We provide foreign buyers with a detailed overview of Medellin real estate, encompassing the steps to acquiring property in Medellin and the typical closing costs.

Foreigners are increasingly drawn to Medellin’s charm, seeking to experience its dynamic culture and opportunities. Entrepreneurs, couples, digital nomads, and families visit and stay in the city for long and short periods.

Laureles, one of Medellin’s prime neighborhoods, recently earned the title of the coolest neighborhood globally by Time Out Global Magazine. Initially favored by retirees, Laureles now thrives as a hotspot for digital nomads, entrepreneurs, and investors, drawn by its perfect blend of tranquility and opportunity.

Medellin is gaining fame as both a dynamic destination for remote workers and a top retirement haven for foreigners, courtesy of its affordable living costs, pleasant “eternal spring” climate, and reputable healthcare, boasting nine of Latin America’s top 58 hospitals. Esteemed outlets like U.S. News, World Economic Forum, Huffington Post, and CNN Money have all recognized Medellin for its retirement appeal.

How is the Real Estate market in Medellin

Colombia’s real estate sector presents unique challenges, differing notably from markets in the U.S. and elsewhere, not least because many agents in Colombia are not English speakers.

We’ve exposed 13 insights that you might not hear from local real estate agents, highlighting the complexities foreigners may face when buying or renting in Colombia.

Our Medellin Guru website hosts a comprehensive collection of articles that guide you through renting apartments (furnished and unfurnished) and deep dives into Medellin’s diverse neighborhoods.

How to buy property in Medellin?

Our Medellin Guru readers have asked about purchasing property in Medellin. To address this, we’ve compiled an up-to-date and comprehensive guide to real estate buyers in the city with the advice and help of Real Estate by expatgroup.co, which is our specialized partner in real estate and other related matters.

Foreigners are indeed allowed to buy property in Colombia, and the process is mainly similar for both foreign and Colombian buyers. However, under the new Resolution 5477 of 2022, some changes in visa regulations may affect foreign investors.

For instance, the investment visa, which can be a pathway to residency for property buyers, has specific requirements that need to be met. Potential buyers must be aware of these changes and consult with legal and immigration experts to understand how these new regulations might impact their investment and residency plans in Colombia. You can access our Medellin Guru Visa Services to obtain complete advice on the matter.

Why buy Real Estate in Medellin?

Many expats are interested in buying properties in Medellin, exploring opportunities to establish a lucrative business in this great city, and even securing an Investment Visa with their real estate acquisitions:

Investment

You can invest in property that produces a monthly rent income

Part-time Home

You can use the property as a short-stay residence without loosing income

Permanent home

A place to live full-time and avoid paying rent with a great cost of living

Increase the value

Renovate your property will increase its value and your profits when you sell it

Set up a business

You can buy a property to stablish a profitable business in a great city as Medellin

Investmet visa

You can obtain an Investment Visa with your Real Estate adquisition

Also, it is essential to understand that smaller apartments in a popular area with tourists (such as El Poblado) are generally better investments when buying real estate for business. These investment properties may differ from where you want to live.

Large apartments can be great homes, including penthouse apartments or fincas in the Medellin area with many amenities. But generally, they are not the best properties for rentals. Also, suppose you want to buy an inexpensive property to live in an area not frequented by foreigners. In that case, you can explore other neighborhoods to get great options.

