries and replacements, hip surgeries and replacements, shoulder surgeries, refractive eye surgeries, and cataract surgeries. The selection process for this ranking involved rigorous criteria, which included recommendations from medical professionals specializing in orthopedics and/or ophthalmology.

Colombian hospitals are making waves in the healthcare landscape, with an impressive 28 institutions celebrated as outstanding medical centers among the top 100 in Latin America. This recognition underscores Colombia's significant strides in delivering exceptional healthcare services.

Healthcare Future Outlook

The outlook is promising for medical services offered in Colombia, derived precisely from the continuous effort to improve the customer experience and provide the most appropriate, first-class, and best-oriented services possible, in addition to the latest recognitions of the medical entities that stand out in the country and Latin America.

This is why, as the Colombian Health System has evolved through its medical centers, it is undeniable that it will continue to grow, drive itself forward, renew itself, and become increasingly prominent in the region. For example, in the case of the Valle del Lili Foundation, which has been recognized as the best hospital in Colombia in the prestigious “World’s Best Hospitals 2025” ranking by the American magazine Newsweek, the commitment from its directors only foresees greater and better news for everyone.

“This recognition is possible thanks to the work and dedication of our team of health professionals and Citizens Lili, who strive daily to provide high-quality service to our patients in Colombia and around the world.”

Dr. Marcela Granados, General Director of the Valle del Lili Foundation

This overview represents a hopeful step toward a more equitable and effective healthcare system in Colombia, along with improved quality and patient experience for medical treatments and the backup for up to 3 years of travel health policy for expats in Colombia.

What is the 2 or 3-Year of Health Policy Coverage for a Colombian Visa?

A 2 or 3-year health policy coverage for a Colombian visa is an option for applicants who wish to extend their health policy beyond the typical one-year period. According to Resolution 5477 of 2022, the validity of the health policy must align with the expected duration of stay in Colombia. This means that if you plan to stay for up to two years, your health policy must provide coverage for the entire stay.

While securing a two-year or three-year policy can increase the chances of visa approval, it’s important to remember that the final decision regarding the visa lies with the Colombian immigration authority, which has discretion over the approval process.

How to Purchase a Travel Health Policy Valid for 2 or 3 Years?

Navigating the visa application process can be challenging, especially regarding health policy requirements. The Ministry of Foreign Affairs specifies that the health coverage must align with the maximum authorized stay for each visa type. Unfortunately, most health policy providers typically offer policies limited to just one year, posing a significant drawback for applicants and potentially hindering their visa validity.

However, thanks to our expert partner expatgroup.co, you can access the best option to secure an extended travel health policy valid for 1, 2 years and even 3-year coverage option. Expatgroup.co has forged strategic partnerships with top international health policy providers, such as EG Assist , enabling applicants to obtain policies that meet the maximum coverage periods required by Colombian visas. This alliance is especially beneficial for those applying for visas mandating extended health coverage, making the process smoother for expats relocating to Colombia.

2 or 3 years of Health Policy Coverage with EG Assist

EG Assist offers a unique advantage with its health policy coverage for Colombian Visas, particularly those planning an extended stay in the country. This is due to the policy’s long-term coverage options, which are especially appealing to digital nomads and expats who intend to stay in Colombia for a longer duration.

The process of obtaining this two or three-year health policy coverage is designed to be straightforward and hassle-free, considering the following indications:

EG Assist allows purchasing policies valid for up to two years but also up to three years.

Clients can select their policy duration, aligning strictly with their visa validity period. EG Assist supports flexible start dates to prevent policy overlap or gaps.

The policy structure is built for visa compliance and operates on a per-event basis, ensuring continuous coverage as required by Resolution 5477.

EG Assist confidently offers extended health policy coverage tailored for Colombian visa holders planning longer stays in the country. Their policies provide validity for up to three years designed to meet all Colombian visa health policy requirements.

The Only Health Policy with the most valued upgrade: Premium Flex

To further enhance your peace of mind and flexibility, EG Assist shows why it is the best health policy provider for expats in Colombia by introducing the Upgrade Premium Flex option, a high-value strategy designed to maximize your benefits beyond a standard policy. Available for a one-time fee of $100 USD, this upgrade is a first-level add-on, especially valuable for long-term visa applicants, as it offers superior protection against unforeseen changes to your colombian visa process, featuring key benefits when purchasing EG Assist Health Policies:

Easily modify your policy start dates to align with any changes in your travel plans or visa issuance timeline.

Receive a 100% refund if your Colombian visa application is denied, rejected, or if a case of force majeure prevents your travel.

