Colombia is home to one of the world’s top healthcare systems, offering high-quality medical services at a fraction of the cost compared to many other countries. Whether you’re an expat, retiree, or digital nomad, understanding how to sign up for health insurance in Colombia is essential for accessing affordable and reliable healthcare.

In this updated guide for 2025, we’ll walk you through the process of enrolling in Colombia’s health insurance system, covering both public (EPS) and private options. Medellín, in particular, has become a top retirement destination, renowned for its excellent healthcare facilities—including nine of the best-ranked hospitals in Latin America.

Some of the most frequently asked questions on the Medellin Guru site by foreigners considering moving to Colombia have been about health insurance. So, we now cover health insurance in Colombia.

Many Medellin Guru readers have asked about health insurance and other types of insurance. So, we partnered to offer Colombian insurance services to readers, which has helped many Medellin Guru readers obtain insurance.

Medellin Guru Insurance Service

The insurance agency we partnered with has helped 1.893 Medellin Guru readers.

Colombia's Healthcare System

The World Health Organization (WHO) ranks Colombia’s healthcare system as #22 out of 191 countries it ranked. Also, no other countries in Latin America were ranked higher than Colombia. So, according to WHO, Colombia has the best healthcare system in Latin America.

In addition, Colombia’s healthcare system is ranked higher than many wealthier countries like the United States (#37), Germany (#25), Canada (#30) and Australia (#32).

In Colombia, it is possible to have access to world-class healthcare at a fraction of the cost compared to the healthcare costs in the U.S. or Europe. Furthermore, the costs for healthcare in Colombia can be significantly lower than the costs found in the U.S.

It is possible to find costs that are from 50 percent to even over 70 percent less expensive in Colombia compared to the U.S. And medical insurance is also relatively inexpensive in Colombia in comparison to the U.S. and Europe.

With lower medical costs than many other countries, Colombia is experiencing an increase in medical tourism each year. Foreigners are coming to Colombia for dental care, eye surgery, cosmetic surgery and other surgeries due to the lower costs in Colombia. So, many hospitals in Colombia have some bilingual staff.

Colombia has the Best Hospitals in Latin America

Colombia has 24 of the best hospitals in Latin America, according to a study in late 2019 by América Economia that looked at the top 58 hospitals in Latin America. So, 41 percent of the best clinics and hospitals in Latin America are found in Colombia.

Medellín has nine hospitals that are on the list of the top 58 hospitals in Latin America as follows with their 2019 Latin American rankings:

- 1. Hospital Pablo Tobón Uribe (#9)

- 2. Hospital Universitario San Vicente Fundación (#16)

- 3. Clínica las Américas (#26)

- 4. Clínica Universitaria Bolivariana (#28)

- 5. Hospital General de Medellín (#33)

- 6. Clínica El Rosario (#41)

- 7. Clínica Cardio Vid (#42)

- 8. Clínica Medellín (#43)

- 8. Clínica Las Vegas (#53)

Also, Bogotá has nine hospitals that are on the list of the top 58 hospitals in Latin America as follows with their 2019 Latin American rankings:

- 1. Fundación Cardioinfantil (#3)

- 2. Clínica Universidad de La Sabana (#25)

- 3. Clínica del Occidente (#31)

- 4. Méderi (#32)

- 5. Hospital Universitario Infantil de San José (#49)

- 6. Clinica de Marly (#50)

- 7. Clínica los Nogales (#51)

- 8. Hospital Universitario Infantil de San José (#49)

- 8. Centro Policlínico del Olaya (#57)

In addition, Cali has two hospitals on the top 58 hospitals list, Pasto has two, Bucaramanga has one and Manizales has one.

We also looked at these top 24 hospitals in Colombia in more detail. The best healthcare in Colombia is found in the largest cities in Colombia.

Health Insurance Options in Colombia

One of the reasons that Colombia has such a highly rated healthcare system is due to a new constitution that Colombia drafted in 1991 that made access to healthcare a basic human right to all citizens of Colombia, as well as foreign residents of Colombia.

There are three types of health insurance available in Colombia:

This is the public health insurance that is mandatory for everybody who is a resident of Colombia. The monthly premium is calculated as 12.5 percent of the 40 percent of monthly gross income that you declare to the EPS.

This is private healthcare insurance in Colombia. The monthly premium for Prepagada varies depending on your age, the plan you choose and any pre-existing conditions.

This is a free government subsidized healthcare system, which is only for colombians with low economic resources .

Medellin Guru partnered with an insurance agent that can help sign up for Prepagada health insurance, auto insurance, homeowners insurance, travel insurance and life insurance.

Medellin Guru Insurance Service

The insurance agency we partnered with has helped 1.893 Medellin Guru readers.

Health Insurance Providers in Colombia

There are several providers in Colombia offering private health insurance including:

Axxa Colpatria

Axxa Colpatria is a financial institution in Colombia that offers various financial products and services, including savings accounts, credit cards, loans, insurance, and investment services. It is part of the Grupo Aval, Colombia’s most prominent financial conglomerates.

SURA

Grupo SURA is Colombian company based in Medellín that was started in 1944. Grupo SURA is a multinational company that does business in Colombia and several other countries in Latin America.

In addition, Grupo SURA is part of Grupo Empresarial Antioqueño also known as Sindicato Antioqueño, which is a large Colombian conglomerate composed of about 125 companies including owning a large percentage of shares in Bancolombia, Grupo Nutresa and Grupo Argos.

SURA’s primary businesses are health insurance, life insurance, investment banking and asset management. Also, SURA reportedly has over 4,600 doctors and over 400 hospitals and medical centers in their network.

Coomeva

Coomeva is a Colombia cooperative that provides its members healthcare services, insurance, financial products, and other services. It operates in various sectors, including healthcare, insurance, finance, and recreation.

Seguros Bolivar

Seguros Bolivar is an insurance company based in Colombia. It offers a wide range of insurance products, including life, health, property, and automobile insurance. Seguros Bolivar is known for its strong presence in the Colombian insurance market and its focus on providing its clients comprehensive coverage and excellent customer service.

