Buying or renting a home in Colombia and working with real estate agents in Colombia as an expat can be challenging. The real estate market in Colombia operates differently than the real estate markets in the U.S. and other countries. And many real estate agents in Colombia don’t speak much English.

So, it’s important to understand the real estate market in Colombia.And there are several things that real estate agents in Colombia may not tell you.

The following list is based on my own experiences with real estate agents over the past eight years in Colombia as I moved to Medellín. In addition, this list is based on research and on my discussions with many expats over the past several years who have bought real estate in Colombia. The following list is in no particular order.

1. There is no MLS in Colombia

There is no Multiple Listing Service (MLS) in Colombia. So, if you are buying or renting this can make it difficult to find all the properties available in the cities in Colombia. And real estate agents may not know about a perfect property for you that is available for sale or rent. Not having a MLS can also make it challenging to find comps and understand market prices.

However, in Medellín the popular website Espacio Urbano is used by many real estate agencies to list properties for sale or rent. So, this site can be used by expats to understand market prices in different neighborhoods in Medellín. This can help to ensure you aren’t paying too much to buy or rent.

The bottom line is there is no Multiple Listing Service (MLS) in Colombia. So, if you are looking to buy a property it is nearly impossible to know even a majority of the properties available and agents won’t know all properties available.

2. Most Real Estate Buyers in Colombia are Local

Foreign buyers of residential real estate in Colombia are very limited. It is important to understand this as a foreign buyer. Reportedly in Bogotá and Medellín it is estimated that foreign buyers represent less than 1 percent of the property buyers in the market.

The market with the largest percentage of foreign buyers in Colombia is likely Cartagena, where I have heard foreign buyers may represent up to 2 to 3 percent of buyers. In addition, many agencies don’t have much experience with foreigners.

Our partner Real Estate by expatgroup..co has all the experience with foreigner buyers and also, can assist you in English. If you want to start a Real Estate process in Colombia, click on the green button to contact them.

Medellin Guru Real Estate Service

Our reliable partner, a leading real estate company, offers a wide range of services:

- Transfer funds to Colombia

- Legal analysis property background checks

- Sales agreement

- Deed registration

- Legal representation

- Investment visa

GET 40% OFF IN REAL ESTATE SERVICES

The expatgroup.co anniversary offer is now open! Our partner, expatgroup.co, is offering high-quality Real Estate services with incredible limited-time offers. Invest in Colombia today!

*Offer available until January 30th.

*Apply terms and conditions.

3. There are Few Exclusive Listings in Colombia

Unlike the U.S. that has exclusive listings with real estate agents, in Colombia most listings are not exclusive. So, a real estate agent can represent many available properties.

It is not uncommon to have three or more agents working to sell a property in Colombia chasing a 3 percent commission. And it’s not uncommon to have several real estate agents trying to rent the same rental property.

4. Estrato 6 Represents Only 3 to 4 Percent of Housing

In Colombia, residential properties are ranked on a 1-6 socioeconomic scale (with 6 being the highest). These are known as estratos. The expensive (for Colombia) estrato 6 properties being touted by real estate agents focused on expat customers – like in El Poblado in Medellín or Zona G in Bogotá – are not the typical housing for Colombians.

Only about 3 to 4 percent of residential properties in Colombia are rated as estrato 6. The majority of Colombians live in estrato 2 or 3 neighborhoods, which represent about 65 percent of housing in the country. We have a separate guide to estratos in Colombia.

If you buy a property in estrato 6, keep in mind when it comes time to sell there is a limited pool of buyers in Colombia that can afford these properties that are expensive for most Colombians.

However, if you are buying a rental property, location is key. Well-located buildings in popular areas for expat tourists like in El Poblado in Medellín can do well as rental properties.

5. It's Relatively Quick to Buy, But It May Take a Year or Even Longer to Sell

It can be relatively quick to buy a property in Colombia. I have met several expats that have bought properties in about four weeks after finding a place. However, an article in the New York Times in 2015 reported that the average time to sell residential properties in Bogotá was 270 days. Fincas and high-end properties can take even longer to sell.

I have talked to several expats this year that have been trying to sell their high-end estrato 6 properties in Medellín and Bogotá for more than one year.

Even new homes in Colombia take a long time to sell. A recent study in 2019 of new home buyers in Colombia by Asociación Bancaria (Asobancaria) and Galería Inmobiliaria found that at the end of March 2019, the average sales time in estrato 4, 5 and 6 in Colombia was 8.9 months for apartments and casas (homes) – see in Spanish.

6. Real Estate Prices are Now Dropping in Colombia

The growth in real estate prices in Colombia has come to an end due to the coronavirus pandemic.

According to Banco de la República the index of used home prices in Colombia dropped from 141.91 in Q1 2020 to 133.06 in Q2 2020 (not factoring in inflation). This is a drop of 6.2 percent in one quarter. This is the largest quarterly drop in the index of used home prices in Colombia in the past decade.

The Banco de la República house price index includes nine cities Bogotá, Medellín, Barranquilla, Bucaramanga, Cucuta, Manizales, Neiva and Villavicencio.

There are few buyers currently in the market based on conversations we had with several real estate agents in Medellín recently. Agents we talked to expect that prices are likely to drop even further with so few buyers in the market.

The real estate market in Colombia had been growing quite well for the past decade until coronavirus hit. However, real estate is a market that goes up and down based on a lot of factors.

Due to the coronavirus pandemic, Colombia is currently a “buyer’s market” with the supply of homes on the market is more than the pool of buyers. This is when prices typically drop.

Nobody can predict the future. How much more will prices drop? Will the economy in Colombia recover quickly or slowly from coronavirus.

7. There is no Strict Regulation of the Real Estate Agents Profession

There is no licensing of real estate agents in Colombia. Anyone can create a real estate agency by selling his/her own house or the house of a neighbor.

In addition, anybody can earn a commission as real estate agents including friends and relatives of the seller, attorneys and others. So, conflicts of interest and misinformation is possible when purchasing real estate in Colombia. And it is possible to find real estate agents that aren’t very professional and don’t really have much experience.

8. Real Estate Agents Tend to Work for Sellers and Owners

According to Colombian business custom, the seller of properties should pay all real estate commissions, unless otherwise agreed to differently. The typical real estate commission in Colombia is 3 to 5 percent for urban residential properties.

Real estate agents that work for buyers are rare in Colombia. So, real estate agents in Colombia tend to be biased to sell more expensive properties so they get a bigger commission. For example, in Medellín the majority of the property listings of real estate agencies selling to foreigners tend to be in the most expensive neighborhood of El Poblado.

In addition, the property price quoted can vary between real estate agents. For example, one expat told me recently that an agent told him the price for a property he viewed was a fixed price. But this expat found the same property listed on another website for 30 million pesos less.

Also make sure to get in writing all costs including taxes, fees, commissions, etc. or you may get a surprise at signing time when buying.

For rentals in Colombia, real estate agents will have a contract with the owner. And they will have a separate contract with the renter and pocket the difference between the contracts as the “commission”. So, the higher the agent can make the rental price, the more “commission” the real estate agent receives.

The bottom line for expats working with real estate agents in Colombia for buying or renting it is important to understand market prices to ensure you aren’t overpaying.

9. Some Agents May Take Advantage of Foreign Buyers

Buying the right property at the right price is perhaps the most critical part of succeeding as a real estate investor. It is critical not to overspend on the purchase price or a renovation, if needed.

Also, keep in mind that agents work for buyers and are paid on commission. So, there is no incentive to try to lower the price for buyers, even though it is currently a buyers market. Knowledgeable buyers should be able to negotiate lower prices with some motivated sellers.

In addition, be very careful when buying real estate in Colombia as a foreigner. We are aware of one unscrupulous real estate agency that increased the price of a property by 50 million pesos due to the buyer being a foreigner and not knowledgeable about the market. The foreigner thought he was getting a good deal based on real estate prices in the U.S. But the unscrupulous agency pocketed the 50 million pesos increase in price.

