The tax filing season in Colombia each year is much later in the year than in the U.S. Most notably, the tax season in Colombia starts in August for filing income taxes for the prior year. This year, during the month of January, the Dirección de Impuestos y Aduanas Nacionales – DIAN (Colombian tax authority) defined, through a tax calendar, the filing dates of the different taxes in Colombia, such as the personal income tax. If you are from the U.S., you can think of DIAN as the IRS of Colombia.

Personal income taxes are known as renta personas naturales in Colombia. Income tax filing in Colombia is known as declaración de renta.

The following article is based on my understanding of Colombian income taxes. This is based on my actually filing income taxes in Colombia over the past several years. In addition, I researched Colombia’s income taxes and also talked to my Colombian tax specialist.

We highly recommend talking to a Colombian tax specialist if you think you need to file income taxes in Colombia or are considering moving to Colombia to understand the tax implications.

Beware that there is a lot of out-of-date and inaccurate information about Colombian income taxes in English found out on the Internet.

For example, some websites claim that expats with residency status in Colombia aren’t taxed on worldwide income until they have been a tax resident for five years. But this is completely out-of-date information, which changed in 2013. So, you now become a tax resident in Colombia and become liable for filing income taxes the first year you reside in Colombia for over 183 days.

*For this article, we will use as an example an exchange rate of $4,500 Colombian pesos to the US dollar. UVT for 2022 is 38.004 Colombian pesos.

Who Needs to File Colombian Income Taxes?

You are considered a tax resident in Colombia if you stay in the country for more than 183 total days during a year, whether this time is continuous or not.

In addition, a year for determining tax residence is any 365-day period. It’s not necessarily a calendar year. And it can even straddle two years. For example, if you were in Colombia 130 days in the last six months of 2022. And if you were in Colombia 53 days in the first six months of 2023, you would be considered a Colombian tax resident for 2023.

If you are considered a Colombian tax resident, and during 2022 you met any of the following conditions, you must file income tax in Colombia in 2023:

- Earned income during the year 2022 for a value greater than 1,400 UVT, which is equivalent to $53,205,600 Colombian pesos or $11,823 USD.

- Made purchases or total consumption during the year 2022 with Colombian financial products for a value greater than 1,400 UVT, which is equivalent to $53,205,600 Colombian pesos or $11,823 USD.

- Made purchases during the year 2022 with Colombian credit cards for a value greater than 1,400 UVT, which is equivalent to $53,205,600 Colombian pesos or $11,823 USD.

- Made movements in Colombian bank accounts, deposits or financial investments in Colombia during the year 2022 for a value greater than 1,400 UVT, which is equivalent to $53,205,600 Colombian pesos or $11,823 USD.

- If as of December 31, 2022, your net worth was greater than 4,500 UTV, which is equivalent to $171,018,000 Colombian pesos or $38,004 USD.

However, if you are not a tax resident in Colombia, you will only have to file income tax in 2023 if you meet any of the following cases:

- During 2022, your income obtained in Colombia was greater than 1,400 UVT, which is equivalent to $53,205,600 Colombian pesos or 11,823 USD and the payer did not withhold at source.

- If as of December 31, 2022, your net worth in Colombia was greater than 4,500 UTV, which is equivalent to $171,018,000 Colombian pesos or $38,004 USD.

If you did not meet any of the above conditions, you do not have to file income tax in Colombia in 2023.

What is the importance of differentiating whether or not I am a Colombian tax resident?

The importance of determining if I am a Colombian tax resident is that the following conditions would change depending on it:

– Your income tax rate in Colombia.

– Income that will be subject to income tax in Colombia.

– The values that you must consider knowing if you are obliged to file other taxes in Colombia.

Consequently, it will be exposed on the previous topics.

What Income is Taxed?

Colombia taxes the worldwide income of tax residents. Non-residents are taxed only on Colombia-sourced income.

If you were a tax resident of Colombia in 2022. And if your worldwide income was $11,823 USD or higher in 2022, you are technically supposed to file income taxes in Colombia for 2022.

Most income is taxed in Colombian including salaries and rental income. Foreign pensions/retirements are also taxed in Colombia according to a ruling from DIAN. However Colombian pensions are exempt from Colombia income taxes (up to a limit) and from 2023, foreign pensions are exempt from income taxes. Also, 25 percent of labor income (up to a limit) is exempt from taxation.

Capital gains such as inheritances, gifts, gains from the sale of stock and gains from the sale of real estate are taxed in Colombia at a rate of 15 percent. However, gains from the sale of stock on the Colombian exchange are exempt. This is provided the stock don’t represent more than 3 percent of the total shares of the Colombian company.

Colombia also has a wealth tax starting in 2023. This tax obliges the following people:

– Colombian tax residents who as of January 1st, 2023, have a net worth of more than $678,592 USD

– Non-Colombian tax residents who, as of January 1st, 2023, have assets in Colombia greater than $678,592 USD

In addition, there is no joint filing of income taxes in Colombia. Each person must file, if required.

Penalties for Not Filing Income Taxes in Colombia

I have met some expats living full time in Colombia who do not file taxes in Colombia. This is even though they are likely required to file. Be aware that there are penalties, which can be quite stiff, for failing to file if you are required to, even if you don’t have to pay taxes but do file tax returns.

