Colombia has become one of Latin America’s most attractive destinations for foreign investment. In 2023, the country received more than USD 17 billion in foreign direct investment (FDI), reflecting strong international confidence in its economy and growth potential. Whether you’re looking to invest in properties, start a business, or diversify your portfolio, Colombia offers a wide range of opportunities across thriving sectors, including real estate, technology, energy, and tourism.

However, to fully protect your assets and enjoy the benefits available to foreign investors, it is essential to properly legalize your funds through Colombia’s official procedures. In this guide, we will walk you through everything you need to know to successfully legalize a foreign direct investment in Colombia, safely, securely, and in full compliance with the country’s regulations.

Why Invest in Colombia as a Foreigner?

Foreign investors can benefit from attractive tax incentives, special free trade zones, and a simplified process for registering investments with the Banco de la República. Among the best reasons to invest in Colombia are its strong economic growth and an attractive real estate market in cities like Medellín, Bogotá, and Cartagena.

-

- Bogotá is one of the best cities to live in Colombia

-

- Medellín is one of the best cities to live in Colombia

-

- Cerro la Popa, Cartagena

Foreign investors in Colombia can take advantage of tax exemptions, free trade zones, and legal stability agreements that create a secure investment environment, according to ProColombia. The country provides access to regional and global markets through multiple free trade agreements, competitive labor costs, and a skilled workforce. Moreover, there have been significant improvements in infrastructure and connectivity throughout Colombia.

What are the key investment markets in Colombia?

What Is Foreign Direct Investment (FDI)?

Foreign Direct Investment (FDI) refers to the process in which an individual or company from one country makes a direct investment in assets, businesses, or properties located in another country. Common types of FDI include purchasing real estate, establishing or acquiring a business, investing in infrastructure projects, or participating in financial markets. In Colombia, FDI plays a crucial role in the economy by contributing to job creation, technology transfer, and overall economic growth.

Any investment made by foreigners must be registered with the Banco de la República, Colombia’s central bank. This registration ensures that your funds are legally recognized and protected under Colombian law. It also allows investors to repatriate profits, sell their assets in the future without legal issues, and, in some cases, qualify for tax benefits or immigration advantages.

How to Transfer and Legalize Money from Abroad in Colombia

If you’re planning to invest in Colombia, it’s crucial to transfer your funds and to legalize them properly to protect your capital under Colombian law. Follow this step-by-step guide or get in touch with a professional advisor to get help with the process.

Before sending any money, you need to open a brokerage or bank account in Colombia. Brokerage accounts are often preferred for foreign investors because they simplify the registration process with the Banco de la República. Choose an institution familiar with handling foreign investments to ensure smoother transactions.

Once your account is active, you can initiate an international wire transfer. It’s essential to correctly structure the transfer, including proper documentation of the funds' origin, to avoid delays or questions from local banks and regulatory authorities.