Best locations to buy Real Estate in Medellin

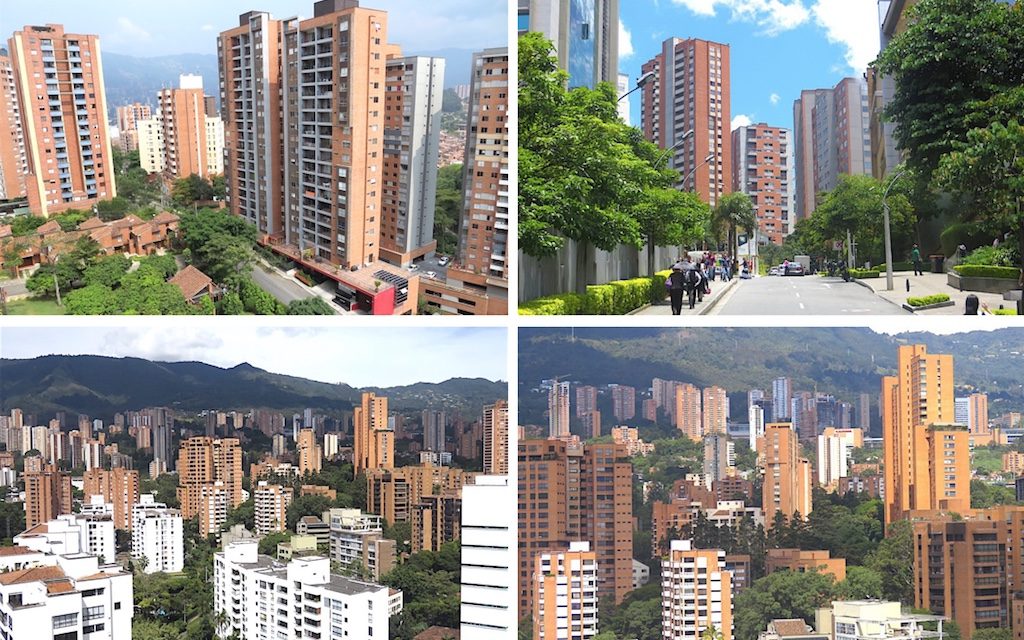

Once you decide why you want to buy real estate in Medellin, it is time to choose where. Like any other location, real estate pricing in Medellin varies by location and amenities, with a wide range of available properties. From luxury homes that cost USD 1 million or more to low-cost and small apartments located in safe neighborhoods for foreigners that could cost less than USD 50,000. Real estate prices in Medellin can vary depending on the neighborhood and estratos (a socioeconomic scale).