In the event the government approves your visa but does not grant the full time requested (e.g., 2 or 3 years), you are eligible for a reimbursement of the premium for the unused time of your health policy coverage.

This upgrade allows you to purchase policies with later start dates, even years in advance. For example, an expat currently covered until March 2027 can purchase a 2-year policy starting in 2027 to ensure 3 years of continuous coverage for their new visa application—a perfect scenario for this mechanism.

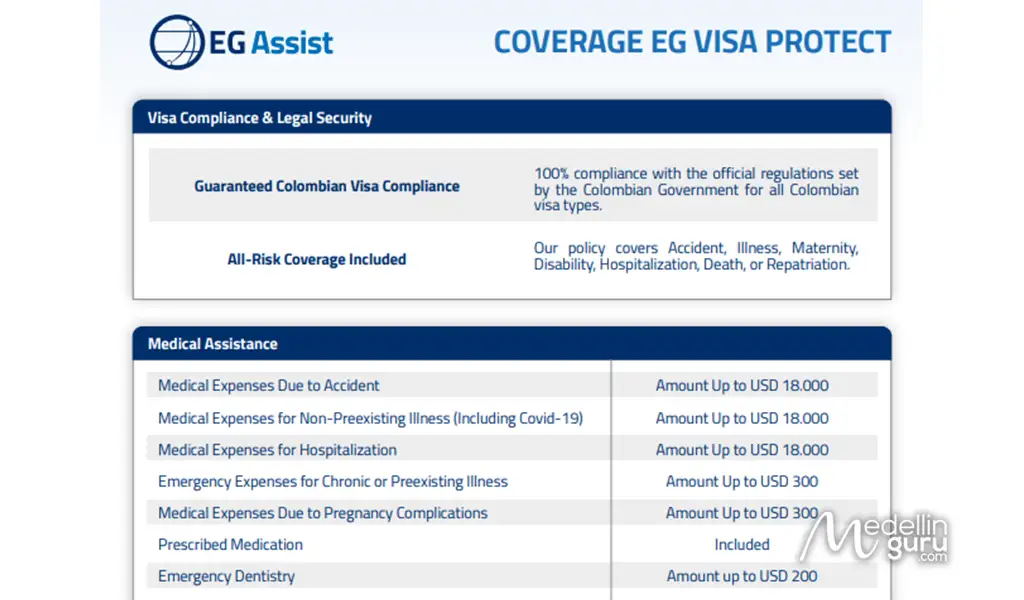

Explore the health policy coverages of EG Assist, designed for visa compliance and provide peace of mind in Colombia

What Must Health Policy Bring for 1, 2 or 3 Years of Health Coverage for a Colombian Visa?

EG Assist offers top travel health coverage for expats in Colombia. However, evaluating and categorizing the key aspects you need to cover during your stay is crucial. Check the following 9 categories, so you can ensure a safer and more comprehensive experience while you’re in the country:

Pre-existing Conditions

We start this comparative analysis with this vital item because Colombia is adopting stricter visa requirements for individuals with pre-existing medical conditions, following the example of countries like the United States. While Colombian law does not explicitly state health-related grounds for ineligibility, authorities classify certain cases as high-risk due to potential medical emergencies. Therefore, applicants must provide thorough and accurate medical documentation to support their applications effectively.

EG Assist offers travel health policy plans that include coverage for some pre-existing medical conditions, which is a crucial advantage for expats in Colombia. The coverage amount and eligibility depend on the chosen policy; applicants should consult policy documents for detailed information on limits and exclusions. For many plans, pre-existing condition coverage is available as part of a broader benefits package, meeting the expectations of Colombian immigration authorities for visa compliance.

With this insurer, you’re guaranteed comprehensive coverage for your pre-existing conditions, providing peace of mind and significantly increasing your chances of obtaining a Colombian visa. You’ll receive the most suitable coverage for your health needs through excellent plans offered by our partner, EG Assist. With their guidance and assistance, you can confidently secure the proper health policy, ensuring you’re well-prepared and informed every step of the way.

Medical Expenses

The health policy must cover medical expenses, including doctor’s visits, hospital stays, surgeries, medications, diagnostic tests, and emergency medical care, providing peace of mind and no hassle during your stay in the country.

EG Assist offers impressive coverage options that meet visa requirements for the entire year. Regardless of the plan choice, from the most economical to the premium options, EG Assist delivers exceptional coverage at highly affordable prices throughout the whole coverage period, and that’s why we consider this item as a great option because when choosing the plan according to your case, you’ll see the excellent coverage for your medical expenses which are provided with bigger clarity for expatgroup.co advisers.