Seguros Falabella

Seguros Falabella is an insurance company affiliated with the Falabella Group, a prominent retail conglomerate in Latin America. It offers a variety of insurance products, including automobile insurance, life insurance, health insurance, and travel insurance.

In addition, there are many providers offering EPS health insurance including:

- Nueva EPS

- EPS Suramericana (EPS SURA)

- Sanitas EPS

- Salud Total EPS

- Famisanar EPS

- Aliansalud EPS

- Compensar EPS

- Coomeva EPS

- Servicio Occidental de Salud SOS EPS

- Comfenalco Valle EPS

- Cafesalud EPS which is now called Medimás EPS

SaludVida EPS and Cruz Blanca used to provide the service but are no longer in operation. Here’s an article (in Spanish) ranking the 5th EPS providers in Colombia..

EPS Health Insurance in Colombia

EPS is the government health insurance in Colombia that is available to everyone with a cedula (local ID), Colombian citizens as well as foreigners with a visa and cedula.

The EPS health insurance in Colombia is available to everyone who is a resident, including people that are not eligible for private health insurance due to age or pre-existing conditions.

In an EPS plan, the delivery of services is through a network of public health providers/facilities. Keep in mind that the EPS plans cover everyone. So, it means longer waiting times to see doctors and receive medical care. Also, EPS plans include dental insurance.

In addition, to see a specialist, run diagnostic exams like blood tests or x-rays or to get a surgical procedure, with an EPS plan you will need a referral from your general practitioner.

Also, family members and dependents can be added to an EPS plan. These include:

In an EPS plan you will be assigned an IPS (Instituto Prestador de Salud), which is basically a health center, which will be your primary care location.

In addition, one thing to be careful with is that some of the EPS providers in Colombia aren’t in great financial shape. So, they are slow in paying medical providers leaving thousands of Colombians without health care services.

Medellin Guru Insurance Service

The insurance agency we partnered with has helped 1.893 Medellin Guru readers.

Prepagada Health Insurance in Colombia

In comparison, a prepagada health insurance plan in Colombia is private health insurance. Prepagada plans use private networks of health care facilities and medical providers. The focus of prepagada plans is to offer high-quality care in a timely manner.

The key benefits of a prepagada plan include:

Referrals

Referrals are not needed for diagnostics, specialists and procedures. You can just book an appointment.

Premium health services

You get access to the best doctors and health care providers in Colombia with preferential treatment.

Travel Insurances

Travel insurance is included for up to 90 days on each trip (is not included in an EPS plan).

Prepagada expands EPS benefits

Prepagada plans are available as a supplemental of EPS, offering an expanded availability of hospitals and specialists and shorter waiting times.

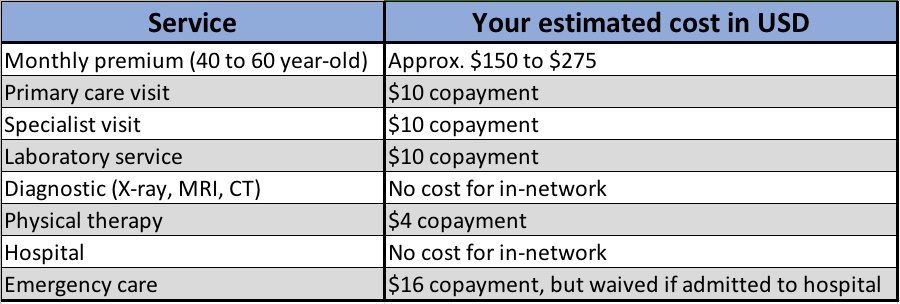

In addition, Prepagada plans have no deductible but have small copayments, as seen in the following table of costs:

EPS plans also have small copayments that are normally slightly lower than the prepagada copayments.

With a prepagada plan, you can get an appointment with a specialist within days and to get a surgery approved typically takes only 48 hours. In comparison, with an EPS plan in Colombia, it can take up to a few months to get an appointment with a specialist and it can take months to get a surgery approved.

Also, with a prepagada plan you can use out-of-network doctors and pay the difference between the standard reimbursement from the insurance plan and the doctor’s fees.

How to Sign Up for a Health Insurance in Colombia

It is possible to sign up for a health insurance yourself. But the forms are in Spanish and can be complicated and difficult for foreigners who don’t speak Spanish.

So, we recommend working with an insurance agent who is bilingual. The insurance agent we partnered with offers a service to help expats sign up for a health insurance in Colombia.

Using an Insurance Agent to Obtain Health Insurance in Colombia

Medellin Guru has partnered with an insurance agent to offer health insurance and other insurance products to foreigners and Colombians.

Features of the Medellín Guru Insurance Service

Bilingual Assistance

English & Spanish speakers

Online Quotes

Get immediate estimates

Free Consultations

Get advice on your needs

Business Partners

We recommend only verified companies

Medellin Guru partnered with an insurance agent to offer Colombian insurance services to foreigners including health insurance, auto insurance, homeowners’ insurance, travel insurance and life insurance. You can get any type of insurance in Colombia from this partnership.

Medellin Guru Insurance Service

The insurance agency we partnered with has helped 1.893 Medellin Guru readers.

Colombia Health Insurance Frequently Asked Questions (FAQ)

The following are three of the most common questions about health insurance in Colombia.

To sign up for an EPS plan in Colombia, you will need to have a visa and a cedula. and to sign up for a prepagada plan in Colombia, you need eps . So, a foreigner without a visa cannot obtain health insurance in Colombia.

After age 69, it is almost impossible to sign up for most prepagada plans. Sura now offers prepagada plans to aget 69 up from age 61., Also, Bolivar provides private health insurance for up to age 74 and must also have EPS and premiums will be higher. Also, an EPS plan will still accept you regardless of age.

Between age 60-69, there is an additional premium for a prepagada plan at SURA. So, it’s best to sign up for a prepagada plan before age 60.

Also, it is possible to get inexpensive travel insurance if you are over 75, see our article about inexpensive travel insurance.

The cost of an EPS plan is 12.5 percent of the 40 percent of monthly gross income that you declare to the EPS.