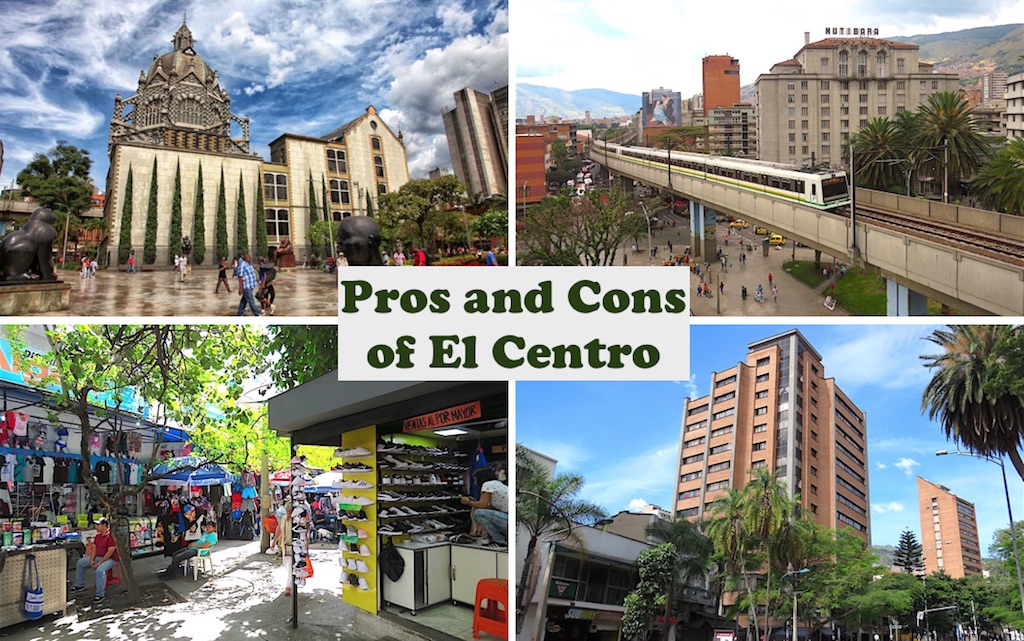

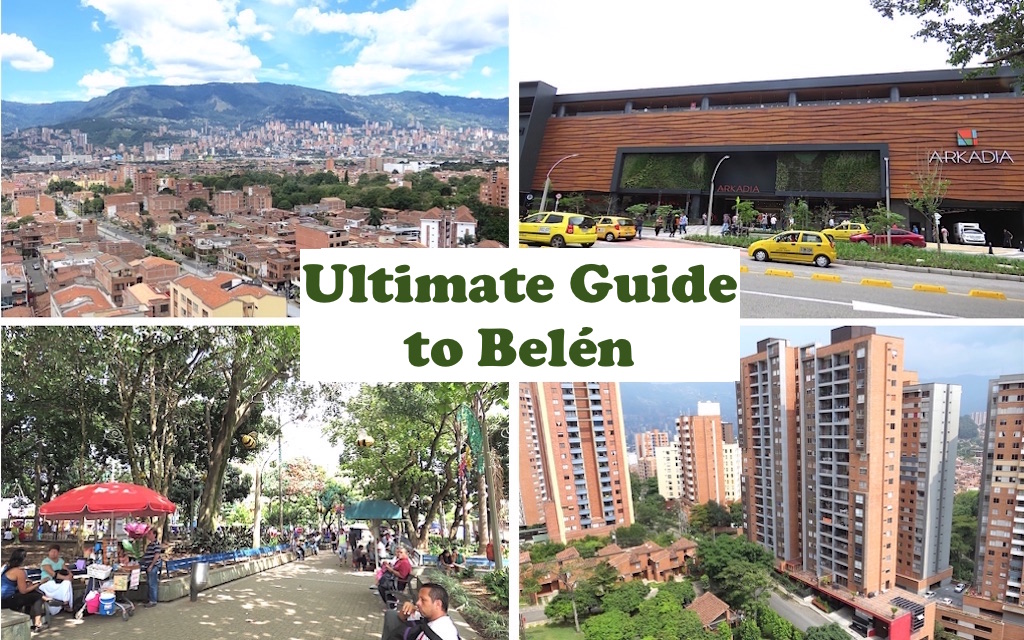

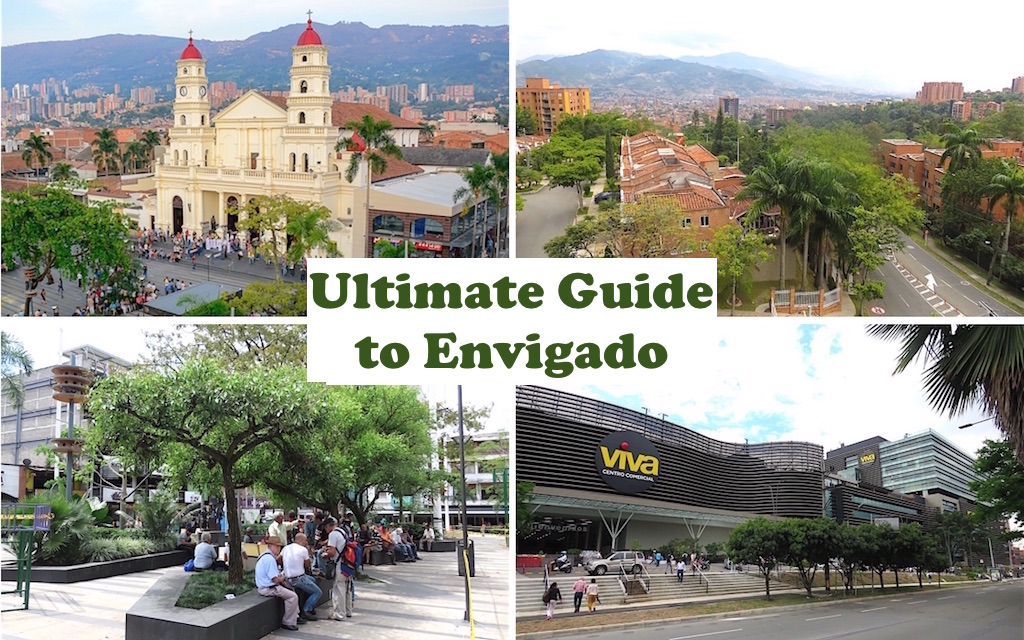

If you are looking for investment properties for business, we recommend El Poblado and Laureles neighborhoods, which have the most demand from business travelers and foreign tourists. Also, if you are looking for a property to live in, the five most popular neighborhoods in the Medellin area can be great options for you. Choosing a place to live is personal, and everyone has different requirements. Also, we have several articles about the neighborhoods in Medellin.