Reportedly, the Colombian tax law indicates the way in which the penalties for not declaring taxes, filing them out of time or with errors should be calculated, so the value of the penalty will vary depending on the case, but as indicated by law, never can be less by the year 2023 at an approximate value of $94 USD.

Also, if you plan to become a dual citizen in Colombia, which is possible after having a resident visa for five years, part of this process looks to make sure you have been filing income tax returns in Colombia.

When to File Colombian Income Taxes?

Your filing date for Colombian income taxes is based on the last two digits of your Colombian tax ID number. The Colombian tax ID number is known as the Número de Identificacíon de Tributaria (NIT). This is found on a DIAN form known as the Registro Único Tributario (RUT).

The filing dates in Colombia for income taxes and foreign asset tax for individuals for the tax year 2022 will begin on August 9, 2023, and run until October 19 of the same year.

On the other hand, the filing dates of the “wealth tax” for the taxable year 2023 will be from May 9 to 23, 2023.

The entire schedule of DIAN filing dates is found here. Your individual filing date can change each year based on my experience. Some years my filing due date was in October and this year it is in August.

DIAN’s office at Alpujarra in Medellín

How to Get a RUT (and NIT Number)

To get a RUT form, you must schedule a face-to-face or virtual appointment with a DIAN official here. On the RUT form is the NIT number, which is your Colombian tax identification number. The last two digits of your NIT determine your required filing date.

When you schedule your appointment, you will receive an email with the information and requirements that you must meet prior to the appointment.

When you attend the appointment, you must have your original identification (identity card or passport) with you, the number of your appointment and, also, if the appointment is in person, you must have a copy of your identification: the front and back of your identity card or the data page of your passport.

In Medellín, to get a RUT form you need to go to the DIAN office in the Alpujarra administrative complex in El Centro. This is located at Carrera 52 # 42-43. Furthermore, DIAN’s office in Alpujarra is located in the basement of one of the buildings. Any of the security guards will be able to direct you to which building has the DIAN office.

You should arrive 15 minutes before your appointment. And when you arrive at DIAN they will ask for your appointment number. You typically will have to wait outside until your appointment time is called. You then enter the building and will be given a number at reception to wait your turn. And you should watch the monitors for your number.

You may need more than just the RUT form at DIAN. DIAN started using electronic signatures for some tax forms. For example, if you need to file a declaration of your assets outside of Colombia you will also need this electronic signature set up.

The entire process in the DIAN to obtain a RUT takes about 30 minutes. This requires moderate knowledge of Spanish.

In my recent experience, I decided to hire a tax advisor to obtain my RUT for which he asked me to sign a power of attorney that I signed before a notary and a copy of my identity card and he took care of everything else.

Colombia Income Tax Rates

If you are a Colombian tax resident, Colombia has progressive rates that depend on the level of your income. The following is the income tax brackets table for 2022 income taxes in Colombia:

Colombia 2022 Income Taxes Bracket Table

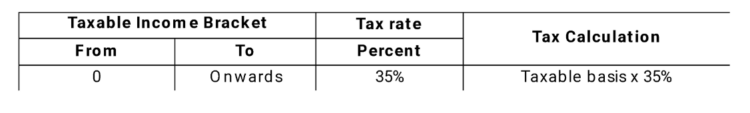

If you are not a tax resident in Colombia and must present the income tax, your tax rate will be a single rate of 35 percent:

Colombia 2022 Income Tax Rate for Non Residents

Note there isn’t a separate tax table rate for being married and filing jointly in Colombia like in the U.S. However, there is a limited deduction from your income available in Colombia for dependents, and in addition, there are other deductions by law that are possible to apply in the tax return.

For the wealth tax, Colombia also has progressive rates that depend on the value of your net worth in the world (Colombian tax residents) or solely owned in Colombia (Colombian non-tax residents):

Colombia 2022 Wealth Tax Rate

Colombian tax residents who, as of January 1 of each year and in the case of the year 2023, have assets abroad for a value greater than $18,849 USD, have the obligation to file a “foreign asset tax” in the country abroad that has the same expiration date as the income tax.

Foreign Asset Tax

Regarding this tax declaration, it is important to indicate that it is informative for the tax authority (DIAN), and it does not generate the obligation to make any payment unless this tax is filed extemporaneously.

What Exchange Rate to Use?

For your end-of-year bank statements, credit card statements and account statements in another currency, you should use the official exchange rate on December 31, 2022, which was 4,810.20 pesos to the US dollar.

However, for a salary and expenses you incur over the year in another currency you have two options. You can use the official exchange rate on December 31, 2022 (4,810.20) for the annual total for each item. Or you can use the official exchange rate on the day when you receive or pay each item.

For example, to convert an annual salary in another currency to pesos to calculate Colombian taxes you could just use the December 31, 2022 exchange rate for the total.

Or you could use the official exchange rate for the date of each salary payment received during the year. So, if you were paid twice a month, you need to make 24 calculations with 24 different exchange rates. You would also need records for each salary payment received.

You can find a list of the official exchange rates in Colombia during the year from the Banco de la República here.