The cost of a prepagada plan is based on your age, pre-existing conditions and the specific plan you choose. And the premiums fall in age brackets: from age 0-14, 14 to 40, 40 to 60 and 60 and up.

In example, for a 60-year-old, SURA’s prepagada plan premium is approximately 800,000 pesos ($277 USD) per month.

Young kids are relatively inexpensive and the premium increases by age. In addition, the premium is increased each year by the annual inflation in Colombia.

Colombia requires health insurance when applying for Colombian visas with minimum coverage of:

- $35,000 USD for Visitor (V) visas

- $60,000 to $70,000 USD for Migrant (M) visas

- $100,000 USD for Resident (R) visas

You can use travel insurance or comprehensive health insurance plans (prepagada) or EPS insurance to meet this insurance requirement.

Travel insurance can meet the health insurance requirement for visas. Many Medellin Guru readers have asked about health insurance needed for visas.

The insurance agent we partnered offers a relatively inexpensive travel insurance policy from ASSIST CARD that meets the health insurance requirement for Colombian visas. See our article about travel insurance for details.

Medellin Guru's Colombian insurance and healthcare articles

- Get Insurance in Colombia

- Assist Card: Why is the Best Health Insurance for Colombian Visas

- Continental Assist: A vital ally to apply for a visa in Colombia

- Travel Insurance: Meets the Heath Insurance Requirement for Colombia Visas

- Auto Insurance in Colombia: A Guide to Colombian Auto Insurance

- Homeowners Insurance in Colombia: A Guide to Colombian Homeowner Insurance

- Medellin Guru Insurance Service: Providing Colombian Insurance

- Colombia has 24 of the Best Hospitals in Latin America

- Emergency Surgery: Expat Experience in Clínica León XIII in Medellín

- Healthcare Colombia: HCA Clinic Offers Services to U.S. Veterans in Colombia

The Bottom Line: Health Insurance in Colombia

In Colombia, it is possible to have access to world-class healthcare at a fraction of the cost compared to healthcare costs in North America or Europe.

Health insurance is also relatively inexpensive in Colombia in comparison to health insurance costs in the U.S. and many countries in Europe. In addition, it’s fairly easy for a foreigner to sign up for health insurance in Colombia.

Also, “How to sign up with Colombian Health insurance?” is a common question asked by expats moving to Colombia. So, we included this question in our list of Medellín frequently asked questions (FAQ).

Many Medellin Guru readers have obtained insurance in Colombia through our insurance agent partnership including health insurance, auto insurance, homeowners insurance, life insurance and travel insurance.

Medellin Guru Social media

Be part of our community. Find out about news, participate in events and enjoy the best of the city.

83 thoughts on “How to Sign up with a Health Insurance in Colombia – 2025 Update”

Real good. Thanks, Jeff

“EPS – Entidadas Promotoras de Salud – this is the public health insurance that is mandatory for everybody who is a resident of Colombia. The monthly premium is calculated as 12.5 percent of the monthly gross income that you declare to the EPS.”

Isn’t the correct amount 12,5% of 40% of income or in other words 5% of income?

This is info online from a visa service (you can search for this specific verbiage and pull up the site; I don’t want to link in deference to the Guru’s preferred visa service):

“If you are renewing a Colombian visa you are required to obtain EPS state-mandated insurance, and pay correctly based on your income. As of August 2020, the Colombian visa officials are reviewing bank statements, employment certificates, tax returns, or other financial documents to determine if applicants are hiding any income. Officials may ask for other documents.

Calculating EPS Insurance costs: You may use an insurance agent, or an accountant to help you out with calculations, however, the amount you must pay is based on your MONTHLY INCOME. Take your monthly income in pesos and then multiply by .05 (5%). The Colombian law says top pay into EPS by calculating 12.5% from 40% of your income, which is a complicated way of saying multiply by 5%.”

Yes, that is what we have in our article that was updated.

Thank you so much for this article.

Angela is more than exceptional. More than highly recommended. We are now insured by SURA

I hired an attorney who got me set up with ONLINE PAYMENTS, paying as many payments as I would like in advance. I can now travel on vacation and not worry about my SURA premiums needing to be paid in person every month as I did throughout 2020.

Roland, please understand that SURA is the name of a gigantic insurance company. They are owned by the same company that owns Bancolombia. SURA, the company, sells many different insurance products. In the US, these are called lines of insurance.

EPS is just one of the products or lines that the SURA company sells. It is the PUBLIC HEALTH OPTION. It is the government plan. Think of it as Medicaid.

So, to clear up any confusion. YES, Angela can sell most SURA products. You are, I am quite convinced, insured by SURA.

But Anglea doesn’t sell SURA EPS. And she didn’t sell you EPS. If you ask her, she will confirm this for you.

Many insurance companies sell EPS but SURA is the largest and most financially sound of all of them.

Older people must buy EPS, they have no other choice.

Thanks Jeff. I have been paying at the market. What do you use to identify you or your account?

The claimed that the paper I had used many times previously with the barcodes was no longer an existing SURA account.

Either the account was closed or I need to get a new paper. The paper was from Pagosimple. Do I need a new paper or do I need to get a translator and go through the hell of visiting SURA?

My Colombian wife went to SURA to get the new payment paper in December for 2021.

I went to pay my SURA EPS today 1/30/21, and was told my account number doesn’t exist. I have been presenting a paper form each month from PAGOSIMPLE.

My experience with SURA EPS.

1) You cannot get any help from any insurance agent. SURA EPS doesn’t pay agents any fees or commissions to help enroll people or answer questions.

Which leads to this:

2) Since the only help comes from SURA itself, the waiting times to speak with someone are horrendous. You can easily be on hold ALL DAY and still never speak to someone. All help is in Spanish only, no one in a public contact role at SURA speaks English.

So forget getting any help. Let’s talk about how you pay each month: IN PERSON

1) Banco de Occidente. Limited hours.

2) Baloto. These are lottery booths that can take SURA payments through Pago Simple. Don’t count on the sole employee being there during published business hours. They have no supervision and unless someone complains (Colombians don’t like to complain), they will leave whenever they feel like leaving.

3) Carulla (and maybe Exito), long lines, the system is often “down”.