Foreigners live in many other parts of the Aburrá Valley and nearby, not just the five most popular neighborhoods. There are many expats in Barbosa, Bello, Buenos Aires, Giradota, Itagüí, La América, La Candelaria (El Centro), La Ceja, La Estrella, Rionegro and Robledo.

The bottom line is that no neighborhood is perfect, and each has benefits and downsides. But it is essential to be near shopping malls, entertainment, and other amenities for investment properties.

Also, looking for properties that permit short-term rentals for higher returns is necessary. Not all properties in Medellin allow short-term rentals. Also, we recommend trying out a neighborhood on a trial basis before deciding to live there permanently. Choosing where to live can significantly impact your cost of living in Medellin and the Aburrá Valley.

Buying Old Properties vs. New Properties

Medellin has a range of ages for real estate properties in the city. Some properties may be well over 100 years old, and others may be only a few years old or recently built. Also, there are many new construction projects in the city.

The age of properties can be a significant factor in pricing. Older properties sell for a lower price per square meter than newer ones.

However, finding beautiful and well-located properties in older buildings and Casas (houses) in Medellin is possible. Some older properties may need extensive renovations. And some older buildings may not have many amenities.

Newer apartment buildings in the Medellin area tend to have many amenities, including pools, gyms, balconies (sometimes with great views), and modern layouts. However, newer apartment projects tend to have higher prices per square meter.

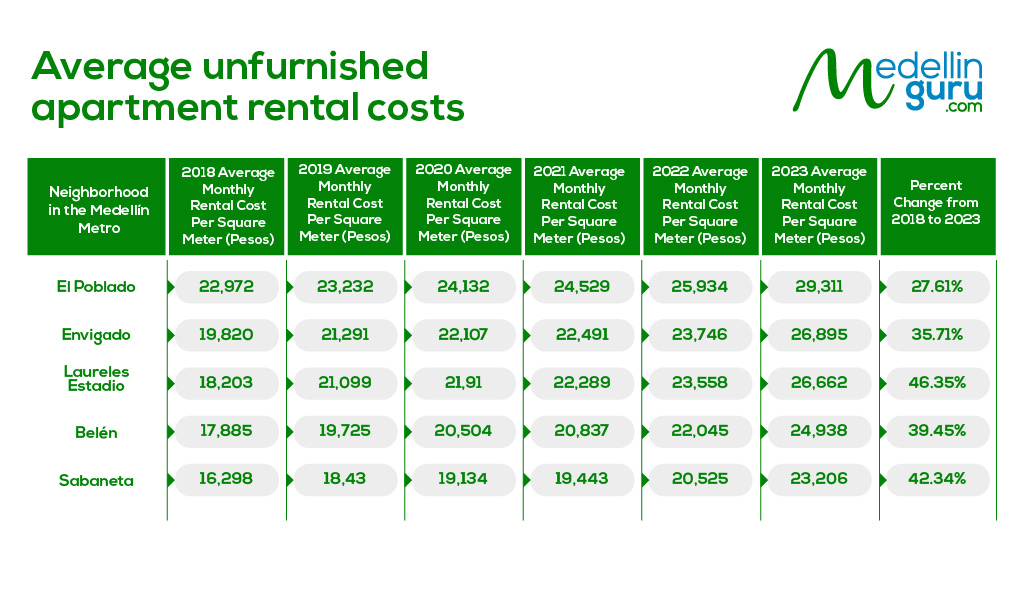

Average unfurnished apartment rental costs per square meter by neighborhood in Medellín for five years

The unfurnished apartment rental prices in these neighborhoods may be lower than in many cities in the U.S. However, the rental prices in El Poblado are higher than in other neighborhoods in Medellin because it is rated as estrato 6 on a 1 to 6 scale.

Transferring Money to Colombia to Buy Real Estate

In addition to the earlier points, when transferring money to Colombia for real estate purchases, it’s important to understand the role of the Banco de la República, Colombia’s central bank. The bank oversees international financial transactions, including large-scale foreign investments like property purchases. The F4 form, filed during the transfer, is submitted to the Banco de la República. This ensures your investment is documented correctly and complies with Colombian financial regulations.