Calculating Colombia Income Taxes

To calculate Colombia income taxes, you start with your gross income and deduct a variety of deductions. The deductions to which an individual is entitled in their income tax return are divided into three concepts:

- Income not constituting income

- Deductions

- Exempt income

Non-income taxable income for the 2022 income tax return (to be filed in 2023) are:

- Mandatory Pension Contributions

- Mandatory Health Contributions

- Mandatory contributions to the Pension Solidarity Fund

- Voluntary contributions to pension funds – must not exceed 25% of income limited to 2,500 UVT 95,010,000 colombian pesos per year ($21,113.33 USD).

Deductions

- Payment of interest or mortgage – Maximum limit 100 UVT monthly $3.800.400 colombian pesos ($844.53 USD).

- Dependent payments Cannot exceed 32 UVT Monthly $1.216.128 colombian pesos ($270.25 USD).

- Payments for prepaid health care Not to exceed 16 UVT per month 608.064 colombian pesos ($135.12 USD).

Exempt income

- Contributions to voluntary pension funds – may not exceed 30% of labor or taxable income for the year and up to a maximum of 3.800 UVT per year 137.970.400 colombian pesos ($30,660.08 USD).

- Contributions to AFC accounts may not exceed 30% of labor or taxable income for the year and up to a maximum of 3800 UVT per year 144.415.200 colombian pesos ($32,092.26 USD).

The result after subtracting deductions is your Colombian taxable income. From this you calculate Colombian income taxes due for your Colombian taxable income using the Colombia income tax table (see above).

Colombia Double Tax Treaties

Colombia has Double Tax Treaties with several countries including Japan, France, Italy, Great Britain and Northern Ireland, the Czech Republic, Portugal, South Korea, Mexico, Canada, Switzerland, Spain and with the countries that are part of the Community of Andean Nations (CAN). These tax treaties include a tax credit for income taxes paid in the other country.

Colombia does not yet have a Double Tax Treaty with the U.S. and many other countries. But Colombia still permits a tax credit for some income taxes paid in other countries. This is even though there isn’t a tax treaty in place.

For example, I pay income taxes in the U.S. as a U.S. citizen even though I live in Colombia. The U.S. taxes worldwide income, as does Colombia. But I was able to get credit for some of the income taxes I paid in the U.S. when filing income taxes in Colombia.

Finding a Colombian Tax Accountant

If you need to file a Colombian income tax return, you should talk to a Colombian tax advisor. A tax advisor can help to navigate all of the Colombian tax regulations, determine what things you can deduct, and help you file.

We recommend using the expatgroup.co through WhatsApp or their email, sales@expatgroup.co, to get help filling your Colombian Tax Income.

Dirección de Impuestos y Aduanas Nacionales (DIAN), the IRS of Colombia

The Bottom Line

The bottom line is that moving to Colombia can be tax neutral for some people, but not everybody. Moving to Colombia has been tax neutral for me in two out of the past four years. You may have to pay some income taxes in Colombia, depending on your personal situation. And this can also change from year to year based on my experience.

I now include Colombian income taxes in my budget as another cost of living in Medellín. But the overall cost of living in Medellín is relatively low for expats, as there are many surprisingly cheap things found in the city.

Over the past several years, I have met many expats living in Medellín that file Colombian income taxes. Many of these expats told me they pay little or no Colombian income taxes. Most notably, it really depends on your personal situation.

So, if you are planning to move to Colombia it is important to understand the tax implications. We recommend talking to a tax professional.

*The exchange rate used in this blog was 4,500 Colombian pesos per dollar. In any case, to make the corresponding calculations in each case, it is the exchange rate corresponding to the day of each economic operation.

Sign up for the Free Medellin Guru Newsletter – You can see all of the previous Medellin Guru weekly email newsletters and sign up here.

Editors note: Updated on July 19, 2018 with information that Colombia’s double tax treaty with the UK is not yet in force based on a reader comment.

Editors note: Updated on April 24, 2023.

80 thoughts on “How to File Income Taxes (Declaración de Renta) in Colombia – 2023 update”

My situation is as follows:

I am from Holland

I am 63 years old, I work in secondary education, a Hihh school and an international school.

I have a Colombian girlfriend.

I want to take an early (pre)retirement and leave for Colombia.

The pension will be on a Dutch account.

Furthermore I sell my house, the money will be transferred to a Dutch banc account.

I don’t buy a house in Colombia, I don’t make any other major investments, I don’t open a bank account. Every now and then I withdraw some money.

I opt for a marriage visa or a pension visa.

What about my capital in the Netherlands, if I stay longer than I think 187 days in Colombia, I will be taxed twice over.

The forums mainly focus on American expats, although their situation is similarI think.

Nobody who can tell me exactly, unfortunately.

Nevertheless, it is of importance. I know there is no tax treaty, nor is there a social treaty between the Netherlands and Colombia.

In the Netherlands, I made a phone call to tax matters abroad.

In Colombia I have been in contact with consultants / accountants, Dian etc..

I also studied various publications and (expat) forums and whether or not I submitted a question there.

An unambiguous answer, unfortunately…..very difficult to get.

Everyone tells me another story.

Maybe some one here can tell me some more..at least, this is what I hope.

Sincere greetings,

Wim van Boekel

Breda, Holland

I have a resident visa in colombia and i have stayed less than 180 days in colombia every year. I live, work and pay taxes outside colombia. Legally do i still have to pay tax in colombia ?