Maybe there are other payment points like PagoSimple offices, but I am unaware of them.

Would you like to pay online? SORRY: NOT POSSIBLE.

Would you like to pay 6 months or a year in advance? 6 months would be $410 for me. SORRY: NOT POSSIBLE.

Did you miss last month’s payment and want to catch up by paying the missed payment + the current payment? SORRY: NOT POSSIBLE.

The system can only collect one month’s premium at a time, per day. Two months behind? You’ve got to make 2 or 3 visits to a payment point on different days.

Unlike the U.S. where your account number stays with you for life, apparently the paper I present to make my payments must be replaced with a new piece of paper annually.

Keep in mind if you are in your 60s, this is THE ONLY HEALTH INSURANCE AVAILABLE TO YOU.

Does anyone know who I can turn to for paid advice that is bi-lingual and who actually know what they are talking about?

We pay SURA EPS in Exito in Sabaneta during the week (before noon) and the lines and never more than a few people and they never have system problems in years of paying.

Sorry no insurance brokers we are aware of will help as EPS does not pay a commission.

“Keep in mind if you are in your 60s, this is THE ONLY HEALTH INSURANCE AVAILABLE TO YOU.”

Norm, is this correct only for various visa holders (Retirement, Resident, Marriage) or is it also true for US Citizens who eventually become Colombian citizens? Is private health insurance not available? I am 63, have been married to my Colombian wife for 10 years (brought her to the US on a fiance’ visa and married her here), and am considering retiring in Colombia after reaching SSA full retirement age (66 and 7 months), because of the high health care and living costs in the US. I have been attracted to Colombia because of the supposed health care, but this thread is a scary eye opener.

I don’t know the answer, but I think it has been answered here on the forum. But private insurance is costly when you are old and at higher risk. I think you can get some private insurance up to age 65. But SURA EPS is available to everyone.

But I just use a bilingual doctor here and pay out of pocket. An office visit is like $25 to $50. Almost all medications that require a prescription in the U.S. are available here over the counter. Again much cheaper.

I have the SURA EPS for emergencies. All the hospitals, even the best ones in Medellín, accept SURA EPS. It is a total nightmare to deal with SURA, though.

I haven’t found a way to pay online, and now I need to hire someone bilingual to help me get this piece of paper with bar codes that I need to have to pay every month. Apparently, I need a new paper every year.

SURA EPS was also supposed to assigned me to a community medical center and a primary care physician, but it has never been done.

ANYONE READING THIS THAT IS BILINGUAL AND KNOWS THEIR WAY AROUND SURA EPS, I WILL BE HAPPY TO PAY FOR THEIR TIME TO HELP ME GET THIS MESS STRAIGHTENED OUT.

I had my bilingual accountant, Paula Cruz, often mentioned by expats, set me up with EPS SURA (for a fee of course). So it was totally painless. She even set up my account with PagoSimple, the SURA online payment system, and sent me instructions as to how to pay online each month. SURA does have a 60+ additional insurance you can take, in addition to the basic plan, but looking over what it provides I decided to do without it. Like Jeff, I plan to normally pay medical services out of pocket, and have EPS just as an emergency back up. It’s also useful if you are going to eventually need to renew a visa or apply for permanent residency or citizenship, as they now require proof of having had EPS coverage for some time.

I would be happy to pay Paula her fee to get this done for me. Because I have been trying since I got SURA to find a way to pay my premium online, so I don’t have to go to Baloto or Banco de Ocidente or Carulla. I have a Bancolombia account that I have used to pay other businesses.

I was using Pagosimple, but apparently that paper is only valid for one year. I do not understand why all of a sudden my SURA PAGOSIMPLE account number is invalid.

What’s the best way to connect with Paula?

To contact, see this website – https://usatax.co/

Hi Jeff, excellent articles. This question is for you or anyone really with personal experience. It is so hard to find consistent answers to some questions… I am planning to retire at age 50 but am UNDECIDED on location. I want to retire in Colombia but it depends on this question. If I retire to Colombia, which means travel to the US perhaps 3 times a year, for say 2 week periods, do any of these health plans cover you if you have something medical happen in the US? Would that fall under a separate travel insurance you have to purchase for each trip?

I like most people it would seem am looking for affordable healthcare as it is one of the biggest obstacles to early retirement (pre medicare). But I do still plan to periodically travel to the US and abroad. I find very little information on how this scenario plays into the Colombian healthcare schema.

Well, it looks like we are back to the starting point. Although I must admit that reading the original post and all of the responses, I pretty much felt left in the dark. The only difference is that now many of us residents will be forced to get some type of EPS to renew our visas with the change in regulations. Can Medellin Guru take another look at this and provide a real update, now that it’s not possible to pass questions on to their friendly broker…who did not seem anyway to be able to answer many questions and who’s services seemed limited to speaking English and filling out forms ?

I would be interested in finding out info on getting EPS as well for visa renewal purposes, and also whether payments can be done online.

I chatted with Angela via Whatsapp today and I guess she no longer handles anything with EPS as when I asked he about more information on EPS she said she Handles Private Health, Auto, Miro, Renters, Homeowners, Life accident disability etc.

She did say that Online you would just do it on your own at EPS Sura which seems to be what everyone else here seems to be talking about.

Anyone have any updated experiences with them since the post above from Fred James on June 13, 2018 at 6:50 pm? Has the system been improved since his post or is it still a mess?

I take it this is the website: https://www.epssura.com/

I really can not find anything on there about how to apply for insurance on there or what the cost is.

I take it I will need to sign up with them next year when I go to get my residency visa since it is now required and I take it that after I get my R-Visa I can just drop it?

Yes, insurance agents do not help with EPS and the insurance companies do not pay commissions for EPS.

Jeff…

I know you like to recommend working with a broker, but readers should know that SURA EPS does not pay insurance agents a commission for selling EPS.

Since the signup process for EPS and other SURA products is similar, Angela does a great job of getting ex-pats signed up since all the forms are in Spanish.

Angela charges a reasonable fee for her time since she gets nothing in commission selling EPS. And Angela is fully bilingual.

So now I have some questions that Angela cannot answer.