We recently heard about another agency that essentially did the same thing. This agency increased the price by 30 million pesos for a foreign buyer. We talked to the seller who was very unhappy about this, as he didn’t get any of the increase in price.

10. Some Foreign Real Estate Investors Have Lost Money in Colombia

Some real estate agencies in Colombia have been touting 8 to 10 percent (and even higher) annual returns for investment properties used for rentals including factoring in property appreciation. But keep in mind that property appreciation is in the local currency and doesn’t factor in the currency risk.

The Colombian peso has been weak over the past few years. Due to this currency risk, foreign investors who bought properties several years ago in Colombia may have lost money in terms of U.S. dollars (USD). This is even though properties may have appreciated in terms of Colombian pesos.

For example, I talked to an expat investor recently that bought an investment property in Medellín back in 2014 when the exchange rate was about 1,885 pesos to the USD. The exchange rate is now 3,723 pesos to the USD.

This investor said his property has generated profit from rental income until coronavirus hit. But this investor believes that his property has not appreciated very much in terms of Colombian pesos over the past six years due to the recent impact of the coronavirus pandemic on the real estate market.

So, if this investor had to sell now, he believes he would likely lose at least 40 percent of his original investment in terms of USD.

The exchange rate may be favorable now as it has been in a higher range over the past eight months than in the prior nine years. But exchange rates are very difficult to predict.

What happens if the Venezuelan crisis become worse and many more Venezuelans come to Colombia? What happens if there is another global financial crisis in addition to the coronavirus pandemic? Or what happens if Colombia elects a business unfriendly president?

11. Property Websites are Not Updated Regularly

Properties listed for sale or rent on real estate agency websites in Colombia may no longer be available for sale or rent. Many real estate agencies in Colombia are challenged in keeping websites up-to-date. So, properties that have sold or are no longer on the market may still be listed on websites.

Several expats I have talked to have been frustrated by this. They see a perfect property that meets their requirements on a website. And then they find it is not available for sale or rent.

12. It is Possible to Rent Without a Fiador

Most real estate agents in Colombia will require a fiador to rent an unfurnished apartment or house. A fiador is a cosigner who is a local property owner. Under Colombian regulations a real estate agent is responsible for collecting rent.

A fiador guarantees the tenant’s rent payments, so the agent can go after the fiador if the tenant stops paying rent. Fiadors are common in several countries in Latin America, not just in Colombia.

But it is possible to rent unfurnished apartments in Colombia without a fiador. I have done this for over seven years. And I have met many expats living in Colombia that also rent apartments without a fiador. We have a separate guide to overcoming the fiador requirement.

The most common ways to avoid the fiador requirement include paying rent in advance with an agent or renting directly from an owner. There is also insurance available and some may accept a deposit. We plan to provide more details in a guide to apartment rentals in a future article.

13. New Property Development May Take Years to Complete

Many of the property development projects in Colombia are delivered way past the original planned completion date. And some are never completed. For example, I am aware of some apartment buildings in Medellín that took three to five years to complete when the original plan was two years.

In addition, I know of a few property refurbishment projects that took double the original planned time (two years instead of one year). Don’t trust the completion dates touted by property developers or real estate agencies in Colombia. In many cases the promised dates are highly optimistic.

The perfect example of this is the incomplete Luciérnagas apartment building project of Grupo Monarca in Sabaneta (south of Medellín). Over 110 apartment buyers bought homes in this building, which had an original planned completion in 2009. This building still isn’t complete eight years later and buyers reportedly have been trying to get their money back.

This incomplete building is totally abandoned. Also, it’s been subject to the weather for over eight years now. And I haven’t seen any activity at the building in the past several years.

Are you looking to buy or sell Real Estate in Colombia?

Medellin Guru has partnered with Real Estate by expatgroup.co to provide real estate services to foreigners and locals interested in buying and selling properties in Medellin and across Colombia.

Recognizing our readers’ demand for real estate guidance, this partnership with Real Estate by expatgroup.co, desires to deliver trustworthy and comprehensive real estate services to our audience.

We chose to collaborate with Real Estate by expatgroup.co for buying and selling real estate services for several reasons:

- Real Estate by expatgroup.co is recognized globally and is a familiar brand for foreigners.

- As one of Colombia’s largest realtor companies, Real Estate by expatgroup.co has extensive coverage throughout the country, enabling it to serve various locations in Colombia.

- They boast a robust team of agents, many of whom are bilingual in English and Spanish.

- Real Estate by expatgroup.co ensures fair pricing through a thorough Comparative Market Analysis (ACM).

To access this real estate partner service from Real Estate by expatgroup.co, click the button below, complete a brief form, and receive a complimentary consultation offering insights into the local market, current pricing, and tips for buying or selling properties.

Medellin Guru Real Estate Service

Our reliable partner, a leading real estate company, offers a wide range of services:

- Transfer funds to Colombia

- Legal analysis property background checks

- Sales agreement

- Deed registration

- Legal representation

- Investment visa

GET 40% OFF IN REAL ESTATE SERVICES

The expatgroup.co anniversary offer is now open! Our partner, expatgroup.co, is offering high-quality Real Estate services with incredible limited-time offers. Invest in Colombia today!

*Offer available until January 30th.

*Apply terms and conditions.

Medellin Guru’s Airbnb Series

Medellin Guru now has a series of several articles about Airbnb in Colombia:

- 9 Strategies to Find Killer Deals on Airbnb in Colombia

- 15 Things to Know Before Investing to Become an Airbnb Host in Colombia

- 10 Airbnb Best Practices for Airbnb Hosting in Colombia

- 9 Tips to Attract Long-Term Airbnb Guests in Colombia

- 7 Strategies for Airbnb Slow Season in Colombia

- How to Identify Problem Airbnb Guests in Colombia Before They Book

- 15 Ways to Increase Your Airbnb Search Rank In Colombia

- How Safe is Airbnb in Colombia? Is it Safe to Use Airbnb in Colombia?

- Airbnb Travel Itinerary for Your Airbnb Guests in Colombia

- How to Get Started on Airbnb in Colombia: A Guide

Medellin Guru's guide to buying, selling and renting apartments and choosing a neighborhood

On the Medellin Guru website, we have a comprehensive and up-to-date guide to buying, selling, and renting apartments and choosing a neighborhood in Medellin found in several articles, including:

Buying and Selling Apartments

- Medellin Real Estate: Property Buyer’s Guide for Foreigners

- Selling Real Estate in Colombia: A Guide to Selling for Foreigners

- Mistakes Foreigners Make When Buying Real Estate in Colombia

- Current Costs to Buy New Apartments in Medellin

- Rent vs Buy: Downsides of Renting and Buying Property in Medellin

- 13 Things Real Estate Agents in Colombia May Not Tell You

- How to Obtain a Colombia Investment Visa

Renting Unfurnished Apartments:

- Apartment Rental Guide: Renting Unfurnished Apartments in Medellin

- Guide to Finding Unfurnished Apartments and Casas in Medellin

- Guide to Overcoming the Fiador Requirement in Colombia

- Unfurnished Apartment Rental Costs in Medellin

- 6 Inexpensive Neighborhoods for Unfurnished Rentals in Medellin

- Furnishing Apartments: A Guide to Furnishing Apartments in Medellin

- Apartment vs Casa (House) Rentals in Medellin: Pros and Cons

Renting Furnished Apartments:

Choosing a Neighborhood in Medellin:

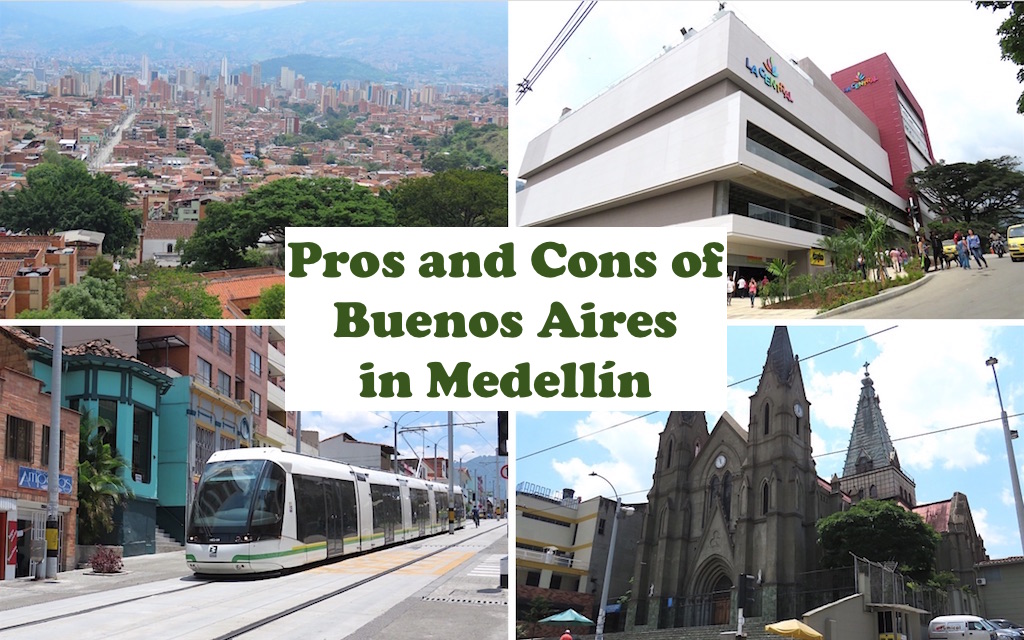

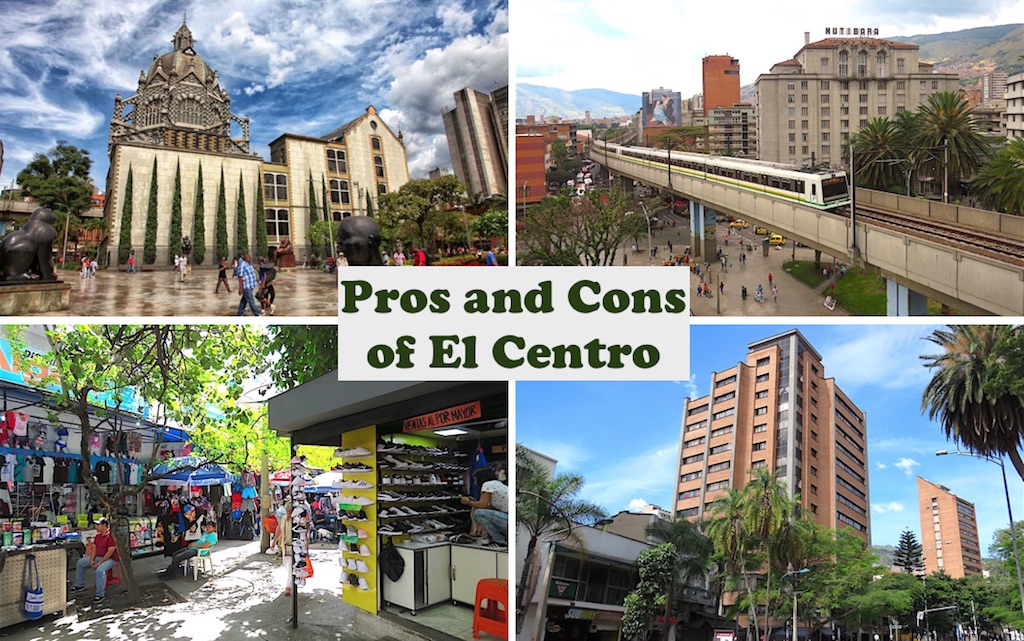

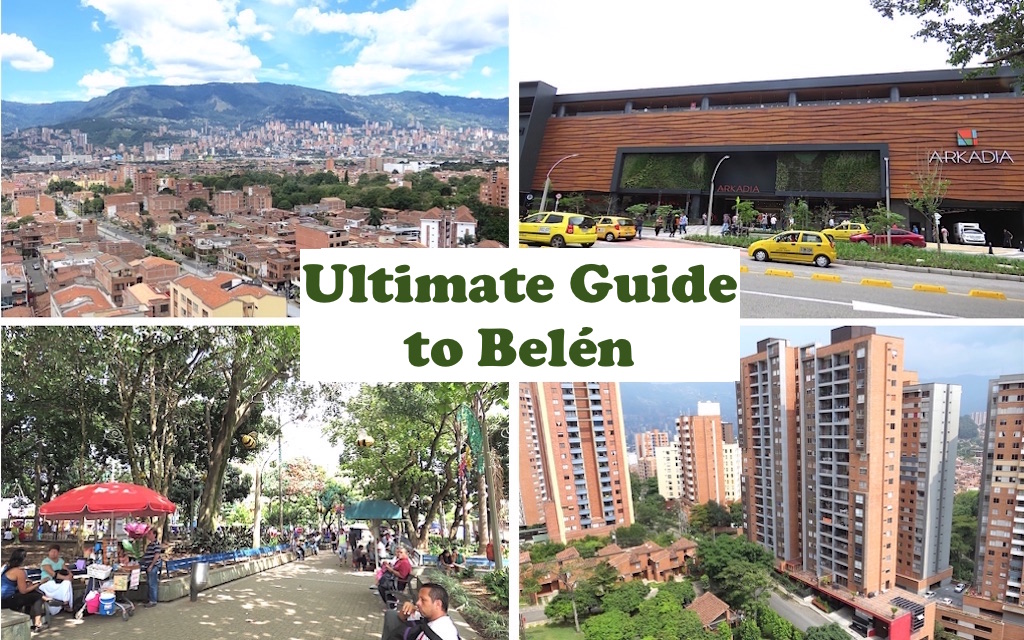

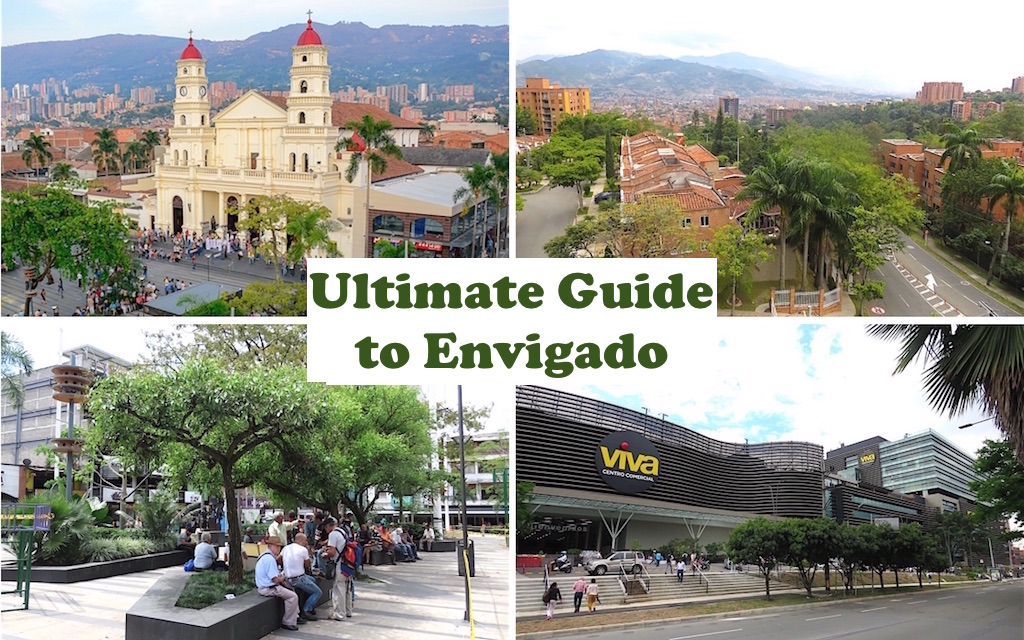

Also, we have several articles that can be used to help foreigners choose a neighborhood in Medellin:

- Laureles: The world’s coolest neighborhood for 2023 by ‘Time Out’ is in Medellin, Colombia

- What are the Safest Neighborhoods in Medellin and the Aburrá Valley?