If you reside in Colombia for less than 180 days you are not a tax resident of Colombia. But keep in mind it’s not necessarily a calendar year. It can straddle two years – it is more than 183 total days during a year time period, whether this time is continuous or not.

Recommend you consult a tax professional, see contact info in the article.

Thanks Jeff your a legend and i really appreciate the info you have on this website its very helpful.

Yes, email is correct. See their page that also has a WhatsApp number – http://www.expatgroup.co

Very interesting discussions. I have a new question. Having paid Colombian taxes for the two years of 2017 and 2018 (paid in August 2018 and August 2019 respectively), I would like to know if I need to file for 2019 this August 2020, because (1) I filed during the previous years, but (2) I have been out of COLOMBIA for about 7 month and since January 2019 till now, I do not have a period of 183 days that I have been in the country during a rolling 365 day period.

A. Do you think I need to file, and B. I have not been able to find any info on the DIAN website but would like to know if it is described on their website.

Thanks for any insight, Henk

We recommend contacting the tax accountant expatgroup.co

Jeff, Thanks for your quick reply. I also looked further and received my answer from the KPMG Accounting website and it stated the following:

“Non-residents

A person who does not meet the criteria of a resident is considered to be a non-resident for fiscal matters.

A person who spends less than 184 days in any 365 days period in Colombia is therefore a non-resident for fiscal matters.

Colombian nationals and foreign taxpayers who are considered non-resident for fiscal matters, are liable for tax in Colombia only on income derived directly or indirectly from a Colombian source.”

Therefore any bank account interest is still taxable and I would need to file.

Thanks for your great website.

It’s not necessarily correct that you need to file a return just because you have bank account interest. Normal banks in Colombia deduct tax known as ‘retefuente’. If you don’t have a lot of movements in your account, you may not need to file a return.

For example, I have an email from a bank explaining the figures for filing a return in 2020 for 2019. (I have used Google translate.)

“In 2020, natural persons who during 2019 meet any of the following conditions indicated by DIAN must declare income:

• Gross equity as of December 31, 2019 was equal to or greater than $ 154,215,000.

• Gross income during the year equal to or greater than $ 47,978,000.

• Credit card consumption during the year equal to or greater than $ 47,978,000.”

If you don’t meet those criteria and are non-resident, you may not need to file (according to my accountant). You should check with an accountant.

That is also what I was told by one of the “accountant” here in Jardin. Only problem I have is with the:

• Gross equity as of December 31, 2019 was equal to or greater than $ 154,215,000.

How does one know that? My house is in a development that still has not been divided up by the local government here into separate taxable lots and so it is taxed as one big finca which then everyone chips in about $65,000 pesos which is nothing to pay the township.

Nobody can seem to be able to give me a straight answer on that situation.

2019 was my first year here full time, with a Colombian wife and a Cedula and I managed to get a NIT number from DIAN when they visited Jardin last year so I am good to go if I can get a straight answer about the land and house that I own here.

Any updates on taxes for 2019/2020? I have my NIT but not sure if I just do an online filing at the DIAN website that you have a link to in your article or if there is another place you go to file.

I do not work and I have no income so I am thinking I do not even need to file? What about owning a home here? Does this effect your taxes or is that a separate thing?

Is “renta personas naturales” and “declaracion de renta” the same thing?

If you do not have income or low income, there is no need to file but depends on your situation. We recommend contacting the tax accountant listed in the article for more information.

Sorry, Jeff, are you sure that is right? I am not an expert but, if Mark owns a home in Colombia, might that not be covered by renta presuntiva? (I assume this is not the same Mark in Colombia on a student visa who mentioned a six figure income in the US earlier in these comments.)

Questions for a tax accountant. Everyone’s situation is different so best to talk with a tax accountant.

Hi Jeff,

Hope you are well. Can you update this for 2020, considering the tax season is coming up and Covid-19?

Thanks,

John and Susan

I prefer to do my own taxes. Is this permitted in Colombia? I have a Colombian tax accountant friend living in Canada. I had a brief discussion with him of which he was very unwilling to provide information. I told him what my income was and he told me what my tax would be. He did not talk about deductions which suggests that he is a pleasant friend but not necessarily a good accountant.

I’m getting a handle on what is allowed and what is not. I will work with this information. Are there tax forms to fill out? I would imagine that there are. I will have fines to pay. I will pay them with a smile. I don’t know what I have for receipts? I was paying for things like insulin and pills out of pocket for several months. How might I deal with this?

You have not provided much information. Are you resident or non-resident? How good is your Spanish? Do you have a NIT? Everything is done online at the DIAN’s website. Particularly if this is your first tax filing in Colombia, I strongly recommend using a tax accountant, preferably a creative one. Even more so if you say you will have fines to pay. After that, it may be possible for you to file subsequent taxes yourself if you know what you are doing.

Dear Sir / Madam,

With this my question.

I live and work in the Netherlands.

My age is 63 years old.

I work in education, I am a semi-official (www.abp.nl).

I want to retire soon.

My status: I am a retired Dutchman at that time.

I receive pension income from the General Civil Pension Fund.

I want to settle in Colombia soon.