1) After I signed up, they sent me to Social Security where they gave me an 8.5 x 11 form with a bar code. Apparently I need to take this form to a bank or a balota EVERY MONTH to make my premium payment.

This presents problems for me when I am out of Colombia traveling. No one seems to know how to pay online or via automatic withdrawals. Everyone agrees there must be a way but no one knows the procedure. Trying to get any telephone support from SURA is not difficult, it is IMPOSSIBLE. They simply do not answer phone calls.

2) SURA EPS has not assigned me to a clinic or a personal care practitioner. Since they do not answer phones, this means yet another visit to SURA HQ with a good translator.

3) I need someone who is bi-lingual and who knows the process from personal experiences. I need this person to hand walk me through the process. Angela would probably be the first to agree that teaching the process of the ins and outs of EPS is not her area of expertise.

Are any readers able to pay their EPS premium electronically? Private insurance can be paid electronically but no one knows about EPS.

This reply is for Doug Ball. In order to find English Speaking Doctors may I suggest Geovid.net WhatsApp +57 320 4255508. This is a medical service that searches out English Speaking doctors here in Medellin. Also San Vicente Fundación has an international department with bi-lingual speakers who set up all your appointments, walk you through the process at each visit and translate for you. The contact information is as follows: Andrea Aristizbal Molina, Practicante Oficina Internacional, Hospital Universitario SAN VICENTE FUNDACION, [email protected]. Tel (575)444 1333 ext 2158. Calle 64, #51D-154, http://www.sanvicentefundacion.com.My experience was excellent. In Oct I had surgery to remove a sarcoma cancer tumor on my ankle. Due to complications from a previous surgery 4 year earlier they removed old scar tissue and covered with skin grafts. The oncologist, surgeon, anesthesiologist, and wound specialist all spoke English, even the specialist for some other exams spoke English. Those working in the Lab, Cat scan, MRI did not speak English, But Andrea stayed throughout the entire process to translate which is part of their international service which you do not pay extra for. After my surgery I spent 2 days in ICU and 4 more days in a private room. The nurses did not speak English but we were able to communicate. However, during regular hours Andrea was always available to translate. I might add that two weeks later I obtain an infection and had to go into emergency. The doctors who treated me there spoke English except for the nurses. This was late afternoon on a weekend when Andrea does not work, but my loving bi-lingual Colombian friends took shifts around the clock staying with me in case I needed a translator .

I have Sura, my Spanish is fair. I have found them spotty, The only Doctor I have seen was absolutely excellent. I have tried to see others and have found the staff very rude. Making appointments is very difficult and they have few English speakers. I have gone to apooints twice to get a horrible run around and I never see a real doctor. I would be very cautious proceeding with SURA

Jeff you publish many fine and important articles. Many of us have friends still living in their home country. They ask questions about specific things. Is there any way (or are you working on it) that we can share a specific article with our friends living outside of Colombia, rather then providing your web site and having them search through everything to find the answers to their questions. Once they see the specific article then they can go to your web site for further information. We can then provide them a direct article to their question while also leading them to your web site.

Hi David, you can already share articles on Medellin Guru to friends via Facebook, Twitter, Pinterest or WhatsApp – there are buttons on every page. Or you can provide links.

Content on Medellin Guru cannot be copied. It is copyrighted content and Google can penalize both sites for content that is copied to another site. And we will never give permission for copying content anywhere.

informacion en How to apply for low to no cost healthcare insurance con colombia; de colombia en america!

Hello Jeff, you have sold me on moving to Medellin for my retirement. You provide good information on food, malls and areas around Medellin for renting apartments. Banking information is sketchy as to how to transfer money from a Canadian bank account. It looks like I will be depending on a piece of plastic with a magnetic strip that has PLUS until my retirement and cedula visas are issued.

I will be turning 65 in October this year, 2019. I have been taking meds daily for high blood pressure, a statin and diabetic 2 meds. Would the government insurance provide me with a doctor that I can see for regular needed blood tests and prescriptions?

Thank you.

For details about the insurance coverage in Colombia, we recommend contacting the insurance broker listed in the article.

Thanks for all this information. I am 70 years old and now have my visa and célula. My conclusion after reading all of this is that I should just pay privately for any required medical services, and hope for the best. I did slip on wet asphalt a few months ago, hurt my shoulder, and went to a clinic in El Poblado where I received excellent immediate attention (intravenous for pain, x-ray, discharged with nothing broken within two hours). I did have to pay in advance before being looked at, and was refunded the difference upon leaving. Cost was quite reasonable. So, I intend to continue the “pay as you go” option. MY QUESTION: I keep reading that basic EPS is obligatory for everyone with a visa and célula (residents). No one ever mentioned this to me all along my process of getting my residency in Colombia. And I obviously received good private attention when I needed it without being asked for proof of basic EPS coverage. So why would I apply for basic coverage ?? What does “obligatory” mean? What do I risk for not having basic EPS coverage ? Can someone explain? Many older people like me would want to understand. Thanks in advance to anyone who can clarify this.

Hi Giles, I recommend asking the insurance broker listed in the article about “obligatory”. I have SURA EPS with my Colombian wife. But I also have met some expats that go naked without insurance in Colombia due to healthcare costs being inexpensive.

Thanks Jeff, but I an not confortable with the idea of asking a broker for that information. A broker lives from selling insurance, so she would not be neutral in advising what the legal requirement might be for “obligatory” basic EPS. If you, or a neutral party, can advise on this, that would be more credible for your readers. If not, you can add me to the list of those older retirees who go without insurance and pay for private medical services if and when needed. Regards.

So I finally have my visa and my cédula (thanks to my Colombian wife), 55 years old and I have no income. What are my health care options? She seems to get free medical care. Is that an option?

Ask the insurance broker listed in the article or come to the Medellin Guru meetup on May 21 and talk to her directly – https://medellinguru.com/may-medellin-guru-meetup/

Hello Mark. all Colombians have the right to health so we are not working through the system that your Colombian wife should have, you just have to say that you add as a beneficiary and you will have free health service until you can have a job or a stable income , there you could access the paid health service that is much better than the government subsidized

Ok, thanks for the information David. Is there a place or website my wife and I go to in order to add me as a beneficiary?