- 5 Best Neighborhoods in Medellin: A Guide to Choosing a Neighborhood

- 9 Downsides of El Poblado: Living in Medellin’s Expensive Neighborhood

- Estratos: A Guide to Understanding Estratos in Colombia

- El Poblado vs Laureles: Which is the Better Neighborhood to Live in?

- El Poblado vs Envigado: Which is the Better Neighborhood to Live in?

- El Poblado vs Sabaneta: Which is the Better Neighborhood to Live in?

- El Poblado vs Belén: Which is the Better Neighborhood to Live in?

- 2018 Unfurnished Apartment Rental Costs in Medellin in 5 Neighborhoods Popular with Expats

- 6 Inexpensive Neighborhoods for Unfurnished Rentals in Medellin

The Bottom Line: Things Real Estate Agents in Colombia May Not Tell You

The bottom line is do your own due diligence before buying or renting property in Colombia. Keep in mind that real estate agents are essentially incentivized to sell or rent properties for higher prices, so they earn higher commissions. Also, some agents may try to take advantage of foreigners that are not knowledgeable about the market.

So, it is very important to make sure you understand the market and understand market prices in different neighborhoods. Otherwise you may be taken advantage of as an expat.

What experiences have expats encountered with real estate agents in Colombia?

Medellin Guru Social media

Be part of our community. Find out about news, participate in events and enjoy the best of the city.

84 thoughts on “13 Things Real Estate Agents in Colombia May Not Tell You”

I am regular reader, how are you everybody? This article posted at this web site is really good.

Hi Timm, thanks for your comment!! At Medellin Guru, we always care about making content that is useful and interesting! We invite you to continue following our blog.

Hi Rich,

I was born in Colombia but have basically lived all my life in the US. I inherited a store in Bogota and want to sell that place but not sure how to move forward finding a realtor to list and sell the place that is located in an industrial area only 15 minutes from the center of the city.

Thank you for your help and quick response.

Best Regards,

-Juan

Juan you may contact our Bogota City Manager, Jorge Diaz-Granados at [email protected] and he will refer you to some local contacts who may be able to assist you in Bogota.

I would like to sell my apartment in Medellin….what do I need to do….charlie

Email [email protected] and we will list on a non- exclusive basis with a 3% seller paid commission in the event of a sale.

I’m wondering if it’s possible to buy a warehouse and convert it to live in, in Bogota? Where would I find this out? Thanks!

We are from the US and we have property to sell in Columbia . We are looking for someone to help us sell this property. Can you guide me in a direction? Thank you

If your property is in El Poblado, Laureles, Envigado or Sabaneta, we will list it on a non-exclusive basis for a 3% seller paid commission. Send info to [email protected] and I will put you in touch with our listing department. We currently have 400 sales listings in Medellin on our web site.

This is a very helpful article. Thank you!

Does anybody know a website similar to Espacio Urbano that is for Barranquilla? I’ve lived in both Medellin and Barranquilla for months and the Barranquilla area is definitely giving a better ROI for rental properties. Much lower purchase costs there.

Hi Chris, for Barranquilla you can find rental properties on https://www.metrocuadrado.com/apartamentos/arriendo/barranquilla/ and https://www.fincaraiz.com.co/arriendos/barranquilla/. And to buy properties – https://www.metrocuadrado.com/apartamentos/venta/barranquilla/ and https://www.fincaraiz.com.co/apartamentos/venta/barranquilla/

While costs for are lower than in Medellín keep in mind there are downsides to living in Barranquilla – https://medellinguru.com/medellin-vs-barranquilla/

Thanks for the links Jeff. Much appreciated! I read your comparison a month ago. It has good information and the data sources you used are good. However, you are missing some key important details about Barranquilla. I lived in Barranquilla for 4 months last year.

1) Many locals in Barranquilla speak some English. Almost every day a Colombian speaks English to me in Barranquilla, and it is very common for Uber and taxi drivers to use English words when I’m riding with them. In Medellin, it is rare for a Colombian to speak to me in English.

2) Barranquilla has two excellent, large upscale nightclubs for live music in Trucupeay and Discolo. Therefore, they have many concerts here with popular artists singing original music. Medellin does not have large nightclub venues for concerts. Therefore you get to see many artists performing in Barranquilla that never go to Medellin. In Medellin you only hear cover bands in nightclubs or stadium concerts.

3) Few expats in Barranquilla has its advantages. First little to no prostitution. In Medellin, there are regular nightclubs where it seems the majority of women are prostitutes. You never encounter that in Barranquilla. Also no tourists means a lot LESS drugs. I have seen many people in Medellin nightclubs using drugs without trying to conceal it. I’ve never seen that in Barranquilla…nor have I ever had someone in Barranquilla try to sell me drugs on the street. In Medellin, foreigners have a bad reputation due to the drug and sex tourists and smelly backpackers. In Barranquilla you are considered exotic, different, cool for being a foreigner. Being a foreigner definitely works more towards your advantage when dating in Barranquilla.

4) Less crime which means friendlier people. You mentioned the homicide rate, but that does not tell the whole story. I never hear about two people on a motorcycle robbing people in Barranquilla. I don’t hear horror stories about people being drugged and robbed in Barranquilla like in Medellin. Therefore, it is much easier to make friends. I lost count of how many people gave me their number after talking with them for 5 minutes. Telling me to contact them if I ever need anything or have questions. People are not that friendly in Medellin because people are less trusting of strangers.

5) Proximity to other major cities. Advantage Barranquilla. You can pay $6 to take a comfortable shuttle van with AC and wifi to either Cartagena or Santa Marta. The ride is only a couple of hours and the vans leave once per hour, so it is very inexpensive and convenient if you want to have a last minute, cheap beach getaway.

Hopefully you consider adding some of these details to your comparison because I think Barranquilla is much cooler and fun than you realize. 🙂

Hi! In this article you can read another reasons to live in Barranquilla

https://www.ciencuadras.com/blog/tendencias/vivir-barranquilla-costo-calidad-vida

See https://www.lifeafar.com/en/destinations/laureles?currency=USD

hi and thanks for this useful information. I need a studio apartment in Laureles between April 1st and July 25th. Which real estate agent would you suggest I contact or which website should I look at? Thanks a lot. Harvey Burgess

1. You have to decide if you wish to rent to locals or to foreigners. If foreigners then you will see the most demand in El Poblado, Envigado and Laureles, and to a lesser degree, Sabaneta. If for locals just about any Stratas 3-6 nieghborhood will work.

2. See #1 above

3. Open a brokerage account at Alianza Valores. If you have a Colombian bank account you can bring funds in that way. Check the cost for bringing funds in. At Alianza it is 0.4 to 0.6% plus the 4X1 banking fee (0.4%) and about 0.1% for your F4 funds registration. Total cost of about 1%. Some banks are competitive with this and some are not. You have to ask.

4. send an email to [email protected] and we can assist.

Jeff – thanks so much for all the great insights. I have a couple questions that I hope you or others might be able to address (happy to come by in person if that’s easier!):

– What kind of comps (price/sq ft or meter) do you think are attractive today (early 2019) for new builds in attractive neighborhoods?

– Are new builds (assuming they are in late stage and actually get completed), easier/more attractive to buy for any reason?

– I read that short-term rentals (of less than 30 days) are not allowed. Is that still accurate?

– In terms of getting funds into the country, there are comments suggesting Alianz Valores. I also read that BBVA will let you open an account with only a passport. As a non-resident who won’t be seeking residency through investment, is one better than the other?

Thanks!

Hi Eric, thanks. Here’s some answers to your questions.

– For comps (price/sq ft) I recommend picking up a copy of Informe Inmobiliario, which is a monthly magazine with information about most of the new apartment projects in the city with some pricing. Bigger Exito stores tend to have this magazine. We plan to look at purchase prices of properties in a future article but this will take time to research.

