W e provide a guide to homeowners insurance in Colombia, updated for 2024. Homeowners insurance is important and can protect your home from fire, robbery, and other damages. If you own an apartment or casa (home) in Colombia, we highly recommend obtaining homeowners insurance in Colombia.

With homeowners insurance, if at any time an event covered by insurance occurs, such as a fire, flooding, lightning strike, among others, the insurance company provides money to help replace what is affected.

You can also obtain additional coverage that supports you in case of robbery or theft with or without violence, damage to others, and damage or loss of mobile content that may be outside your home, for example, laptops, tablets, or cameras.

Homeowners Insurance in Colombia

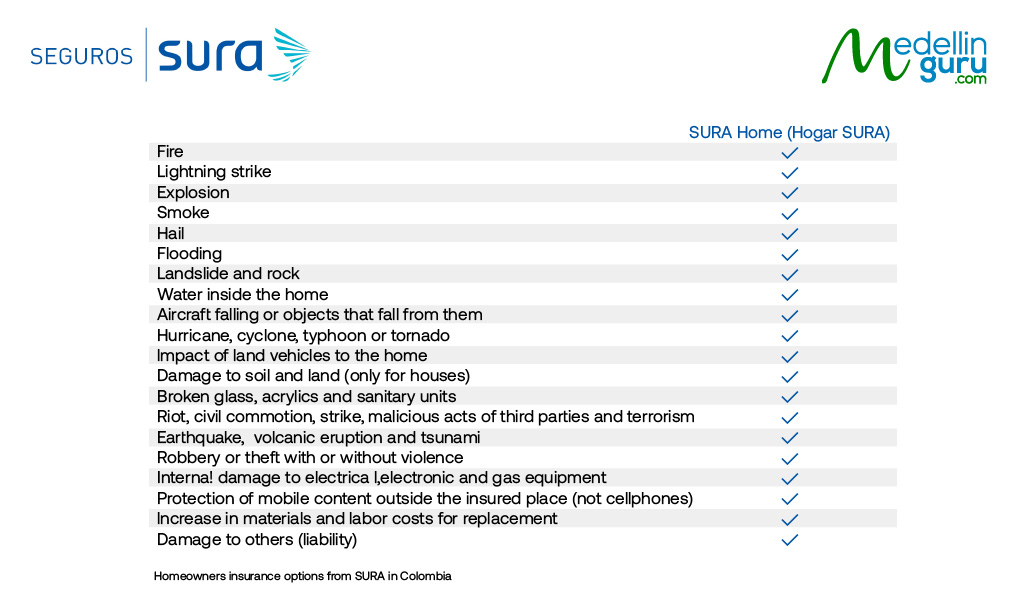

Homeowners insurance services offered in Colombia by insurance companies have different options for what is covered. The following table compares insurance coverage options from SURA:

You can see more details about this homeowners insurance on the SURA website (in Spanish). Also, it is possible to get insurance just for contents of a home, which is basically renters insurance.

How to Sign Up for Homeowners Insurance in Colombia

It is possible to sign up for homeowners insurance yourself. There are several larger insurance companies in Colombia offing this type of insurance include SURA, AXA Colpatria, Seguros Bolivar and Seguros Falabella.

But signing up for insurance is in Spanish and can be complicated. So, we recommend working with an insurance agent who is bilingual when signing up for homeowners insurance.

Using an Insurance Agent to Obtain Insurance in Colombia

Medellin Guru has partnered with an insurance agent to offer homeowners insurance and other insurance products to foreigners and Colombians.

Features of this Colombian insurance service include:

- Bilingual – English and Spanish.

- Online quotes.

- Free consultations.

- Offers health insurance, auto insurance, homeowners insurance and life insurance.

Medellin Guru Insurance Service

The insurance agency we partnered with meets the requirements for Colombian Visa Applications

Many Medellin Guru readers have obtained insurance in Colombia through our insurance agent partnership including health insurance, EPS insurance, auto insurance, homeowners insurance, life insurance and travel insurance.

Medellin Guru Insurance service offers insurance services to all foreigners and Colombians who need assistance in their process of finding the best insurance protection while living in Colombia. With over ten years of experience, they design the plan that best fits your needs allowing you to enjoy your life abroad.

Our insurance partnership is an affiliate relationship (like the Amazon affiliate program). If you use our Colombian insurance partner, Medellin Guru receives a small commission and you support this website. This is at no additional cost to you. The price remains the same, whether you use a button or affiliate link on this website or not.

Cost Examples of Homeowners and Renters Insurance

The following are two examples of the cost of SURA homeowners insurance:

Homeowners insurance example:

- Type of home – Apartment built after 2010 on 12th floor of 18 story apartment building

- Coverage – 400,000,000 pesos for damage to home, 50,000,000 pesos for home contents

- Annual premium – 1,597,723 pesos ($478 USD). Note checked the premium in two different estratos and the annual premium was the same for this coverage.