Dear Jeff,

Thank you for this useful information. Do you happen to know if any of these private insurance providers also cover repatriation for expatriates taking out policies?

Many thanks,

Aline

I recommend asking Angela Berrio, the insurance broker listed in the article.

Fyi , We used Angela’s services and believe she is more exceptional!

Hi Roland, happy to hear that.

Thank you for this venue and info. Question: does anyone know if I can order tests and labs myself without a doctors order, since I can interpret some of this. I would like to pay out of pocket for tests then maybe have a provider see me and recommend treatment, I am 68 years old and don’t meet requirements for prepaid.

I can take the results that seem significant to a primary care to assess me for treatment after getting the test at my own expense.. Can I go to Pharmacy and order my meds without a script, I do this in Panama?

Also, anyone able to provide me with a resource to research how much specific drugs cost?

Thanks a lot, Nancy

You can get some tests without a doctor order and get some meds at pharmacies without a script. I am not aware of a resource to research how much drugs cost and the cost varies by pharmacy and if generic drugs or not. Colombia has many generics that are made here and are inexpensive.

For those over 60, this may be of interest.

The topic of health insurance availability in Colombia is ambiguous to say the least.

In my first two years in Medellin I simply paid out of pocket for health care as I needed it for routine exams etc. Then two years ago I decided that I should get health insurance and applied with SURA. Family here told me they were the best. I was immediately refused their prepaid insurance simply because I was over 60, period. (I was 65 at the time, take no meds whatsoever and generally enjoy good health). I’ve since heard on other forums that some expats in their 60s have been able to obtain prepaid insurance with SURA…. it must depend on who you ask. I was then encouraged to apply for Medicina Prepagada with Coomeva and received it no problem and I didn’t need a visa/cedula either.

A few months later I received my visa/cedula and then applied for the basic EPS, also with Coomeva, thinking I might be fine with just that and cancel the prepaid insurance. I couldn’t have been more wrong. Since then I have witnessed my Colombian friends and family who have EPS with various providers and I am absolutely stunned at the depth of bureaucracy they must endure to get treated. They are tossed back and forth and wait in countless queues for approvals and appointments, little of which can be done by telephone. I imagine that if you are in an emergency situation you would get treated faster but I wouldn’t count on that. I had to call an ambulance for my mother-in-law who was having stroke symptoms and after waiting half an hour I called for a neighbor to take us to the clinic. The ambulance never did show up at the porteria.

You may also be turned away at a hospital because your EPS isn’t recognized there. It’s also worth mentioning that most of the best physicians won’t work with EPSs because they don’t pay well enough and/or because of the bureaucracy involved and lack of funds, take forever to pay.

As well, contracts with the EPSs and clinics are typically renegotiated every January and it’s very common that the clinic you need for a scan or test will not serve you until a new contract is signed, which could take a couple of months. Don’t be discouraged, read on.

On the other hand, the service I’ve experienced with Coomeva Medicina Prepagada has been outstanding. I still enjoy excellent health but I am proactive with routine examinations, basic dental work/cleanings and I can say I never have to wait for appointments, referrals or approvals. I just call and I’m seen within a day or two, and that includes specialists. They even have domicilio and ambulances on duty if necessary. The level of care and professionalism is far superior to anything I’ve had elsewhere.

Bottom line, the cost difference between EPS and Prepaid is substantial. I pay a premium of $220.00/mo for a top tier package with Coomeva. EPS coverage will vary based on your age and income but at roughly $30-40 a month, you’ll get what you pay for and you’ll need to be incredibly patient. I suppose the question is, what value do you put on your health care?

Henry, any particular place in Thailand ?

This is definitely a subject that needs discussion and it seems there are many contradicting views concerning the quality and accessibility of care available to expats as well as locals here in Colombia. At any rate, being able to pay out of pocket at the best facility would probably always be an individual’s first choice, but not a reality for many who choose to retire in Colombia on fixed incomes and have been attracted by the country’s lower cost of living.

As someone who’s lived and worked in developing countries on four continents, has a cedula but has only been living in Colombia for six months, my anecdotal experience of the Colombian health care system isn’t at all positive. Mention the survey Jeff cites in this post rating Colombia’s medical care at the top of Latin America and locals look astonished and laugh.

I had a horrible experience at a clinic in Pereira last year while traveling–incompetent doctors, equipment, todos, and this was the clinic recommended by my hotel.

My former colleague in the Middle East, who’s lived in Colombia longer than I have and has insurance with Medimas, has been put through hell and ended up paying mostly out of pocket for all specialists (which here basically means anyone who has more than a bachelor’s degree) trying to get a diagnosis for a condition she’s developed.

Based on the above, I’m still hedging on the health insurance front here and just paying for travel policies that cover accidents and emergencies. I’m not sure which direction to go in at this point. One thing is certain: If I had major health issues, I wouldn’t choose Colombia as a place to live.

I like so many things about Colombia, but, so far, healthcare isn’t one of them. I received the best medical care of my life while living in Thailand, again for a fraction of the cost in the USA. And don’t even get me started on the mess that is the medical system in the USA.

Good luck to all!

Medimas is a small EPS so no real surprise about problems. Also, no surprise about Pereira as the smaller cities in Colombia don’t have the best healthcare in the country which is found in Bogota and Medellin. I have Sura private health insurance and have experienced only good health care in Medellin. And I have found Sura to be much easier to deal with than the complete insurance mess in the US.

Hello my name is Laura Peña, I am an attorney and beside my legal work I offer a program to enroll in a health insurance EPS with Sura or other EPS, most of my clients are foreigners and there is an easy way to enroll any body no matter the age or illness he/she has.

Laura, I am a Canadian who is beginning to live in Cali Colombia with my wife who is a Colombian citizen. I will be turning 65 in March of 2019. I do take some medications. Soon I will apply for spousal visa and then residency. I am wondering about the best route for me for medical insurance and the approxiamte cost. thankyou. James

Hello James,

If you want to know how to get your health insurance for your specific needs, please give me a call cel 310 8324889, it will be my pleasure to help you.