Death Coverage

Death coverage is essential not only for the applicant’s peace of mind but also for the safety of their family and loved ones. In case of unfortunate events, this coverage can alleviate financial burdens and facilitate the necessary arrangements without added stress. Moreover, it demonstrates to Colombian authorities that the applicant is responsible and prepared for any eventualities during their stay in the country.

In Colombia, health and safety regulations mandate that foreign applicants provide proof of adequate health policy, including coverage for death. This is particularly important because the EPS (Health Promotion Entities) does not offer such coverage, which can lead to visa denials or rejections when many expats attempt to affiliate with it. Therefore, obtaining death coverage is not just a formality but a crucial step in meeting visa requirements and ensuring a smooth experience in Colombia.

EG Assist includes death coverage as a standard component in its health policy plans tailored to meet Colombian visa requirements. By choosing EG Assist, you strengthen your visa application with a compliant and comprehensive plan designed to suit your specific needs, helping to ensure a smooth and worry-free experience during your stay in Colombia.

Repatriation

Repatriation is a vital requirement for obtaining a Colombian visa, as it guarantees that individuals are protected in unforeseen circumstances, such as illness or accidents. This policy coverage ensures the individual’s safe return to their home country and alleviates financial burdens on the host nation’s healthcare and social services. By mandating repatriation coverage, Colombia demonstrates its strong commitment to the safety and well-being of foreign visitors and as a mandatory requirement for having proper health policy coverage.

EG Assist confidently includes repatriation coverage in all policies tailored for Colombian visa holders. This inclusion guarantees you peace of mind and a hassle-free experience during your stay, no matter the unexpected situations that may arise.

Duration of Coverage

The health policy coverage duration should typically match the duration of your visa or intended stay in Colombia and it is essential to ensure that your policy remains valid throughout your time in the country, because the Colombian immigration authorities want to ensure that you’re protected for every single day you’re in the country.

When securing your Colombian visa, having the right health policy is critical. EG Assist offers comprehensive health policies valid for up to 3 years coverage tailored to the specific visa requirements. Unlike many other insurers that primarily offer one-year policies, EG Assist’s extended 3-year coverage significantly enhances your chances of visa approval for the longest possible duration.

Choosing EG Assist not only provides peace of mind but also perfectly fits the needs of digital nomads, expats, retirees, investors, and anyone planning an extended stay in Colombia. Their multi-year policies, especially the 3-year option, help you avoid the hassle of annual renewals, ensuring continuous protection for the entire duration of your visa and simplifying the application process.

Extra Medical Coverage

It’s essential to verify that your health policy comprehensively covers your specific medical needs, including appointments with a general doctor and specialists, as well as non-emergency assistance, as outlined in Resolution 5477 of 2022 for maternity, disability, accidents, illnesses, and hospitalizations. Many insurers have exclusions that you need to be aware of and that’s why to ensure you are fully protected in an emergency, take the time to review your policy’s exclusions thoroughly. Understanding what isn’t covered is crucial to avoid surprises in the future.

Many insurers have exclusions that applicants need to be aware of to ensure full protection in case of emergencies. EG Assist offers a range of plans designed to meet these comprehensive coverage requirements, but it is crucial to carefully review your policy’s terms and any exclusions.

Extra Non-Medical Coverage

When choosing health policy for your Colombian visa, look for additional non-medical benefits that can improve your travel experience. Some of them could be coverage for hotel expenses if you need to recover from health issues, ensuring you have a safe place to stay. You should also consider support services for children or seniors, which can help make traveling with family easier, or even assistance if your documents are lost or stolen so you can replace them quickly.

Consider luggage protection services to safeguard your belongings from loss or damage during travel. Additionally, coverage for lost or canceled flights, trains, or cruises can enhance your experience. Choosing a plan with these extra benefits will help ensure a safer and more enjoyable stay in Colombia.

Certainly, EG Assist provides valuable extra benefits that go beyond basic medical coverage, enhancing your security and confidence during unexpected situations while you’re in the country.

Network of Providers:

Verify whether the health policy provider has a network of healthcare providers in Colombia. This can facilitate easier access to medical care without upfront costs. However, in this case, as our trusted health policy provider, we can assure you that with EG Assist, you’ll have medical attention from high-quality private hospitals, medical centers, professionals, and the most modern and accurate amenities you’ll need.

Pros and Cons

When choosing a travel policy provider, it’s essential to carefully evaluate the options available to ensure you receive the best coverage for your needs. EG Assist offers unique benefits and services where understanding the features can help you make an informed decision.