Given the complexity of international transfers and Colombian banking regulations, working with a specialized real estate agency like Real Estate by expatgroup.co can be highly beneficial. They can assist with navigating these regulatory requirements, ensuring that your transaction adheres to all legal norms and is processed smoothly.

Medellin Guru Real Estate Service

Our reliable partner, a leading real estate company, offers a wide range of services:

- Transfer funds to Colombia

- Legal analysis property background checks

- Sales agreement

- Deed registration

- Legal representation

- Investment visa

GET 40% OFF IN REAL ESTATE SERVICES

The expatgroup.co anniversary offer is now open! Our partner, expatgroup.co, is offering high-quality Real Estate services with incredible limited-time offers. Invest in Colombia today!

*Offer available until January 30th.

*Apply terms and conditions.

What are the steps to buy Real Estate in Medellin and Colombia?

There are four primary stops to buying real estate in Medellin and Colombia, not including moving money to Colombia to buy a property:

Step 1: Negotiation and verbal offer

This is when the buyer negotiates the price and terms with the seller. We recommend to involve an experienced professional who understands real estate laws in Colombia to do a deed search and other background checks.

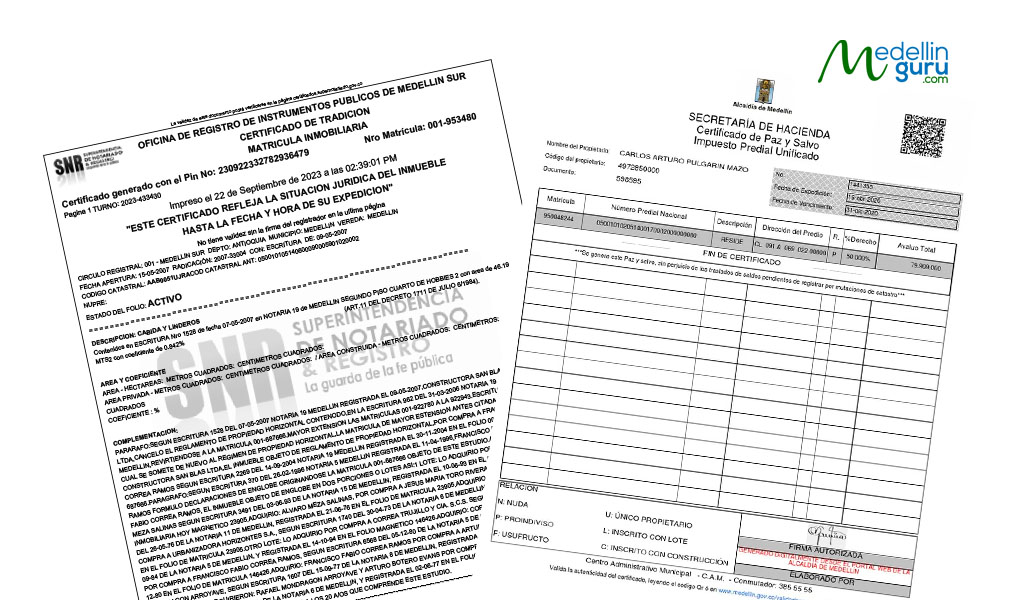

A lawyer will conduct a thorough check of the property’s history using the “Certificado de tradición y libertad” and confirm that all municipal property taxes are up to date with the “Certificado de paz y salvo predial.” Additionally, the lawyer will verify the payment of taxes related to any increase in the property’s value through the “Certificado de paz y salvo de valorización.”

Some properties in Colombia can have hidden complications, including debts or a questionable ownership history. If you are interested in a property with some issues, fixing things is usually a long process. So, we recommend trying to avoid buying properties with problems.

Also, if buying in an apartment building or gated community, it is important to check if there are a lot of unpaid administración fees (similar to HOA fees in the U.S.). Some apartment buildings or gated communities do not adequately collect administración fees from owners, resulting in insufficient maintenance funds.

If everything checks out with the lawyer, it is time to negotiate the price. Nothing is binding at this point. Also, it is essential to understand if an owner is desperate or patient. The owner may say the price is negotiable. And you can make an offer lower than the listed price to feel out the owner.