– New builds will be more expensive than existing properties. But existing properties may require some refurb work. Also, some new builds may not be in the best locations for desirability for rental purposes.

– Short term rentals of less than 30 days are not permitted in many buildings and this depends on the rules/by-laws (reglamento) of a building and 70% of the owners in a building and change the rules to not permit short-term rentals.

– Alianz Valores appears to be used by more expats to bring money into the country to invest in real estate.

Hi Eric,

in addition to Jeff’s comment: For a proper short term rental, the building resp. the apartment needs to have a “certificado de turismo’ (I think that is how it is called officially} which needs to be renewed every so often. As far as I know, there are a couple of buildings in El Poblado which have that qualification. Apartments in these buildings command a higher price per sqft, of course. As for bringing money into Colombia, some banks (BanColombia e.g.) may allow to open up accounts to bring in money without going to F4 forms and similar requirements, but, as far as I know, there is a limit to the amount per transfer (7,000U$) and amount per year ($28,000) you can bring in, which is of course not sufficient for R/E invest.

Cheers

Harry

Hi Jeff and Harry, thank you SO very much for all this useful information. I am Colombian but have lived abroad all my life. My husband and I are currently living in the USA and we are very interested in investing in Realstate in Colombia. Our objective is to buy and rent apartments in Medellin but we are wondering:

1. What are the best neighborhoods to invest in Medellin nowadays? El Poblado, Laureles, Envigado or other?

2. As an investment, would you recommend to buy apartments in popular expats/tourists neighborhoods

or where there is a big demand from locals? If so, which neighborhoods among locals?

3. What is the best way to transfer funds from USA to Colombia for down payment purposes, etc? (Considering I am a Colombian citizen)

4. In regards to financing options, local taxes and legal issues between USA and Colombia, can you recommend one or two great and reliable professionals willing to help us with all these questions?

Thank you for your valuable information and feed-back!

Best,

Monica

Monica, in addition to what Rich laid out: You need to consider if you want to rent out on a monthly basis or if you want to enter the world of daily rentals (higher revenue, but higher invest per sqft) and if you want to manage the rentals yourself (relocating to MDE?) Another company to consider besides lifeafar would be CASACOL, they are also pretty knowledgeable (never mind the trashing of “gringo real estate firms looking only for your buck….” as some earlier comments indicated)

Hi Dawnya, this is exactly what Alianza required from me in order to open u a bank account to move $ into Colombia for my R/E invest in MDE (I don’t know about the consequences for obtaining any kind of visa, since I am not terribly interested in residence in COL) Good that you speak some Spanish, but Alianza has some bilingual staff on hand.

Good luck!

Cheers

Harry

Wow, I love this forum. Thanks for all the advice. I will be in Medellin in March with the intent to search for a property in the $125 USD range , perhaps in Laurels neighborhood? I need a realtor experienced in investment properties. It sounds like Poblado will be out of my price range for a three bedroom, two bath, with balcony. The intent is to move there with my children, ages 4 and 6. I understand I need a form 4, but should I bring all documentation on my last three months bank statements and my 2017 tax return in order to open an account so when I make my purchase I am setting myself up in a positive manner for obtaining a migrant visa? I own several vacation rental properties in US and Mexico, now so I can work from anywhere as long as I have wifi and cell phone service. I can prove prove ability to have ongoing income for migrant visa if this is needed? Thanks for any advice. I speak a fair amount of spanish, but not enough to handle legal and accounting issues in Columbia.

I thought Form 4 did not have to be sent for 15 days? No, am waiting to talk to Alianza when I’m back in Medellin. The money for the purchase will actually be coming to me from my mother’s account in the States. So will they need her tax info ? Since the M 10 (Migrant) Visa is awarded for only a real estate purchase, how can they label it a Form 4 before there is any real estate purchase? Basically I just need to make sure that the Down money will count toward the total (minimum about 289 mil) needed for a M10 Visa. I haven’t talked to anybody in Colombia yet as this opportunity just came about over the holidays as we discussed more about me having to move from my Medellin apartment in a few months (being turned into Airbnb) and definitely planning on staying in Medellin. And would love to own my own apartment. Thank you for the info and the suggestion re a money market account. Although, in real estate even being unavailable for 60 days does not sound ideal. Alianza would not have an account shorter than 60 days? But yes, I will ask them all this. I am just trying to educate myself as much as possible and be able to hit the ground running when I return. Thanks again, Clarice

Hi Clarice, once again from my own experience: You do not have 15 days for the form 4 and they (Alianza) are big on documentation as to where the money comes from. They requested 3 recent bank statements from the account the funds originated to make sure it was legit money and my tax return to see there was some logic between income and available funds (think money laundering…). But go and talk with them..

Cheers

Harry

I have been living in Medellin for 3 years with a work visa, but now have a tourist visa. I plan on continuing to live in Medellin and want to buy an apartment which I will live in. The maximum I have to spend is 100,000 USD which is now in a US bank account.I I have learned that to get a M 10 (Migrant) Visa which is good for 3 years, I have to buy real estate for a price of at least 289,840,600 COP. And that it is important that the money which I bring in to purchase real estate is reported on Form 4. I have been told that the best way to bring it in is through Alianza Valores, a brokerage firm. However, I was told there are time issues with regards to this, ie, they can only hold money so long. My question is if I first just bring in the equivalent of a 10 % down , and if this has to be reported within 15 days , will it be submitted on a Form 4 form (making it eligible for the Migrant/real estate Visa since it’s just a deposit? or even a future deposit if I have not yet found a property) Or if they do file it as a Form 5 if I don’t yet have a property, can it retroactively be rolled into the Form 4 when the balance for the sale is reported? And, if the deal fell through, but my down money was still sitting there in the brokerage, is there a time limit on how long they will hold it until I find another property. ie, should I not bring it in until I see a property I want to make an offer on. But then there would be a several day delay before my funds for the down would be available. I would think the 289,840,600 minimum requirement for a M10 visa would be based on the total figure on the sales agreement (or would it be what’s on the deed, which can differ I hear). But at least that there would be a way of including the down payment on a Form 4. Any advice would be much appreciated. I am out of the country for the holidays but returning soon and will immediately get a brokerage account set up , but am confused about whether I should immediately transfer in the equivalent of a 10-20% down, or wait until I find a property.

Hi Clarice,

one way to get around the timing issue with Alianza could be to set up the account, transfer the full amount and have them invest it in a 60 day money market funds. From own experience, I found that a convenient way to hold funds available (in all likelihood. they would not request you to invest the full amount, so a 10-15% per cent down pay would be readily available. Keep in mind, however, that they want to see your last income tax return and bank statement(s) for the account from which the U$ would be transferred. And the famous form 4 would have to be filled out basically on the day the funds hit your Colombian account. Did you talk with Alianza representatives?

Cheers

Harry

I like that you recommend simply hiring a professional appraiser. It makes sense that real estate appraisals can be a daunting subject if attempted without the help of a professional. Hiring a professional would also be a good way to have a number that’s backed by research and facts rather than relying on a guess. Thanks for the post; this could be very helpful whether looking to buy or sell just so you know exactly what you’re dealing with.

Real Estate agent in Pineville, Louisiana, USA, need help. I’m trying to close on a property and one of my Seller’s is working in Medellin. I need to get a Power of Attorney notarized and this could not be done as no notary would no do unless in Spanish- which its in English. Any advise on how to get it notarized in English somewhere in Medellin?

Thanks Amy Brocato / Century 21, Buelow-Miller Realty

See this article about getting a Power of Attorney notarized for use in the U.S. by someone not in the country. https://legalbeagle.com/5827613-power-attorney-someone-out-country.html. The U.S. embassy in Bogotá provides notary services for documents in English to be used in the U.S.

My wife, a native Colombian, purchased a condo/apartment unit with our joint funds and took title in her name only. How do I get my name on the deed?

Hi Jon, I expect you will need to talk to a lawyer. And I recommend asking on the big Medellin Expats Facebook group. https://www.facebook.com/groups/159461177529433/

Thanks for your blog post with very informative information. I will be checking everyday appreciate your help.