Renters insurance example (only contents):

- Type of home – Apartment built after 2010 on 12th floor of 18 story apartment building

- Coverage – 50,000,000 pesos for home contents

- Annual premium – 425,648 pesos ($127 USD)

Medellin Guru's Comprehensive Real Estate and Investment Series

On the Medellin Guru website, we have a comprehensive and up-to-date guide to buying, selling, and renting apartments and choosing a neighborhood in Medellin found in several articles, including:

Buying and Selling Apartments

- Medellin Real Estate: Property Buyer’s Guide for Foreigners

- Selling Real Estate in Colombia: A Guide to Selling for Foreigners

- Mistakes Foreigners Make When Buying Real Estate in Colombia

- Current Costs to Buy New Apartments in Medellin

- Rent vs Buy: Downsides of Renting and Buying Property in Medellin

- 13 Things Real Estate Agents in Colombia May Not Tell You

- How to Obtain a Colombia Investment Visa

Renting Unfurnished Apartments:

- Apartment Rental Guide: Renting Unfurnished Apartments in Medellin

- Guide to Finding Unfurnished Apartments and Casas in Medellin

- Guide to Overcoming the Fiador Requirement in Colombia

- Unfurnished Apartment Rental Costs in Medellin

- 6 Inexpensive Neighborhoods for Unfurnished Rentals in Medellin

- Furnishing Apartments: A Guide to Furnishing Apartments in Medellin

- Apartment vs Casa (House) Rentals in Medellin: Pros and Cons

Renting Furnished Apartments:

Choosing a Neighborhood in Medellin:

Also, we have several articles that can be used to help foreigners choose a neighborhood in Medellin:

- Laureles: The world’s coolest neighborhood for 2023 by ‘Time Out’ is in Medellin, Colombia

- What are the Safest Neighborhoods in Medellin and the Aburrá Valley?

- 5 Best Neighborhoods in Medellin: A Guide to Choosing a Neighborhood

- 9 Downsides of El Poblado: Living in Medellin’s Expensive Neighborhood

- Estratos: A Guide to Understanding Estratos in Colombia

- El Poblado vs Laureles: Which is the Better Neighborhood to Live in?

- El Poblado vs Envigado: Which is the Better Neighborhood to Live in?

- El Poblado vs Sabaneta: Which is the Better Neighborhood to Live in?

- El Poblado vs Belén: Which is the Better Neighborhood to Live in?

- 2018 Unfurnished Apartment Rental Costs in Medellin in 5 Neighborhoods Popular with Expats

- 6 Inexpensive Neighborhoods for Unfurnished Rentals in Medellin

Airbnb in Colombia:

- 9 Strategies to Find Killer Deals on Airbnb in Colombia

- 15 Things to Know Before Investing to Become an Airbnb Host in Colombia

- 10 Airbnb Best Practices for Airbnb Hosting in Colombia

- 9 Tips to Attract Long-Term Airbnb Guests in Colombia

- 7 Strategies for Airbnb Slow Season in Colombia

- How to Identify Problem Airbnb Guests in Colombia Before They Book

- 15 Ways to Increase Your Airbnb Search Rank In Colombia

- How Safe is Airbnb in Colombia? Is it Safe to Use Airbnb in Colombia?

- Airbnb Travel Itinerary for Your Airbnb Guests in Colombia

- How to Get Started on Airbnb in Colombia: A Guide

Medellin Guru Real Estate Service

Our reliable partner, a leading real estate company, offers a wide range of services:

- Transfer funds to Colombia

- Legal analysis property background checks

- Sales agreement

- Deed registration

- Legal representation

- Investment visa

Medellin Guru's Colombian insurance and healthcare articles

- Get Insurance in Colombia

- Travel Insurance: Meets the Heath Insurance Requirement for Colombia Visas

- Auto Insurance in Colombia: A Guide to Colombian Auto Insurance

- Homeowners Insurance in Colombia: A Guide to Colombian Homeowner Insurance

- Medellin Guru Insurance Service: Providing Colombian Insurance

- Colombia has 24 of the Best Hospitals in Latin America

- Emergency Surgery: Expat Experience in Clínica León XIII in Medellín

- Healthcare Colombia: HCA Clinic Offers Services to U.S. Veterans in Colombia

The Bottom Line: Homeowners Insurance in Colombia

If you buy an apartment or casa (home) in Colombia, this is one of the biggest purchases you will make.

Your home is likely one of the most valuable assets you have. So, it only makes sense to protect such a large investment with homeowners insurance.

Also, it is important to keep in mind that insurance coverages come with some limits, the maximum a policy will pay toward a covered claim. So, when selecting coverage limits, be sure to consider things like the potential cost of rebuilding your home or replacing your belongings.

The bottom line is that a homeowners insurance policy won’t prevent damage to your home or belongings. But insurance can help provide a financial safety net if the unexpected occurs.

Medellin Guru has partnered with insurance agent to offer Colombian insurance services to foreigners with a convenient office located in El Poblado in Medellín. This service is easy to use, just click on the button below to get started.

Medellin Guru Social media

Be part of our community. Find out about news, participate in events and enjoy the best of the city.

9 thoughts on “Homeowners Insurance in Colombia: 2024 Homeowners Insurance Guide”

I bought my homeowners policy at falabella insurance at homecenter. They sell renters and owners policies offering several different company’s policies. I bought Sura due to their reputation. I pay 52.000 pesos per month for my owners policy. Angela is great and speaks fluent english. I went to Falabella because I wanted to know all options and prices. Sura is my first choice. Good luck..

What if you don’t own? And just want a policy to cover theft and disasters as is done in the states.

They offer options for renters. Ask the insurance broker we partnered with – click on this link – https://angelaberrioseguros.com/landing/

What about insurance for an investment property that is tenented. Is it the same as homeowners insurance.

Yes, similar but you just wouldn’t insure the personal contents of the tenants. If you click on this link – https://angelaberrioseguros.com/landing/ you can chat directly with the insurance broker we partnered with for details.

If you live in an apartment check with your administrator whether home insurance is included in your monthly administration fee. You don’t want to be paying twice for the same thing.

Bought mine at Homecenter in Laureles. Full coverage 54.000 pesos a month. Took 15 minutes. Simple. No agent but I do speak Spanish. Sura Insurance policy. Others available for less money but for the price SURA is worth the extra few pesos.

The costs… the costs… When do they learn that no offer is interesting when they leave out the price…..

The cost varies depending on the property and the amount of coverage just like in the U.S. or other countries. Will research and add some example costs later this week.