James, I’m in a very similar situation to yours so was interested to know how this all turned out for you. Thanks, John

All turned out great with no issues. Once I got my spousal visa I got my Cedula, all within 3 weeks. I signed on with my wife at her work for the Colombian medical insurance. We then applied for ColSanitas which is a prepagado.< and one of the best. Paid 2 million pesos to join, get a medical within 70 days and then pay 1 million pesos per month for both me and my wife. Easy. You must apply before your 65th birthday. Good luck to you.

It has been a long time since this post but what is your contact information?

Sorry, we do not permit personal information to be exchanged in comments due to trolls and scammers. Medellin Guru will not be responsible for personal information getting into the wrong hands.

If you need help with insurance, contact the insurance broker we partnered with, here – https://angelaberrioseguros.com/landing/

hi Laura my name is James. i need help getting eps sura insurance.

Hi James, we do not permit leaving personal information like phone numbers and email addresses in comments on the Medellin Guru site. This is for privacy concerns. There are many scammers and trolls that could get your private information.

You should Google search for the attorney Laura Beatriz, you won’t be able to contact her here on Medellin Guru.

Thanks Jeff for the information about SURA and healthcare. Malls and churches are interesting but articles such as this are probably far more important to most of us.

Hi David, thanks, I was researching all the insurance providers and it was taking far too long with so many options. So decided to write the article and focus on SURA, which most expats I have talked to with insurance end up using.

Hello Jeff,

I am a 70 year old US citizen expat living in Panama since 2013 .I currently have no health issues and take no medication. I am considering moving to Medellin to have cataract corrective surgèry and dental implants.

My question is, would I benefit from a healthplan or should I just pay out of pocket until I decide if I will make Colombia my new home.

Like most US expats I have medicare and a supplemental as a safety net should my overall health change.

Hi Edward, I have met several expats that pay out-of-pocket as medical costs are cheap. If you are 70, you can’t get the Prepagada private health insurance in Colombia, due to your age. And the EPS plan is limited to people with a local ID cedula, which you can’t get unless you have a visa. So, unless you get a visa, it really won’t be an option for you to get health insurance in Colombia until you get a visa. The insurance broker listed in the article speaks English if you have additional questions.

If you are going to having cataract surgery and you have read my previous response here then I can give you some further advice. As Jeff has said below, you can not get insurance as you are over 60. But if you were insured, SURA is one company that will not give you a dime for this. First you were pre-diagnosed so it is a pre-condition prior to insuring. Second, even if you were not, they will put you through hell proving you have had annual intensive clean checkups prior to insuring with them. Assuming you were able to do this, SURA would pay very little for it, especially if you went outside their network. AND they will not pay for premium lenses of any kind or modern multi-focal lenses you would get in the States. As I indicated in my previous response, SURA is one of the worst insurance companies in Colombia when it comes ton reimbursement and their doctors are far from the best. I do happen to know others such as MedPlus or ColSanitaS will cover cataract surgery without the intensive game of attempting to get around paying. But as I said, in your case it is not a possibility. That said, you have only two eyes – go to someone good such as Gustavo Tamayo in Bogota. Do waste your time in Medellín. He is world renown, well published, a pioneer in ocular surgery, and still as fraction for the US cost. Dental implants are like cosmetic surgery – a whole other story. Be very careful.

Why not go back to the states for cataract surgery and use Medicare? Out patient procedure With one day followup.

Oops. Scratch that comment…didn’t see it was posted 3/2018. Maybe I need cataract surgery ?

Is medicare effective outside of the USA??

No – see – https://www.medicareinteractive.org/get-answers/medicare-health-coverage-options/medicare-and-living-abroad/medicare-coverage-for-those-who-live-abroad-but-plan-to-move-back-to-the-united-states-or-travel-back-frequently

Hi.

Thanks for the article. No mention of Plan Complementario of SURA… I recommend to check it out. If you do EPS then you can add between 20 to 40 USD monthly getting more convenient services.

Amir

Amir is correct. The Sura Plan Complementario gives you many of the Prepago benefits but at a much lower cost.

I just enrolled in Sura EPS last week and the Plan Complementario this week. Total I’m paying about $72 a month for both combined.

There is no travel coverage with the Plan Complementario but one can buy travel coverage on a trip by trip basis for about $3.50 a day.

Also, not sure who is getting Prepago without a cedula but I attempted this in Dec. before I had my cedula and was told absolutely not by Coomeva, Sura, Colsanitas and Allianz.

One point that wasn’t clear in the article…….in order to have the Prepago you must have EPS first. EPS requires a cedula so……..

Steve

Hi Steve, the insurance broker listed in the article told me she has several foreigner Prepagada Sura clients with just passports and no cedula.

I also dealt with 2 agents both for Sura and they both told me no, not without a cedula. But the other point is that in my research I was told be every agent and company that I went directly to that Prepago is not possible without EPS first and as EPS is somewhat administered by the government then how would someone without a cedula get around that?

Steve

Ask Angela, the broker listed in the article how. She told me she has several Prepagada clients with just a passport. I’m just passing on what she told me in a meeting.

Very interesting comments if some one want to know more about health insurance in Colombia, I will be glad to help. I am an attorney specialized in insurance issues

Good article, up to a point. I agree that the healthcare system itself is world class, and the medical care is as well. I was a patient at Pablo Tobón Uribe in Medellin this past January after suffering a heart attack. The care, staffing, treatment & overall experience was excellent. My only objection to this article is that, as you say, “In Colombia, it is possible to have access to world-class healthcare…” Possible, yes. Easy? No way. What I found when I had my MI is that ‘access’ to the system is the problem. The piece fails to mention, for example, the lack of ambulance availability, at least in Medellin. There are private ambulance companies, but they’re extremely slow in responding, (I was told it would be three hours!) the delay often because of traffic, and the training & expertise found on an ambulance is very basic. During my eventual transport I was not monitored, had no oxygen or IV, and was not checked for vitals, not once. Anecdotally, people talk of ‘muerte de la calle’ meaning death on the street. A subtle triage practice exists, depending on type of insurance involved. We have EPS Coomeva, and pay very little. (Aprox. $30.00 per month USD) Because of this, and again anecdotally, I was turned away from two hospitals–Clinica Las Vegas, and Cardio Vid, when they saw my Coomeva coverage–in the middle of a heart attack! The bottom line? Colombian health care is unrivalled…once you get into the system. And if you’re going to have a medical emergency, don’t have it during high traffic periods.