I have a girlfriend there.

However, I am not going to work in Colombia.

Colombia is a non-treaty country, there is no social agreement between the Netherlands and Colombia.

In the first instance, I pay taxes in the Netherlands on my pension income.

In the Netherlands there are laws that want to avoid double taxation, but these laws are complex and not transparent.

In case I have a residence permit in Colombia.

Do I have to pay taxes in Colombia from my pension income in the Netherlands?

Do I have to pay taxes in Colombia on my assets and possesions(for instance a house) in the Netherlands?

Do I have to pay taxes in Colombia, as a Dutch citizen, after 5 years of staying in Colombia?

Thank you very much for your help.

Wim van Boekel

You have several questions, so we recommend taking with a Colombian tax accountant regarding your situation.

Very good article, but a couple of very important questions have been left unanswered. Is Social Security income considered pension income in Colombia? Jeff has stated that his accountant has asserted that pension income is exempt, if so is there a limit to this exemption. Does this exemption cover both civilian pensions as well as Social Security pensions?????

Buenas ! Good article, thank you.

I have hard time to understand this specific paragraph though:

“Colombia taxes the worldwide income of tax residents. Non-residents are taxed only on Colombia-sourced income.”

The second sentence implies that “non-residents” should fill taxes. However, the article says that tourists (=non-residents) will be considered tax residents after 183 days. So is there any ways to fill taxes while being considered “non-resident”?!

My guess is that tourists that stay 183 days are still tourists and thus non-resident (they still run on a tourist visa). Even though they are required to fill taxes, they will be taxed on locally-sourced income only. The worldwide taxation would then only happen to people staying more than 183 AND legally asking for residency in Colombia through any Visa other than tourist.

Is my understanding correct ?! Or is there any typo in this paragraph?!

Thanks!

If you are a Colombia tax resident, you are taxed on worldwide income and required to file taxes based on your income. A year for determining tax residence is any 365-day period. It’s not necessarily a calendar year. And it can even straddle two years. For example, if you were in Colombia 90 days in the last six months of 2019. And if you were in Colombia 94 days in the first six months of 2020, you would be considered a Colombian tax resident for 2020.

Thanks for your prompt reply.

So I don’t get who pays taxes on locally-sourced income then?

There is no such situation, right?

Yes, if you are a tourist who owns rental property here but are a tourist less than 180 days in Colombia, you would be liable for possibly filing for locally-sourced income.

Again, important to note that both income and NET WORTH are to be declared and are taxed. If someone is in country more than a total of 183 days, it is then based on worldwide and not just Colombian income and net worth. This is something that is different for many expats and should be considered.

My understanding is that income generated in Colombia is officially taxable in Colombia and presence in Colombia is irrelevant ie even if you never set foot in Colombia. Of course, double taxation treaties etc are relevant to determine to what extent it may be taxable. So, as Jeff says, if you have rental income arising from a Colombian property or business based in Colombia, the DIAN may want to know about it. Whether they find out about it may be a different matter but penalties can be high.

Of course, if you are just a tourist, you are unlikely to have income generated in Colombia.

The top tax bracket – of those making about USD $40,000 or more — is subject to a 33% marginal rate.

But a person who spends less than 183 days in a 12-month period during the fiscal year in Colombia is considered a non-resident for tax purposes. Those people are liable for tax in Colombia only on Colombian-derived income. That, too, is taxed at a 33% rate.

So, I know quite a number of people that spend three months in the US on business, go home to Australia for the holidays, and spend another few months traveling to Chile and elsewhere. So, they will only be taxed on Colombian- earned income, plus corporate income.

It’s well worth paying an excellent accountant for help, especially because services are so inexpensive in Colombia.

Beware! Colombian taxes are based on NET WORTH and income. Not just income like is done in the US. You need to declare (and pay tax on) the value of your bank accounts, investments, property, etc besides your income. More than 183 days in Colombia, it’s you’re WORLDWIDE net worth and income. Less than 183 days, it’s just Colombian net worth and income.

This is something that is keeping many expats from considering Colombia as a place to live. However, it may be changed in the tax laws over the next years. Ensure you find a good tax accountant that knows the tax laws for expats!

Hi Jeff, great site and a great source of information for expats. Your section on taxes throughout references income and income taxes. However, important to note that it’s not just income but also net worth (patrimonio)!! So it’s important that expats realize that they would also be declaring and paying taxes on all of their net worth including property, investments, retirement accounts, trusts, etc. In the US we don’t use net worth for any tax calculation so this is something very new for US expats.

Hopefully Colombia will realize that these tax reforms are driving away people from moving to Colombia and investing in the country. Totally different from countries like Panama, Costa Rica, Ecuador and other countries.

Keep up the great work.

HI Jeff,

Thanks for the article as I’m finding it really hard to find some information. I wondered if you can help as this is a first for our company …even if you can just point me in direction it would be really appreciated. So we invoice a Colombia company from the UK , was paid apart from the WHT, I receive a WHT certificate but how do I claim this back from the government? I can’t find a form and not sure if possible if the taxation treaty is not in force yet?

Thank you

The one thing I have learnt is that no websites advising on Colombian taxes for expats should be taken at face value (other than Medellin Guru, of course!)