Step 2: Promesa de Compraventa – the Purchase Agreement

After you have a verbal agreement on the price and terms for a purchase, your lawyer will draw up a purchase agreement, known as a promesa de compraventa.

This is a binding contract where you state the intention to buy or sell at a given price, and the seller expresses the intention to sell.

Keep in mind that Colombians are sophisticated negotiators. So, it is common for Colombians to renegotiate right up to signing the promesa de compraventa at a notary. You can also make changes if they are needed before signing the purchase agreement contract at a notary.

What is included in a typical Promesa de Compraventa?

There are several standard clauses in typical real estate purchase agreements in Colombia, including:

-

Price and items that are included

When considering the purchase of real estate in Colombia, it's important to clarify what is included in the sale. This includes parking spaces, storage units, appliances, and curtains. Note that parking may have a separate title, and the seller can legally remove anything not explicitly included in the contract, even down to the light bulbs.

-

Down payment (Anticipo)

The down payment, or 'anticipo', typically amounts to about 30% of the purchase price, but this percentage is negotiable. This payment secures the deal.

-

Penalty Clause (Cláusula Penal)

It stipulates the financial consequences if either the buyer or seller backs out. If the buyer defaults, they could lose 10 to 20 percent of the down payment. If the seller defaults, he might face a lien for a similar amount.

-

Settling of mortgages and liens

Property transfer in Colombia requires the property to be free of mortgages, loans, taxes, and administration fees (HOA fees). This ensures a clear transfer of ownership.

-

Commercial and declared value (Valor comercial y valor catastral)

Understanding the difference between commercial value and declared value is the key. There's often a gap between these values, impacting the taxes levied on the property.

-

Prorating the taxes, HOA, and rent

Proration applies to taxes, HOA fees, and, if applicable, rent. These costs are adjusted based on the purchase date, with taxes paid yearly and HOA fees monthly.

-

Closing at a Notary

The final signing at the notary, as outlined in the 'promesa de compraventa', sets the closing date, time, and location for the property sale in Colombia. Payment is usually made through bank checks or transfers, without an escrow system. At this meeting, the property title is officially transferred from the seller to the buyer. While the closing typically occurs on the agreed date, with the exchange of titles, funds, and keys, delays can happen due to unforeseen issues.

Step 4 – Getting your deed

If all things go smoothly with the closing, your lawyer will take steps to ensure everything is done correctly with the Registro de Instrumentos Públicos, which handles titles in Colombia.

Once the new Certificado de Tradición y Libertad is issued, a buyer can rest assured is the property owner. A new certificate typically requires about a week to be ready.

What are the closing costs involved in buying Real Estate in Colombia?

Purchasing real estate in Colombia involves closing costs, including taxes and fees. Closing costs at the time of purchase include notary, registration, legal, and real estate agent commissions.

The approximatelly closing costs for buying a 300-million-pesos property in Colombia are:

For the Buyer:

1% of withholding. Paid by the seller.

1% for registration fees. Split 50-50 between seller and buyer.

1.05% of goverment taxes. Split 50-50 between seller and buyer.

Usually less than 1 million pesos of notary fees. Split 50-50 between buyer and seller.

For title study, purchase contract, and title change, typically a fixed price (around 2 million pesos)

Total estimated closing costs for buyer: Approximately 6 million pesos.

For the Seller:

1% for registration fees. Split 50-50 between seller and buyer.

1.05% of goverment taxes. Split 50-50 between seller and buyer.

Usually less than 1 million pesos of notary fees. Split 50-50 between buyer and seller.

For title study, purchase contract, and title change, typically a fixed price (around 2 million pesos)

3 to 5%,normally paid by the seller. Lower commission typically means fewer services provided.

Total estimated closing costs: Roughly 7.5 to 9.5 million pesos (5.5 to 7.5% of the purchase price).

Note: These costs are estimates and may vary based on specific transactions and negotiations.

Steps for buying are different property new construction

When purchasing pre-construction projects in Colombia, the process differs significantly from buying existing properties:

The process begins with signing a "hoja de negociación," wich is a letter of intent with the builder, usually involving a 1 to 5% percent payment into a fiduciary account.