EG Assist offers competitive pricing and tailored plans for various visa and residency needs, making it an appealing choice for the savvy expat. As our primary commitment is to help you make informed decisions, we will examine the key strengths of EG Assist, enabling you to evaluate their offerings against your travel requirements and preferences.

Pros:

Their health policies provide exceptional benefits for individuals looking to secure their health coverage services for up to 3 years. These advantages include:

-

Compliance with Colombian visa health policy regulations, including coverage for medical emergencies, pre-existing conditions, maternity care, repatriation, and death coverage.

-

Multi-year policy options (up to 3 years) that align with visa validity, reducing renewal hassle.

-

Access to an extensive network of Colombia’s top hospitals and medical providers.

-

Additional services including legal assistance, travel support, emergency funds transfer, and compensation for travel delays.

-

Access to the high-value Upgrade Premium Flex option for ultimate application and travel flexibility.

Nonetheless, it’s important to weigh the drawbacks when deciding to invest in one of their coverage plans:

-

Higher-tier plans with broader coverage come at correspondingly higher premiums.

-

As with most insurers, coverage for certain pre-existing conditions and specific treatments depends on plan details and underwriting.

Medellin Guru's Colombian health policy and healthcare articles

- Get Insurance in Colombia

- Travel Insurance: Meets the Heath Insurance Requirement for Colombia Visas

- Auto Insurance in Colombia: A Guide to Colombian Auto Insurance

- Homeowners Insurance in Colombia: A Guide to Colombian Homeowner Insurance

- Medellin Guru Insurance Service: Providing Colombian Insurance

- Colombia has 24 of the Best Hospitals in Latin America

- Emergency Surgery: Expat Experience in Clínica León XIII in Medellín

- Healthcare Colombia: HCA Clinic Offers Services to U.S. Veterans in Colombia

Medellin Guru's comprehensive visa and passport series

The Colombian visa changes that went into effect in October 2022 were significant. So, on the Medellin Guru site, we have a comprehensive series of visa articles that are kept up-to-date and should answer most visa questions. These articles include:

- Colombia Visa Guide: Ultimate Guide How to Get a Colombian Visa

- How to Obtain a Colombian Visa with Up-to-Date Info – an overview of all the Colombian visas

- Popular Colombian Visas for Foreigners: Which Visa is the Most Popular?

- Coronavirus Impacts on Colombian Visas and Tourist Visas

- Visa Agencies: A Guide to Visa Agencies in Medellín and Colombia

- 9Common Colombian Visa Mistakes: How to Avoid Them

We have looked in detail at the nine most popular Colombian visas used by foreigners:

- Digital Nomad Visa

- Retirement visa

- Marriage visa

- Investment visa

- Business Visa

- Resident visa

- Work visa

- Student visa

- Visitor visa

Also, we have looked in detail at three additional Colombian visas, which are less popular for foreigners:

- Rentista visa (annuity visa) – for foreigners with a fixed income

- Beneficiary visa – for relatives of visa holders

- Expertise visa – for professionals

In addition, we have a guide to Colombia tourist visas and how to extend a tourist visa. Also, we have a guide to renewing U.S. passports in Colombia and a guide to obtaining a Colombian passport.

Furthermore, we provide information about travel health policy that meets the health requirement for Colombian visas. And we have a guide to how apply for a cedula extranjeria in Colombia and a guide to using notaries in Medellín and Colombia. Finally, Medellin Guru has partnered with a visa agency to offer Colombia visa services.

All of our Colombia visa articles are up to date (2024) and constantly receive updates in 2025.

The Bottom Line: How to obtain 3 years of health policy coverage for a Colombian visa

When applying for a Colombian visa, securing long-term health policy coverage (with options for up to 3 years) is an exceptional option for a successful application, as it meets the Ministry of Foreign Affairs requirements and helps avoid complications during your stay. This comprehensive coverage boosts your chances of visa approval while eliminating the hassle of multiple renewals.

You can achieve this by choosing EG Assist, the specialized long-term policy. Receiving advice from experts like expatgroup.co can help you find the best plan tailored to your needs, simplifying the process and increasing your chances of obtaining the visa for up to 3 years.

Our in-depth analysis of the 9 essential elements for securing your health policy confirms that EG Assist is the definitive solution for expats. This assures us that we are choosing from a high-quality, specialized insurer, poised to deliver an exceptional experience while securing your long-term health policy coverage for a Colombian Visa.

Medellin Guru Social media

Be part of our community. Find out about news, participate in events and enjoy the best of the city.