Only on their Colombian income in first four years

Sorry, not accurate. You become a tax resident in Colombia if you stay in the country for more than 183 total days during a year and you are taxed on your global income. You should contact the Colombian tax accountant listed in the article.

According to GLOBAL property guide foreign residents are not taxed for the first FOUR years of residency and then are taxed the 5th year on worldwide income.

Article as of July 18, 2018

Hi Mike,

Sorry, that is inaccurate. That is old information that changed several years ago and I am 100 percent sure about this. The rule is now you become a tax resident in Colombia if you stay in the country for more than 183 total days during a year, whether this time is continuous or not. I have filed income taxes in Colombia for several years. If you don’t believe this contact the Colombian tax accountant listed in the article.

Jeff, you listed requirements to file if you are a tax resident. My wife has dual citizenship, Colombia and U.S. I am U.S. We live in the U.S. My wife has some rental income in Colombia, about $9,500 per year. I’ve never been able to determine whether filing is required….or not because she isn’t a tax resident. Can you clarify?

I recommend asking the Colombian tax accountant listed in the article.

If I get a investor visa do I have to pay income taxes in the US and Colombia automatically or is it still based off how long I stay in the country

I also would like to know the answer to the question but the linked article is wrong in at least one respect and makes me question the rest of it. It says fiscal residents are those who have lived and worked in Colombia for any 6 months during a calendar year.

First working is irrelevant. You can be resident without working.

More importantly, the calendar year is irrelevant. It is not 6 months in a calendar year. It is 183 days in any rolling period of one year. So, for example, 4 months from August to November 2018 followed by 3 months from February to April 2019 makes you fiscally resident.

I do not know what their qualifications are but such a serious mistake would make me not trust their advice, particularly as the article was only recently published.

Norman, I agree that website looks suspect.

Everything I am reading keeps pointing to that pensions are taxed. The DIAN clearly states that foreign pensions are not afforded the exemptions Colombian pensions do. Colombian pensions are only taxable if the monthly income exceeds 1,000 UVT, this is what “numeral 5 del articulo 206 del Estatuto Tributario” explains. The DIAN makes it certain that article doesn’t apply to foreign pensions and therefore they would still be taxable. I would love to know where Paula is getting her information that they are not taxable since everything points to that they still are. Please, please, please prove me wrong, because I would like nothing more than being wrong right now. I would hate to move to Colombia thinking they are not taxable, only to realize they are come tax time. As it stands right now Colombia is not tax friendly for me which is unfortunate.

If you can read Spanish here the info straight from the DIAN: https://www.dian.gov.co/impuestos/personas/Renta_Personas_Naturales_2017/Clasificacion_y_definicion_Rentas_Cedulares/Rentas_de_Pensiones/Paginas/default.aspx

Jeff, Ian, Norman, AJ, Has anyone yet found a definitive answer as to the taxability of foreign pensions, e.g. US Social Security? I would think that this is an important question for many US expats in Colombia.

Yes, see my comment above –

“You should talk to a Colombian tax accountant like Paula listed in the article. Foreign pension income is no longer taxable in Colombia according to my Colombian tax accountant.”

Paula gave me similar advice on the foreign pensions NOT being taxes in Colombia, yet two different consulting firms (PWC and this link) state that it IS taxable, possibly after 5 years residing in country (for tax purposes, al menos 183 days) and only after ~$34,000 is pension income then taxed apparently:

https://fascpaconsultants.com/five-new-tax-rules-for-americans-living-in-colombia/

Thanks for the article,

My question is how to prove being out of the country more than 183days?

I plan to do a visa with my girlfriend and probably regsitred .myself to the embassy.

Means i will become resident here and then have to pay income taxe on my incomes from Europe?

I work by rotation 6weeks on 6weeks off then i m out of the country more than 183.

Thanks for your answer.

You can determine you time in the coutnry by your immigration records from the stamps in your passport and you can also get a report from Migracion in Colombia about your movements in and out of the country. You only have to file taxes in Colombia if you are a tax resident. You are a tax resident f you stay in the country for more than 183 total days during a year, whether this time is continuous or not.

And a year means any rolling 365 day period. So you have to be very careful. I this it used to be a calendar year but not any more.

Yes, as it states in the article – “… a year for determining tax residence is any 365-day period. It’s not necessarily a calendar year.”

Thanks a lot for you fast answer.

Len

Thanks Jeff, this is a very useful email and intricately detailed primer on COL’s tax system for ex-pats.

I’ve emailed Paula, who is probably swamped during now during the country’s tax season, but curious as to two points:

A. If I receive a US federal retirement annuity with a yearly IRS form 1099R, that is NOT taxed by the COL government? If so, that’s a relief.

B. In the future, my IRA distributions won’t be taxed either on the same grounds?

Thank you.

Hi Ian, thanks. Yes, Paula is very busy at times. Try her on Skype. She is the better person to answer your questions. Also, I am planning to meet with her sometime and write an updated Colombia income tax guide.

Jeff,

Any progress on an updated article for taxes? I tried emailing Paula but she never answered. I saw you mention she says foreign pensions are no longer taxed but I can’t find anything to corroborate that. I researched this topic on the DIAN website specifically on foreign pensions and didn’t find anything that would stipulate they are no longer taxed. I’m particularly interested in any information regarding the tax implications for US goverment pensions and US non taxable disability pensions in Colombia. Would appreciate any info you could share about it.