These entities, often insurance or banking companies, provide services similar to escrow, managing finances and contracts for new housing developments. They offer buyer protection and monitor payment compliance.

The purchase typically involves a "cargo" contract with the fiduciary, paralleling the promesa de compraventa for existing properties. Detailed documents outline the specifications of the new construction. Initially, 1 to 5% percent is paid upon signing, followed by 25-59% percent in monthly installments over up to two years.

The remaining 40 to 70% percent is paid to the fiduciary upon project completion. After full payment, the builder issues an "escritura" (deed) in the buyer's name.

Are you looking to buy or sell Real Estate in Colombia?

Medellin Guru has partnered with Real Estate by expatgroup.co to provide real estate services to foreigners and locals interested in buying and selling properties in Medellin and across Colombia.

Recognizing our readers’ demand for real estate guidance, this partnership with Real Estate by expatgroup.co, desires to deliver trustworthy and comprehensive real estate services to our audience.

We chose to collaborate with Real Estate by expatgroup.co for buying and selling real estate services for several reasons:

- Real Estate by expatgroup.co is recognized globally and is a familiar brand for foreigners.

- As one of Colombia’s largest realtor companies, Real Estate by expatgroup.co has extensive coverage throughout the country, enabling it to serve various locations in Colombia.

- They boast a robust team of agents, many of whom are bilingual in English and Spanish.

- Real Estate by expatgroup.co ensures fair pricing through a thorough Comparative Market Analysis (ACM).

To access this real estate partner service from Real Estate by expatgroup.co, click the button below, complete a brief form, and receive a complimentary consultation offering insights into the local market, current pricing, and tips for buying or selling properties.

Medellin Guru Real Estate Service

Our reliable partner, a leading real estate company, offers a wide range of services:

- Transfer funds to Colombia

- Legal analysis property background checks

- Sales agreement

- Deed registration

- Legal representation

- Investment visa

GET 40% OFF IN REAL ESTATE SERVICES

The expatgroup.co anniversary offer is now open! Our partner, expatgroup.co, is offering high-quality Real Estate services with incredible limited-time offers. Invest in Colombia today!

*Offer available until January 30th.

*Apply terms and conditions.

Medellin Guru's Comprehensive Real Estate and Investment Series

On the Medellin Guru website, we have a comprehensive and up-to-date guide to buying, selling, and renting apartments and choosing a neighborhood in Medellin found in several articles, including:

Buying and Selling Apartments

- Medellin Real Estate: Property Buyer’s Guide for Foreigners

- Selling Real Estate in Colombia: A Guide to Selling for Foreigners

- Mistakes Foreigners Make When Buying Real Estate in Colombia

- Current Costs to Buy New Apartments in Medellin

- Rent vs Buy: Downsides of Renting and Buying Property in Medellin

- 13 Things Real Estate Agents in Colombia May Not Tell You

- How to Obtain a Colombia Investment Visa

Renting Unfurnished Apartments:

- Apartment Rental Guide: Renting Unfurnished Apartments in Medellin

- Guide to Finding Unfurnished Apartments and Casas in Medellin

- Guide to Overcoming the Fiador Requirement in Colombia

- Unfurnished Apartment Rental Costs in Medellin

- 6 Inexpensive Neighborhoods for Unfurnished Rentals in Medellin

- Furnishing Apartments: A Guide to Furnishing Apartments in Medellin

- Apartment vs Casa (House) Rentals in Medellin: Pros and Cons

Renting Furnished Apartments:

Choosing a Neighborhood in Medellin:

Also, we have several articles that can be used to help foreigners choose a neighborhood in Medellin:

- Laureles: The world’s coolest neighborhood for 2023 by ‘Time Out’ is in Medellin, Colombia

- What are the Safest Neighborhoods in Medellin and the Aburrá Valley?

- 5 Best Neighborhoods in Medellin: A Guide to Choosing a Neighborhood

- 9 Downsides of El Poblado: Living in Medellin’s Expensive Neighborhood

- Estratos: A Guide to Understanding Estratos in Colombia

- El Poblado vs Laureles: Which is the Better Neighborhood to Live in?