Does anyone know how I can find a broker that can assist with retail in Colobmia?

Vincent,

you may want to check out the real estate company run by the Canadian gentleman (the company name has been mentioned in this thread..), though I would be doubtful that potential sellers would agree to a payment plan (based on my own experience…)

Good luck

Harry

Hey Jeff! Thanks for this post. I was very interesting. I do have a follow up question concerning financing options. My plan is to purchase a couple of apartments in Medellin and rent them out with the use of a property manager. As an American, would I have to buy the property outright with the money upfront, could I work out a payment plan with the seller, or could I leverage the credit system within a Colombian bank?

Thanks!

Hi Vincent, thanks. Some property owners selling properties will do private mortgages and I am aware the real estate company FAR International has some selling customers like that.

It is extremely difficult for a foreigner to get a mortgage from a bank in Colombia, as you need to demonstrate you are established in Colombia with a bank account, Colombian credit history and filing taxes in Colombia.

In addition, keep in mind that interest rates in Colombia (including mortgages, if you should get one) are quite a bit higher compared to the US or Canada (think around 9 to 10 per cent), so your RoI would suffer a fair bit…

I appreciate the feedback and both are very insightful. I did happen to read in another article the difficulties of obtaining a mortgage in Colombia and I’m glad to hear that private financing plans are known of. From what I understand FAR International should be avoided.

I have been spending days reading a variety of articles this blog. Thank you for this excellent resource!

Hi Rich, I’d be interested to know. thinking Laureles is a nice neighborhood. Cheers Brock.

I have nobody up the hill to recommend. In the El Poblado/Envigado/Laureles areas I can recommend a real estate attorney who is bi lingual.

B. Arnold, you are 100% correct to be concerned. We have four bi lingual architects and several attorneys who spend a lot of time in POT planning in Medellin and Envigado. It is not an easy process and one has to know how to navigate the process. From everything that I have heard it is more difficult in rural areas both for permitting and for title searches and clear title. Just look at what happened at Meritage. Good luck if you move forward and, if you do, be sure your legal, planning and tax team know how to navigate the process.

Rich: good stuff – experience counts. Do you have any referrals for some trustworthy independent attorneys (bilingual would be a plus but not mandatory) in and around the Medellin area (Antioquia) I could contact to consult with?

Do you have someone that can help find retail locations for lease?

Jeff and Medellinguru Community:

What sould I expect outside the metropolitan cities of Antioquia where you can pick up – say a finca around 10-20 hectares and then try to develop into lots for resale? My fear is running into wall after wall of (excessive and beyond normal, even questionable) zoning requirements from the local authorities to get proper permitting to sell the lots. I don’t want to buy a finca and then find I’m up against the unreasonable and sometimes dubious demands of some low (or high) level employee working for the “Departamento de Planeacion – POT – Plan Básico de a Ordenamiento Territorial” or what I would call here in the US the ZONING AND PERMITTING Dept. Any input is appreciated. BA

Saying that “gringo agencies” are only selling overpriced properties is completely simple minded… It is like comparing buying a Porsche or a Kia… Of course they list the most expensive properties as their potential foreign investor can afford the lower market price of Colombia, but they are usually located in the best area and have feature like penthouse, pool, terrace… Most properties are listed by several agents anyway, so you can make your homework to see which has the lowest price, and negotiate from there with the owner.

I bought a property through FAR, mainly because they have a knowledgeable team of lawyer and accountant that help me through the purchase, the sales lady also gave me great advises about the market of Medellin. It doesn’t really matter if you buy from a local agent or “gringo agency”, I really advise you to use a lawyer in the process of buying property in Colombia as it could be very complex from title search to filing incoming funds with the central bank.

I own an apartment in Neiva and need a real estate agent who lives in Neiva. Please contact me if you can help me if you can help list my property and sell my property.

Hi Dennis, sorry I can’t help you. I recommend you google search for “agente inmobiliario Neiva”.

Jeff

My name is Cory I live in Mesa Arizona I’ve been doing my homework for a couple weeks now I am having serious thoughts about possibly relocating to Medellin or Bogotá maybe and perhaps becoming a land lord but I do you have questions I’m starting to get a grasp on the areas as far is Stratus 123456 and so on and everything around it and I was wondering if you knew the best way I could go about getting the A book for dummies or perhaps a mentor of some kind I don’t even know if this is your area I think I read something about you being a landlord in Colombia above if you think you can help me send me an email I’ll be checking every day appreciate your help

HI Cory, I will send you an email.

I’m also in the process of relocating to medillin in a month and would also like that same information

In regards to Mark´s comments you need to compare apples to apples. In Medellin in stratus 1-3 neighborhoods there are condos available for $25,000 to $50,000 USD with government subsidies for down payments and mortgages. El Poblado is stratus 6 so it is more expensive. And keep in mind that less than 1% of the buying in Medellin is foreigners. The market is set by the locals and the key component in El Poblado is new construction pricing at about 6 million COP per sq meter or about $180 per sq ft for the most expensive real estate in Medellin. If you buy in El Poblado 15-20 year old properties, then you can be looking at 3-3.5 million per sq meter – or about $90-100 per sq which is competitive pricing when looking at the most expensive areas in other cosmopolitan cities worldwide. Gringos are not as dumb as you might suspect in buying here. They look for value, location and views. We find a lot of the locals do not look at value (i.e., they buy new construction), they are not concerned about being near a touristic area so there location preferences are different (want to be near work, schools or family) and they are less concerned with views than foreigners as they have been spoiled with great views their entire lives. In fact the lowest income people here often have the best views as they are up the side of the mountains here. So please keep this in mind as you jump to your conclusions.

The gringo real estate companies like Casacol and FAR International are out to get your money. I received an email from Casacol yesterday touting a 100 square meter 2-bedroom apartment in Poblado for 570 million pesos which is $189,556 US dollars at the current exchange rate. That is crazy expensive for Medellin. I just spent 3 minutes on Espacio Urbano and found in the same area a nice larger 158 square meter property with 3-bedrooms for a cheaper price of 550 million pesos and another even bigger 164 meter apartment with 3-bedrooms for 500 million pesos.

I agree with comments above to RUN from the gringo real estate firms. Make sure to your own due diligence and look at the market prices on the Espacio Urbano site to ensure you are not ripped off and taken advantage of.

Yes run from CASACOL with their overpriced listings. Do they think we are clueless? Here´s a link to that 570 million listing which is is a crazy price for 100 sq meters even though its furnished ‘ https://listings.casacol.co/property/high-floor-unit-with-spectacular-views-from-every-room-strategically-located/. For that price I could buy 2 nice apartments and live in one and rent out the other.

Wow those gringo real estate firms like Casacol look to be out to get your money. That is a way overpriced property and you can find so much cheaper in Medellin in my experience.

Yet another overpriced listing being touted via email by Casacol is 780 million pesos for 192 meters – https://listings.casacol.co/property/exceptional-luxurious-high-level-duplex-striking-distance-to-parque-lleras-and-provenza/. Yet another example where I could easily buy 2 nice apartments and live in one and rent out the other.

A $260,000 property in a country where the minimum wage is only about $250 per month should draw a red flag to anyone. Who are the buyers of such properties? Gullible gringos being sold overpriced properties by the gringo real estate agencies.

This is a nice article that should be required reading for anyone planing to buy or rent in Colombia.

Thanks again Jeff, I’m learning so much reading you posts. The comments are are also fantastic. Won’t be around much this weekend. We’re playing music on Saturday and Sunday.

Cheers, Brock

I do not live in Medellin but am a frequent visitor. I have a sizeable portfolio of apartments in the US and thus quite a bit of experience in purchasing and selling properties. I would like to point out that in the US all brokers, whether they admit it or not, work for sellers. Their commission depends on higher prices BUT often they will negotiate a lower price to complete the sale and get their money. The tone of your article is that it is somehow “bad” for agents to work for sellers, but it is no different than in the US

Yes FAR international screwed us too. This is one of the reasons they are going through what they are going through. My wife and I bought a property on the Poblado side of La Frontera.