Hi Aj, no I haven’t met with Paula yet to enable writing an updated taxes article. But she told me last year that foreign pensions are no longer taxed up to a limit.

Thanks for the response Jeff. I know pensions are not taxed up to a limit but from my understanding that only applies to Colombian pensions. From all my research so far, everything I have read on the DIAN’s website is that foreign pensions are still taxed. Would be great to know where Paula is getting that they are no longer taxed. If that’s the case great, but really tough to plan an overseas move on the word of a single person. Would hate to move to Colombia only to realize that i have to pay taxes. Or worst live there for a few years and suddenly realize you have been delinquent for years, especially if I eventually seek citizenship.

Are pension of other countries taxable or not in Colombia. I am very confused with all that have read on this site. Can I get an official ruling on this subject. I want to apply for a TP7 it is Important for me to know the reality on this subject

We recommend asking a Colombian tax accountant and there is contact information in the above article.

Jeff,

I’ve recently discovered your website and I’d like to say DAMN! You’ve done an excellent job on a number of topics pertinent to expats with real answers. While I’m several years away from retiring, I like to have things planned out for major life changes such as retirement. I will certainly visit each city/country that is on the short list, but I can already tell that Medellin is at the top of that short list. That being said, it looks to me like Columbia is not a good country to retire in based on tax concerns. I’m looking at about $200K/year in retirement income (pensions, 401Ks, IRAs) which will all be taxed in the U.S. and Columbia. Since you can only stay for 183 days per calendar year, do you know of expats living in two different countries to avoid this double tax problem?

You should talk to a Colombian tax accountant like Paula listed in the article.

Foreign pension income is no longer taxable in Colombia according to my Colombian tax accountant. Also, you can subtract some income taxes paid in another country so not really double taxation. Everyone’s situation is different so you should talk to a tax professional.

If all my income is from SSA, and nowhere else, is that counted as taxable income in Colombia? And if not do I still need to file a declaracion de rentas but put 0 in total?

SSA income is no longer taxable according to my Colombian tax accountant. I recommend contacting her regarding filing taxes and her contact info is in the article.

Hi Alan, Paula is currently in Europe and returns on Tuesday next week. So, may be slow to respond.

Very helpful article. May I correct one point? Colombia and the UK signed a double taxation treaty in November 2016 but it is not yet in force. My principal source is the UK Government website https://www.gov.uk/government/publications/colombia-tax-treaties.

Hi Norman, thanks I updated the article to say the double tax treaty with the UK is not yet in force.

Dear Jeff!

I do not understand one thing.

I do not have to declare incomtax for 2016 if the total income do not exceed or is less than 1,400 UVT, which is 41,654,200 pesos ($ 13,881 USD at the official exchange rate at the end of 2016).

And in the table below it is written that from above $ 32,430,770 I should pay 19 percent the tax.

Can you explain this diference to me please?

What will happen when my income exceeds these two amounts, eg total income is 46 million. Do I pay taxes for the amount that exceeds the first or second amount.

Is the gift treated like other income earnings?

Do you have somewhere similar information for 2017

I will be very grateful for a short answer to my questions.

Hi Leszek, keep in mind that 25 percent of your income (up to a limit) is exempt from taxes in Colombia. So, that is why you don’t have to file taxes if your total income does not exceed or is less than 1,400 UVT, which was 41,654,200 pesos ($ 13,881 USD at the official exchange rate at the end of 2016) – which is higher than the income in the tax table. The income used for the tax table is income after excluding 25 percent (up to a limit)) of your income that is exempt from taxes.

I don’t yet have an updated article for 2017. I recommend contacting the tax accountant listed in the article if you have other questions.

Hi Steve, Paula sometimes travels or may have been on vacation over the long weekend. I am aware she will be at a conference I am at on Thursday this week and I will provide her with your email.

Mark,

This may apply for the US income.

“If a tax resident individual pays tax in another country, on income earned abroad (foreign source income), the amount of tax paid abroad may be deducted from the tax payable in Colombia, up to 100 percent of the tax payable in Colombia in respect of that income.”

Hello Jeff:

I’ve just discovered your site and found this article vary illuminating. I’m a dual citizen who has lived and worked most of my life in the USA. I’m planning to retire in a few years and started thinking about the possibility of spending part of the year in the US and part of the year in Colombia. One of the major issues I see down the road is a hefty dual taxation here in the US and in Colombia. Since most of my retired income will come from 403K and Social Security. Everyone knows that you have to pay US taxes on Tax Deferred Contributions ( aka Pensions ) . I wonder if anyone has any feedback on a similar situation.

Also, I will have to buy an excellent Comprenhensive Health Care Insurance in Colombia since my job’s insurance and Medicare will not work overseas. And, of course, there are a lot more expenses associated with living in two countries in retirement;

Thanking you in advance for any feedback/tips from people in a similar situation.

Best,

John

Hi Jeff,

If you are here on a student visa, do you still have to file for taxes?

I plan to study here for 3 years and only rent during that time.

I do have a six figure income in the US which concerns me as after my US deductions the 33% Colombian rate scares me. Based on the info above my Colombian Liability would be in the tens of thousands.