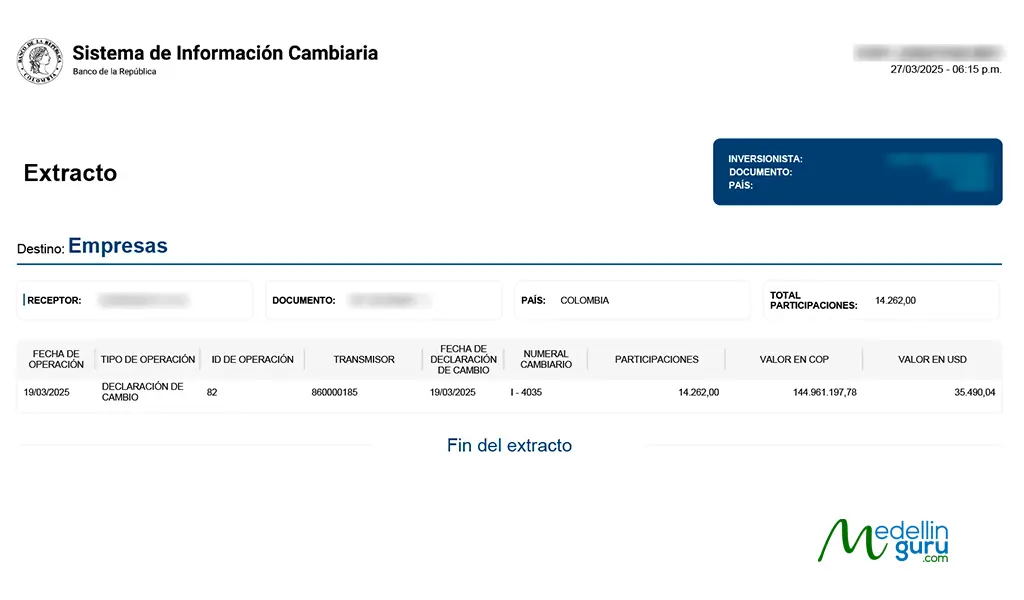

After the money arrives in Colombia, the next critical step is to register your investment. This is done by filing a Foreign Investment Registration form (Form F4 or F5) with the Banco de la República, and you will receive the Investment Certificate (Certificado del Banco de la República).

Common Mistakes Investors Make When Making a Foreign Direct Investment in Colombia

Legalizing foreign investment in Colombia requires precision and strict compliance with regulations. Many investors, especially first-timers, make avoidable mistakes that can lead to serious legal, tax, or financial problems.

-

Sending funds to a personal bank account without structuring the investment properly

One of the most frequent errors is transferring money directly to a personal account without planning the registration process. This can complicate the legalization of funds and create issues when trying to prove the legal origin of the capital.

Best Practice: Open a brokerage or investment-specific account that is designed to handle foreign direct investments from the start. -

Missing the registration deadline with the Banco de la República

Foreign investments must be registered promptly once the funds enter Colombia. Failing to meet the official deadlines can result in fines, loss of investment rights, and difficulties in repatriating funds later.

Best Practice: Ensure your broker or financial advisor files the investment registration immediately after the transaction. -

Using incorrect codes when transferring funds

When wiring money internationally, specific transaction codes must be used to correctly classify the investment. Using the wrong code (such as classifying it as a personal remittance instead of a foreign investment) can prevent you from registering the capital incorrectly.

Best Practice: Confirm with your Colombian bank or broker the correct codes to use before initiating the transfer. -

Incomplete or incorrect paperwork

Submitting incomplete forms or documents with discrepancies is another common issue. Mistakes in the paperwork can delay or even invalidate the registration process, which can complicate future property sales, dividend withdrawals, or visa applications.

Best Practice: Double-check all paperwork with professional assistance. Keep organized copies of every document submitted. -

Failing to update the investment

If you modify your investment, you must update the registration using the correction form provided by Banco de la República. Ignoring these updates can cause your registration to become non-compliant.

Best Practice: Maintain an open line of communication with your broker or accountant to ensure all changes are adequately reported.

Getting professional support from advisors experienced in foreign investment registration can save you time, money, and unnecessary stress. Mistakes are costly. It’s worth doing it right from the start.

Take the First Step and Invest in Colombia

Our reliable partner expatgroup.co offers a wide range of services for Foreign Investors:

What are the Benefits of Making a Foreign Direct Investment in Colombia as an Expat?

Investing in Colombia allows foreigners to receive full legal protection for their assets under Colombian law. This protection ensures the security and effective management of real estate, business holdings, and financial investments, which in turn fosters confidence for long-term planning and future transactions. Additionally, a notable benefit of foreign direct investment (FDI) is the possibility of applying for Colombian residency. Depending on the amount and type of investment, foreigners may be eligible for an Investment Visa or a Business Owner Visa, which allows them to live, work, and legally expand their activities in Colombia.

How to Get the Colombian Investment Visa with a Foreign Direct Investment?

Foreigners who make a significant foreign direct investment (FDI) in Colombia can apply for the Colombia Investment Visa. To qualify, you must demonstrate that your investment meets the minimum capital requirements set by the government, which often involves purchasing property or making deposits for free-use investments. Read more about this visa in the blog below.

How to Obtain a Colombia Investment Visa – 2025 Update

The investment visa is a great option for foreigners interested in Colombia's fast-growing economy. It can open doors for entrepreneurs and investors to exploit the country's diverse and expanding market....

Read MoreHow to get the Colombian Business Visa with a Foreign Direct Investment?

The Colombia Business Visa is another excellent option for foreign investors seeking to operate a company or establish a business presence in Colombia. To be eligible, you must either found a new company or invest in an existing one. Authorities will require proof of ownership, financial statements, and evidence that the business is active and generating economic activity. Get more information in the blog about this visa.