- El Poblado vs Envigado: Which is the Better Neighborhood to Live in?

- El Poblado vs Sabaneta: Which is the Better Neighborhood to Live in?

- El Poblado vs Belén: Which is the Better Neighborhood to Live in?

- 2018 Unfurnished Apartment Rental Costs in Medellin in 5 Neighborhoods Popular with Expats

- 6 Inexpensive Neighborhoods for Unfurnished Rentals in Medellin

Airbnb in Colombia:

- 9 Strategies to Find Killer Deals on Airbnb in Colombia

- 15 Things to Know Before Investing to Become an Airbnb Host in Colombia

- 10 Airbnb Best Practices for Airbnb Hosting in Colombia

- 9 Tips to Attract Long-Term Airbnb Guests in Colombia

- 7 Strategies for Airbnb Slow Season in Colombia

- How to Identify Problem Airbnb Guests in Colombia Before They Book

- 15 Ways to Increase Your Airbnb Search Rank In Colombia

- How Safe is Airbnb in Colombia? Is it Safe to Use Airbnb in Colombia?

- Airbnb Travel Itinerary for Your Airbnb Guests in Colombia

- How to Get Started on Airbnb in Colombia: A Guide

The Bottom Line: Medellin Real Estate: 2023 Buyer's Guide for Foreigners

Relocating to Medellin and investing in its real estate market is an exciting yet substantial decision involving potential rewards and risks. Understanding the processes, costs, and risks associated with property transactions in Colombia is crucial.

Our blog offers detailed insights into the steps involved in purchasing Medellin real estate, including understanding closing costs and associated risks. Additionally, the current exchange rate for the Colombian peso (COP) significantly influences property pricing. As of March 15, 2024, the rate is approximately 3,891 COP per USD, making Medellin and Colombian real estate more accessible in USD than in previous years.

Medellin Guru Social media

Be part of our community. Find out about news, participate in events and enjoy the best of the city.

7 thoughts on “Medellin Real Estate: 2025 Property Buyer’s Guide for Foreigners”

Unanswered questions are 1) whether you have to pay cash to buy property in Colombia, or if local banks are willing to finance the purchase 2) what is the property tax rate you will pay while holding the property?

Mortgages are almost impossible to get from banks by foreigners. But some owners may be will to finance with a shorter term mortgage. Property taxes in Colombia typically range from 0.3 to 3.3 percent, depends to the location and type of property.

Thankful for sharing this useful post!

For older buildings you may also need to negotiate the value of the transaction stated on the title, which can be different than the agreed upon price. A new law this year makes this much harder but in the past sellers looked to have the official price seem lower to reduce their capital gains tax. Of course as the buyer this only increases how much capital gains you will pay in the future. The realtor I have been working with has seen deals fall apart because the seller was unwilling to recognize the true sales price on the title. The advice to have a good lawyer holds true here too.

Nice detailed article. I looked at buying but decided to rent for a while first.

Great article with lots of details.

In my experience, new construction projects require by law at least 30 % payments of the signed purchase price (say 5% separation at the contract signing and then 25% in monthly payments to the fiduciary account) until a couple of months before the construction ends and hands over the new apartment to the buyer (entrega) at the notary. The final payment has to be done to the fiduciary account before signing the title at the notary.

The benefits of buying an new apartment are:

– no history of previous owners (meaning no potential problems with the title)

– higher investment return in most cases compared to buying an existing apartment

– no hidden defects in the new apartment

– modern design and many new buildings have security (porteria) with videos, a small gym, swimming pool, barbecue and social area and so on.

However new apartments have higher prices per square meter/feet compared to existing ones.

Be aware that there is a capital gain tax of 33% between the sale and purchase price if you sell the apartment within the first two years from the purchase date. After two years, the capital gain tax is just 10%. Preferibly either live in the apartment or rent it to someone for the first two years to avoid paying the higher capital gain tax.

No hidden defects is right. I purchased a property where the owners withheld the fact that termites had infested the roof. Now I have a huge legal battle on my hands. I never even moved into the property. Unlike in the United States, there is no inspection procedure set up as part of the buying process. I’ve sunk a huge amount of money into a place I can’t live in. Total nightmare. Be careful out there.