I make no income in Colombia and just want to learn Spanish and enjoy the culture for 3 years or so.

Hi Mark, yes regardless of the type of visa, if you are in Colombia for over 183 days you are considered a tax resident and likely will have to file taxes in Colombia depending on your individual situation. You can subtract some income taxes paid in another country from income taxes due in Colombia. Also there are a number of deductions in Colombia including up to 25% of your salary (up to a limit). You should talk to a Colombian tax accountant and there is contact info in the article above.

Thanks Jeff,

I will make an appointment with a tax accountant.

You should look into the Foreign Earned Income Exclusion with your accountant.

You may be able to save a substantial amount on your US taxes.

Approx. the first $101,000 (US) of earned income may not be taxed in the US if you visit the US less than 35 days per year and meet other conditions.

In your opinion, if one stays in Colombia less than 183 days a year, they do NOT have to file taxes in Colombia? Even if they become a citizen? I ask as I believe that my personal situation would require me to pay a substantial amount of Colombian income tax even though my income is derived in another country. That being said, I would still be interested in purchasing a 2nd home here. I am just a little timid in doing so as my personal tax situation would more than negate the savings from living in Colombia.

I hope the higher ups revisit the tax situation here on the World Wide Income (WWI). Some of the higher income, higher net worth foreigners feel they are forced to leave at least 6 months a year and are wary of purchasing anything substantial due to the WWI tax in Colombia.

Hopefully after meeting with the accountant my fears with calm.

Thanks for the great info and the service you provide.

Mark,

If you move to Colombia you may qualify for the US Foreign Earned Income Exclusion which can exclude the first ~100K of your US income. Pretty easy to qualify for if you live outside the use for 11+ months of the calendar year.

https://www.irs.gov/individuals/international-taxpayers/foreign-earned-income-exclusion

This is one of the rare cases where if you spend an hour with the IRS tax code you’ll have a pretty good understanding of the exclusion and this might make it net cheaper when you pay Colombian taxes.

Yes, I am familiar with the exclusion. Thank you. The problem is, that you save in the US, but have a net increase in tax liability with the 33% here in Colombia.

After doing much research, I think it is better for me to only stay less than the 183 days a year.

For high net worth, high (foreign) income individuals, the world wide tax law in Colombia makes living here longer than the 183 day limit very expensive.

I hope the powers at be revisit this and make some changes. In my opinion, it deters investment and forces higher income people to leave (or lie) after the 183 day mark. Then the country loses on the 19% sales tax that those individuals would have otherwise spent in their additional days spent in Colombia.

For example, let’s say a person set themselves up that they are making $125k (or more) a year from income from the US. They do not have to live in the US to earn that money, they can live anywhere. With the deductions from SEP IRA’s and the FEIE, that person would pay no income tax in the US (or very little). With the current tax laws here, a person like that would be forced to leave after the 183 day mark or close to $40,000 US in taxes to the Colombian government.

It just doesn’t make financial sense for those type of people to stay and frequent the restaurants, shop at the stores and employ cleaning help, use taxi’s, etc, for more than 6 months. Hence, the county loses out on the 19% from those individuals for half the year.

Not to mention the loss in real estate sales. I would be much more likely to spend substantially more for a permanent home here if I did not have that tax threat, or being forced to leave my home because of it.

Thanks for the reply, I hope things change in the coming years so I can stay longer and purchase a property.

Mark,

Really appreciate your answer as well as the details. Based on what you shared Colombia is turning away a good number of expats that most countries welcome.

Then, add the wealth tax and there are more reasons for expats to not choose Colombia for more than 6 months at a time.

WEALTH TAX: Tax residents have to include assets owned in Colombia and abroad and non-tax residents have to include assets owned in Colombia. The wealth tax applies to individuals whose net worth is higher than COP 1 billion (USD $345,000).

Note: Thanks Jeff for the informative article. Much appreciated.

Do yo know if somebody moves to Colombia AFTER 2014 will they be subject to the wealth tax?

The article says “Colombia also has a temporary wealth tax for tax years 2015 to 2018. And this wealth tax reportedly is expected to be eliminated in 2019.” I also recommend talking to a tax accountant.

Hi Jeff, very nice article. I have a question. In your article you stated

“Also, if you plan to become a dual citizen in Colombia, which is possible after having a resident visa for five years, part of this process looks to make sure you have been filing income tax returns in Colombia.”

This was in the “Penalties for Not Filing Income Taxes in Colombia” section.

If you have a TP-7 (pensionado visa) do you have to become a dual citizen or can you continue to live in Colombia by renewing your visa each year in Bogota?

Thanks,

David

If you have a pensionado visa, first you need five years with that type of visa before you can get a resident visa. Then after five years with a resident visa you have the option to become a dual citizen.

But you don’t have to do that, you can continue to live in Colombia with visas. One of the benefits of becoming a dual citizen is that you avoid the costs of visa renewals.

Thanks Jeff, Great post. I’ll read it a couple of more times as there is a remarkable amount of info here!

Cheers, Brock

Very, very helpful, thanks a lot.

Thanks this is a very helpful article!

It is hard to find clear, up-to-date and correct information regarding taxes in Colombia, especially in English.