Jeff: Thanks for the article. 1) I’ve just learned about the deal breaker for many: Getting private insurance after 60 is a bummer for those planning to retire in Colombia ( at least a portion of the year ) at that age or later since US Health Insurance and Medicare don’t cover overseass.

Anyone with any feedback on this issue?

2) Recently, I learned via a Colombian friend that SURA is perhaps the best private health care insurance in Colombia ( SURA, I’m quite sure is the acronym for Suramericana de Seguros ). However, you have to be up to date with the premiums; otherwise, they will deny you coverage until you pay no matter how serious the situation might be . Any feedback on this?

3) I recommend that any foreigner living in Colombia learn Spanish and watch the national TV and local news to keep abreast of happenings in the country and to give you a better picture of where you are, beyond your sheltered existence. I don’t know how the WHO did the ratings, but when it comes to Health Care in Colombia, like everywhere else, the best care is for those who can afford it. The Public Health Care System in Colombia is a mess, poorly regulated and enforced and notorious for being mostly a strand of horror stories for the less fortunate ones. I hope things improve over the next few years. I don’t like to disparage about the country I was born in, but that’s the reality of it. I welcome feedback on this as well.

There two Sunday evening Journalistic Programs on Caracol TV nationwide that I recommend to those fluent in Spanish: Los Informantes and Septimo Dia: In particular, usually Septimo Dia is a weekly expose of major news impacting the country and its people like scams, the health care mess, corruption, crime, etc. These are news that everyone should be aware of.

Of course, there are many wonderful things about Colombia and its people, but it is best to get a well rounded update on what is happening there.

Best,

John

John & Jeff,

You have covered very nicely a subject of great concern for everyone. However, as a resident of Colombia since 1999 I feel you have led people astray with perhaps your unintentional bias toward of SURA. Indeed, SURA has a big presence in Medellin, but is NOT highly regarded outside of Medellín or accepted by many of Colombia’s best doctors. Nor will SURA pay for your use of these doctors – though they claim you can go out of “network” and will be reimbursed. As a SURA customer I have sadly learned from experience on numerous occasions. As a large business owner in Colombia and businesses all over the world, I have come to learn that, much like Bancolombia, SURA and other companies Grupo Sura owns, these are NOT customer friendly companies. Big is not always good. For example, Bancolombia is probably the worst bank unless you are a corporate customer. They will fee you to death including silly unheard of things as a $4 charge for making a deposit to your account outside of the city your account resides. (Fortunately the law is catching up with some of these money grabs as indicated in the company’s stock price and recent downgrades) SURA Insurance has so many loop holes and drags its feet to get around reimbursements that you will lose your mind dealing with them. I consider myself a far more sophisticated international businessman than most of your readers, have lived all over the world and would not recommend SURA to anyone – particularly given the alternatives. Further, as someone who’s business is actively involved in the healthcare arena woking with many of the doctors all around Colombia, I would hardy say SURA attracts the best. It’s an HMO ! You get what you pay for. But unfortunately you are overpaying in SURA’s case. Now I am not endorsing others – they are insurance companies and they make money saying “NO”. But I have done my due-diligence and would say there are far better ones than SURA.

Jeff: Thanks for the update and correction. I actually wasn’t endorsing any plan since I don’t have any experience with any. I was planning to drop by a SURA office on my next vacation to get some estimates. However, my retirement is years away and it seems we have to deal with similar situations outside of the US when it comes to Health Care Coverage and Premiums. I’m sure for basic non-critical issues most places would do. However, for critical issues the US seems to be the place to be, provided you get advanced notice of a critical issue and it is wise to fly back to the US for treatment. Otherwise, we are all on the same boat. What would probably help is to get everyone’s input on this issue, cost, quality of care, etc. so that we can make a more educated guess. This might be a deal breaker for me. We’ll see.

Even in the US we face the same issue of affordability and accessibility and Health Care cost in the US keeps going up. I’m fortunate that I live in NYC and have insurance through my job. But a lot of people in the US are unable to afford and/or access quality health care.

Thanks, again

Dear john the healthcare insurance rate formula was,. 12.5% of 40% of the declared income.

Thanks Jeff, nicely researched and presented. I’ll revisit it a few more times. Maybe more. I know what I need, and will speak with Angela, before I do anything. Been a very busy day for me. Will be moving to another place over the next week so may be late on any you put out. Have a wonderful night, will have some questions but not tonight.

If I sign-up for Sura EPS as I am over 62 is it possible to request and receive an English speaking primary care doctor?

Hi Norm, I recommend asking the insurance broker listed in the article as she may know. Or you could check with SURA’s bigger IPS (Instituto Prestador de Salud) health centers like the one near the Industriales metro station. It’s a big one so I wouldn’t be surprised if they have at least some English speaking doctors.

Thanks. A very helpful article.

hi jeff great article was waiting for you. It seems to me that the health system in Colombia is good as long as it is the prepaid EPS. I have used it and have no complaints excellent service. The problem is that not all doctors speak English.

Hi David, thanks. Yes, unfortunately not all the doctors speak English.

The government plan is 12.5% of monthly income. That could make it much more expensive than private plans for some of us. Do we declare the minimum required for residency to reduce the monthly cost or just go with a private plan? For those of us over 60 and solvent it appears that our options are limited in finding cheap but none the less affordable health insurance.

I have talked to some expats that declare the minimum Colombia income to the EPS, so they pay a low premium for EPS. I suggest talking to the insurance broker listed in the article for guidance.

Thank you so much for this analysis of health insurance. Other advice that I have heard is to go “naked” or to just pay for care when you need it, especially if you are healthy or over age 60. Please comment and advise based on your own opinion and experience.

Hi Kelly, yes I have met several expats that go “naked” without health insurance if they are healthy, as medical care is inexpensive.