We paid 3.6 million per square meter for a 110 square meter apartment when the apartment was actually 95 square meter. That’s actually 54 million pesos more than what we were supposed to pay.

Also, we were advised to pay 25% of the money in the States which we were reluctant to do. However, as he has mentioned in his statement, we were told that it would save us and the seller money on Colombian taxes .

We agreed to pay the 25% in the States and the rest in Colombia. However, the reported price to the Colombian government was less than the required amount to qualify for a Colombian investment visa.

To make matters worst, six months after we purchase the apartment. FAR international asked us to pay them $25,000 USD to renovate the so they could help us rent it when there was nothing wrong with the apartment.

M. Holman cannot enjoy the money he has stolen from all the people he has stolen from.

Casacol is another sad story. So, foreign buyers beware. Someone already said it. Gringo realtors are not helping gringo buyers, they are ripping us off. Beware! Beware! Beware.

Nick, out of curiosity: Any specifics on your negative experience w/Casacol? I thought of them as quite reputable…

Nick, let me start by saying that I am sorry that you had had a bad experience with FAR International which began in 2007, has sold more than 500 properties to foreigners and has never received feedback such as came from you below. I wish that you had contacted me at the time of your dissatisfaction so that I could have personally intervened.

In regards to your statement that all brokers work for sellers, please note that this is not the case in Medellin where the vast majority of listings are non-exclusive and in fact, of our 400 listings, all are non-exclusive. Our focus has always been assisting and supporting our buyers and trying to negotiate the best deal possible for them. We receive no help or incentives from the sellers and all commissions are 3% seller paid, non-exclusive.

I take exception to your statement ¨that FAR International screwed you too¨. Hopefully some additional facts and considerations will mollify this statement.

You state that you overpaid for a 110 sq meter apartment that was actually 95 sq meters. You also mentioned that you were advised to pay 25% of the funds in the US in order to reduce your taxes. And that upon doing so you then did not qualify for a visa. When I read this my first thought was did you use a real estate attorney? Because if you had, a real estate attorney would have done a title search and a review of the Certificado de Libertad and noted the size discrepancy. The attorney would also have advised you to pay funds in the US as this would affect your visa eligibility. I am a little puzzled by this as 99% of our buyers since 2007 are foreigners, and all but one used real estate attorney as far as I am aware of. Did you use a Colombian real estate attorney? Are you our second buyer who did not?

You noted that you were asked to pay money to FAR International in order to bring it up to suitable rental standards. If I had been in your shoes, and did not agree with that assessment, I would have simply taken my business to one of the other 12 or so other property managers in Medellin and/or dozens of other contractors/remodeling companies. It is the buyer’s right and decision to spend their money with whomever provides the best options.

I have to take a great exception to your statement ¨ M. Holman cannot enjoy the money he has stolen from all the people he has stolen from¨ as this is a direct challenge to my integrity. I would be happy to meet with you personally and see if a face-to-face meeting might help you understand that this is not only untrue, but demands an apology. You do not know me personally as far as I know. You obviously do not know my insistence to always be honest and transparent. If at any time any of our employees violated company policy, including theft, they have been fired with cause. And that starts at the top. Medellin Guru can put you in contact with me if you would like to join me for lunch or coffee so that you can make an informed judgment about my character.

In closing, I would like to say that all of us should be very careful listening to rumors, or coming up with uninformed opinions, and then striking out at people´s reputation in public. We all should have the common decency to first communicate with those we are going to attack and get their side. Only then if you are not satisfied should you castigate away. My offer to meet in person, by phone, or by email still stands, and Medellin Guru has my permission to provide my email address to you. I do hope to hear from you in the near future.

Hi Walter, I agree with your comment above. The gringo real estate agencies like FAR International and Casacol are out to get your money by pushing overpriced properties in the most expensive part of town – El Poblado. They don’t even have many properties listed that aren’t in El Poblado. Even though most of the housing in the city isn’t even in El Poblado.

John, Actually you are right for the wrong reasons. 95% of our buyers, renters and investors are foreigners, non-Colombians as it is very difficult to compete with the Paisas and also somebody needs to assist foreigners. Other than our rural listings, about 75% of our listings are in El Poblado, 10% Laureles, 10% Envigado and 5% Sabaneta. We just do not have foreign demand in other areas nor are we set up logistically to rent and manage properties in other barrios like Robledo, Belen, San Javier, Bello, etc. It is not about the housing prices but about the customer demand.

And many of you forget about the specialized needs of foreign buyers (non-locals) who need help with setting up brokerage accounts to bring their funds into Colombia, how to register those funds, introducing to qualified bi lingual real estate attorneys, ex pat tax accountants, Colombian tax accountants, how to negotiate price on title, assistance with property management if they wish to rent their places, with remodeling, recommendations for other services like medical, shopping, Spanish schools, tour services, schooling for kids, meeting other ex pats, virtual offices, etc. Many local real estate agencies do not know these services or do not care to provide them since their local clients do not need them.

John, I beg to differ. Having worked as an expatriate for a big European global player for many years in South and Central America, I have “fond” memories of local real estate agents and, even more so, local landlords, nicely enriched with a dose of good old plain incompetence. And don’t forget, real estate agents may have only a limited influence on sometimes outlandish expectation of local sellers/landlords. As for El Poblado (or high end neighborhoods in general) vs. less pricey areas: A matter of choice and resources for each individual (my point of view: why even entertain the travails of relocating, when you cannot improve significantly in the new location 🙂 ) Having said that: CASACOL is run by a Canadian with mostly local talent, so the term “Gringo” in the narrow sense might not fully apply…

CASACOL is just as gringo as FAR International. I just received an email from CASACOL touting 8-9% returns for investment long term and also touting 10-12% annual appreciation in Poblado. Also in the same email they are pushing an overpriced property in Poblado priced at 830 million pesos.

Yes, CASACOL is constantly pushing overpriced properties in Poblado. Yesterday I received an email from them about a 1-bedroom 84 meter apartment in Poblado selling for 450 million pesos.

Run from these gringo real estate agencies pushing overpriced properties! There are much cheaper properties available in Medellin.

As far as yearly rent increases go, renters could profit from dealing directly with the owner. When I completed my one year lease contract the real estate agency raised my monthly rent by 70,000 Pesos. It prompted me to make inquiries within my building and I found an owner who needed to rent out his unit. We drew up a standard lease without any deposit and he deleted the part about those hefty yearly increases. An owner’s expenses relating to an apartment do go up yearly so it’s not always the case that you’re being gouged but we discussed it and he agreed not to automatically raise. A rental agency is more impersonal and you get more credit and good will for being a responsible tenant with a “trato directo” direct with the owner.

Thanks Jeff, great article. Not having been there yet, this gives me a good idea of what I’m getting in to. Sounds a bit frustrating, but have experienced that before time and time again. So no big deal. Have a good one and hope to hear from you tomorrow.

Cheers, Brock

Thanks this is helpful. I wish I would have known about the Espacio Urbano site before we rented an apartment recently in Sabaneta. Looking at that site now, I believe the real estate agent took advantage of us as foreigners and increased the rental price.

It looks like we are paying about 400,000 pesos per month higher than some similar apartments in Sabaneta I see listed on Espacio Urbano.

The key determinant of pricing in any area, but especially Stratus 4-6 neighborhoods, is the cost per sq meter and age of the building. For El Poblado new construction pricing is in the 5.5 to 6 million COP per sq meter but if you purchase a 15-20 year old unit it should be in the 3 to 3.5 million per sq meter price range.

Another very important factor is size under air. Sometimes local agents/owners will say the size is for instance, 150 sq meters but they are including balconies or a Terrazzo, when in actuality the true size may be 135 sq meters under air. Also sometimes the actual size will be greater than what is shown on the escritura (title) because the owner may have added a room or space and not recorded it. It never hurts to have your buyers agent or yourself to take actual measurements.