How to Obtain a Colombia Business Visa – 2025 Update

The Colombia business visas are intended for foreigners who have constituted or acquired participation in the capital stock in a commercial company valued at least 100 times the minimum monthly...

Read MoreIf you are considering making a foreign direct investment in Colombia, securing the best visa is a crucial step to fully enjoy the benefits of your investment. Whether you’re looking to settle permanently, start a business, or simply protect your assets, choosing the right immigration pathway can make all the difference. Medellin Guru recommends the visa agency expatgroup.co, who can help you from the start with all the necesary steps to secure your capital. By clicking bellow, you will access to their business directory to fill the quotation form. Don’t wait any longer and contact expatgroup.co today.

FAQs About Foreign Direct Investment Legalization in Colombia

What is considered a foreign direct investment (FDI) in Colombia?

An FDI in Colombia typically involves investing capital from abroad into Colombian assets, such as real estate, businesses, or financial instruments, with the goal of long-term ownership or control.

Why is it important to register my foreign investment in Colombia?

Registering your investment with the Banco de la República protects your legal ownership rights, ensures you can repatriate your funds, and qualifies you for benefits like residency visas.

How do I register a foreign direct investment with the Banco de la República?

You must open a brokerage or bank account, send funds following Colombia’s legal channels, and complete the registration using the F4 or F5 form.

Can I buy real estate in Colombia as part of my foreign investment?

Yes, purchasing real estate is one of the most common ways foreigners make FDIs in Colombia, especially in cities like Medellín, Bogotá, and Cartagena.

What is the difference between the Colombia Investment Visa and the Business Visa?

The Investment Visa is based on passive investments, such as real estate or free-use investments, while the Business Visa requires active business ownership or entrepreneurship in Colombia.

OPEN YOUR BROKER ACCOUNT NOW!

- Broker account opening in Colombia (estimated time: 1 week)

- Guidance through the transfer & legalization process

- F4 or F5 forms processing for legal compliance

Medellin Guru's comprehensive visa and passport series

The Colombian visa changes that went into effect in October 2022 were significant. So, on the Medellin Guru site, we have a comprehensive series of visa articles that are kept up-to-date and should answer most visa questions. These articles include:

- Colombia Visa Guide: Ultimate Guide How to Get a Colombian Visa

- How to Obtain a Colombian Visa with Up-to-Date Info – an overview of all the Colombian visas

- Popular Colombian Visas for Foreigners: Which Visa is the Most Popular?

- Coronavirus Impacts on Colombian Visas and Tourist Visas

- Visa Agencies: A Guide to Visa Agencies in Medellín and Colombia

- 9Common Colombian Visa Mistakes: How to Avoid Them

We have looked in detail at the nine most popular Colombian visas used by foreigners:

- Digital Nomad Visa

- Retirement visa

- Marriage visa

- Investment visa

- Business Visa

- Resident visa

- Work visa

- Student visa

- Visitor visa

Also, we have looked in detail at three additional Colombian visas, which are less popular for foreigners:

- Rentista visa (annuity visa) – for foreigners with a fixed income

- Beneficiary visa – for relatives of visa holders

- Expertise visa – for professionals

In addition, we have a guide to Colombia tourist visas and how to extend a tourist visa. Also, we have a guide to renewing U.S. passports in Colombia and a guide to obtaining a Colombian passport.

Furthermore, we provide information about travel health policy that meets the health requirement for Colombian visas. And we have a guide to how apply for a cedula extranjeria in Colombia and a guide to using notaries in Medellín and Colombia. Finally, Medellin Guru has partnered with a visa agency to offer Colombia visa services.

All of our Colombia visa articles are up to date (2024) and constantly receive updates in 2025.

The Bottom Line: How to Legalize Foreign Direct Investment in Colombia?

With the country’s growing economy, attractive real estate market, and government incentives for investors, Colombia remains one of the most promising destinations for foreign investment in Latin America. Whether you are looking to purchase property, open a business, or secure long-term residency, making a properly registered foreign direct investment is your gateway to success. By following the correct process, such as opening a brokerage account, transferring your funds properly, and registering your investment with the Banco de la República, you will ensure that your capital is both safe and fully recognized by Colombian authorities.

Medellin Guru Social media

Be part of our community. Find out about news, participate in events and enjoy the best of the city.