A very important issue is price on title. The culture here that local buyers and sellers engage in is to put a lower price on title than is covered in the actual sales agreement. This can keep property taxes lower for the new buyer and can reduce the capital gains taxes for the seller, so they both enjoy this tactic. However it can be a problem for foreign buyers who prefer full price on title. This needs to be negotiated between the buyer and seller. A knowledgeable realtor or real estate attorney will know how to do this as their are many nuances in these negotiations.

Our experience is that properties in El Poblado that are properly priced to the market will move in one to three months. The listings that lag are often overpriced, in very poor locations, have higher than average operating costs (HOA and taxes) or are in need of substantial repair.

Typically we find that we are able to negotiate about 5-10% of the list price for properly priced listings in El Poblado, Laureles and Envigado. Also typically the down payment required for a sales contract is 10% but it is not a law, just customary. We have done contracts for more than and less than 10% but the majority of the time it is 10%.

Foreigners sometimes make the mistake of paying in the US (or some other country) for their property. Then later find out they cannot get a visa because the funds were not registered on a Form 4. They also find later that they can have an adverse tax event when selling for the same reason. A good real estate attorney will know how to handle this and to tell the buyer how much he or she can pay outside Colombia and how much needs to be brought into Colombia.

Rich, while I recognize and appreciate most of the arguments in your post, one thing seems counter-intuitive to me: On the one hand side, you quote current prices in El Poblado of 5.5 to 6 mln COP (which I think is realistic), on the other hand side, 10 to 15 year old apartments would sell for 3 to 3.5 mln COP. What happened there to the 7 to 8 % appreciation year over year here? Thanks for elaborating

Cheers harry

Nice article that is spot on. Be careful of real estate agents in Colombia as they are after your money and will inflate prices for foreigners.

I went to a Live & Invest Overseas conference in Medellin a few years ago. First American Realty that is now named FAR International was a presenter and they also took conference attendees around to see expensive properties in Poblado. They were promising foreign investors an expected return of 14% with 7% from rental returns and 7% from annual appreciation. I thought that was totally unrealistic at the time. And look what happened with the exchange rate. LOL, now those same properties are cheaper in US dollars.

7% has been the annual appreciation since 2002 in Medellin and net rental yields can range in the 4-8% range. The currency risk can work for or against you and this is explained to buyers. If you make a profit in COP and do not convert to USD then you have not lost on the transaction. Many buyers are concerned about the long term viability of a country with 20 trillion in debt and are building up assets in other currencies and in the case of Colombia keep their COP in Colombia as a long term hedge against the USD. But yes, currency is a two edged sword and can work for or against a foreign buyer.

As far as showing properties at the LIO conference there were nine showings in ElPoblado (from our 350 listings) that had a price range of $130,000 to $300,000 USD. There are not many El Poblado listings these days for under $130,000 USD that are in Startus 6 areas (El Poblado is 75% Startus 6) but you can search our web site by price to find lower priced listings. And please remember that the sellers set the prices, not the sales agency. The purpose of the LIO tour was to give attendees a look at a broad range of El Poblado apartments.

I just spent a couple minutes and looked on Espacio Urbano for properties in El Poblado less than 360 million pesos (< $125,000 USD) and there are 28 pages of properties listed with 50 per page and most are in Estrato 6. So there are many properties in El Poblado that can be found less than $130,000. Appears you are only selling more expensive properties.

Also 4-8% net rental yield – that doesn’t compare very well to a risk-free CDT at 5-6%. 7% appreciation per year over 15 years – it's meaningless to look back so far. Hasn’t been anywhere near that recently. COP as a hedge against the USD, I don’t think anyone will buy that.

Hi John, I agree with you. There are many properties for sale in El Poblado for less than $130,000. I looked at several and some were nice but you can find similar nice places that are cheaper in other neighborhoods like Envigado and Sabaneta. And who wants rental income that is likely becoming more risky as it looks like lower cost competition is increasing on Airbnb in the city. Also crazy to think of COP as a hedge for the USD.

The COP as a hedge simply means that an American investor (and can apply to investors with Euros, Canadian dollars, etc) may have all their assets tied up into one currency. Thus they are not diversified. When the next recession hits (and if you do not think it is coming then there is no arguing with you) it could be as bad as the last one where real estate values dropped 20-40% across the US and the stock market dropped more than 50%. During the last recession or 2007-2009 real estate prices actually went up in Medellin and the lowest year was up 3.4%. The USD got as low as 1642 when the US had 6 trillion USD in debt. Now the US has 21 trillion USD in debt and the USD is 3000 COP. You go figure that one out.

But over the long term the USD may go back to its normal trading range of 1800 to 2000 where it sat for much of the time from 2008-2014. Or maybe the USD stays strong forever and defies financial gravity. Well say an investor has 90% of his assets in the US and he has made out like a king except for his Colombian investment that is kicking out a nice cash flow in COP. Well he can use those COP to buy more assets here or use them to have a great time visiting and live like a king eating 30 USD steak dinners with a nice bottle of Malbec. At least he is in great overall shape. And he has not lost anything unless he wants to convert the COP back to USD.

On the other hand perhaps the USD goes back to its historical trading range he has a 30-40% capital gain built in if he converts his COP back to USD. In this case he will be wishing he did more but at least he made a nice return in this situation.

Each investor most determine his own risk reward strategy. And nobody knows where currency rates are going. But if you just sit in the US with 100% of your assets tied up there then you will be sorry when this next recession hits, that I can guarantee you.

I just checked our web site and we have 32 listings in El Poblado under 400 million COP with the least expensive being 210 million COP so about 20% of our listings are in El Poblado are in this category. You need to understand we do not control what listings we get other than eliminating some by location and some that are simply unsuitable for Western tastes (95% or our buyers are foreigners). And what we do is listen to what our buyers want in terms of size, location, amenities, rentability, and budget. They tell us what they want, we do not tell them what they want.

A risk free CDT does not offer any appreciation and the rate is only fixed for a short amount of time. The rate can then go up or down. So total return for real estate here has been in the 13-15% range vs. 5% for a CDT.

If you do not believe real estate prices have been going up for the past two years come by my office and I will show you the actual sales figures. But the easiest thing to do is go to a new construction project and ask for the prices and check the cost per sq meter. That really tells the story and if and when you see the new construction prices dropping then that is something to watch as it could be the sign of a top. Also look at Cartagena and Bogota stratus six pricing for new construction, it is 10-12 million COP per sq meter which makes El Poblado look like a real bargain since Medellin is a superior city to live.in.

I have been an expat for 7 years. The best advice I can give anyone is to stay away from any American real estate site! They will try to make there living off of you PERIOD! Stick with the local or you will be sorry! I will not reply to anyone who makes a comment so don’t waste your time!

Hi Rich, saw a program with Sam. Cost of living in Medellin. Where in el Poblado can I find a condominium like yours for under $500k. Planning to move next January 2019. Thanks

Luis my condo is currently worth about $175K. There are plenty of condos less than 500K in El Poblado, the most expensive part of Medellin. If you go to our web site https://www.farinternational.com/sales/ and search by price you will see that we have 353 listings under 500K in Medellin. Let me know if you wish to have an agent to assist you.

Everything you’ve mentioned is so accurate. My husband is from here and still it’s been a challenge. We have always been required to have two cosigners when renting, except the first year when we were renting directly from the owner. Now trying to buy property has been a confusing mess with different stories and two realtors competing for the sale. And friends of ours who paid for a pre-construction that was supposed to be completed next year just got word they found artifacts on the building site and will need another year to excavate.

Thanks for this article with very useful information.

In my experience the Gringo real estate agencies in Colombia only show you expensive properties. Also, the Gringo agencies won’t help at all with unfurnished rentals.

I decided to rent an unfurnished place before buying. I was able to find a rental apartment by talking to building porterias to get the numbers of apartment owners. I lucked out and found an owner who speaks English and I rent a nice apartment in Envigado directly from this owner without a fiador.