We provide an updated 2024 guide for tourists to get an IVA tax refund. One of the downsides of living in Medellín or Colombia is that Colombia has a 19 percent IVA tax (a.k.a. value-added tax or VAT) on many products. This tax makes buying many things in Colombia more expensive than in some other countries.

The IVA tax in Colombia used to be 16 percent but was increased to 19 percent in February 2017. However, if you are a foreign tourist visiting and not residing in Colombia you can get a 100 percent IVA tax refund for many products purchased in Colombia, up to a limit.

Many countries in Latin America tend to have a VAT. Colombia’s 19 percent VAT tax is the same rate as in Chile. In Mexico, the VAT is 16 percent, in Peru, it’s 18 percent, in Brazil, the tax is 17 percent but can go as high as 25 percent, in Argentina, it’s 21 percent, in Uruguay, it’s 22 percent, and in Ecuador, the tax is 12 percent for standard goods and 15 percent for luxury goods.

The Colombia IVA tax refund is intended to encourage tourists to buy things in Colombia to bring back to their home country. But if you were born in Colombia but are a citizen of another country (a dual-citizen) and traveling to Colombia, the IVA tax refund doesn’t apply.

In this article, we’ll look at the IVA tax in Colombia in more detail, which has been updated for 2024. Also, we show how tourists can get an refund of this IVA tax for many items purchased in Colombia

Colombia's IVA Tax

Colombia VAT, which is known as the IVA tax, is the country’s main indirect tax, which is collected by DIAN. And it is levied at 19 percent on most goods and services sold in Colombia. However, there are some things that are exempt from the IVA tax. And some things are taxed at lower rates.

Among items that are taxed at the full 19 percent IVA tax are clothing, personal and household toiletries, movies, airline tickets, appliances, footwear, jewelry, oils, margarine, condiments (spices, sauces and dressings), spare parts for cars and vehicles (except electric ones, which have a 5 percent tax).

Also, it is important to take into account that, in November 2023, sugary drinks and ultra-processed foods such as cereals, cookies, breads, among others, will also begin to have a VAT tax.

Some electronic products will only be taxed beyond a certain price. For example, there are exemptions for lower-priced computers and tablets. For example, computers that have a value equal to or less than $1,900,000 Colombian pesos are excluded from VAT, this applies to desktop computers (PCs), and laptops. Computers that exceed that value are taxed with VAT at the general VAT rate, today at 19%.

The IVA tax is 14 percent on domestic and imported beers. Also, there is a 5 percent IVA tax on several products such as coffee, toilet paper, lower cost bicycles, among others.

In addition, for some services the IVA tax is the lower 5 percent including prepaid medicine plans, surgery and hospitalization insurance policies and health insurance policies.

Medellin Guru Insurance Service

The insurance agency we partnered with has helped 1.893 Medellin Guru readers

Furthermore, some grocery items such as milk, eggs and fruits and vegetables and several other items are exempt from the IVA tax in Colombia.

The IVA tax is included in prices you see posted on items in stores. But your receipt will break out the IVA tax into the different categories, such as 19 percent, 5 percent or exempt (zero percent).

Colombia’s IVA Tax Refund

Foreign tourists not residing in Colombia have the right to a 100 percent refund of the IVA tax paid on several types of goods purchased in Colombia.

For this 2023. the regulations contemplate that a refund may be requested on all products taxed with VAT. Previously, only 12 product categories were contemplated for this procedure.

Likewise, foreign tourists may request a VAT refund when their purchases of goods, including sales tax, VAT, are for an amount equal to or greater than 3 UVT (Tax Value Unit), that is, a total of $108,924 Colombian pesos. With the previous regulations, purchases must be of a minimum of 10 UVT.

In addition, Colombian nationals who hold dual nationality are not considered to be foreign tourists or non-resident foreign visitors in Colombia. So, they do not have the right to the IVA tax refund.

How to Request a Refund

They can request a refund of VAT on taxed assets within the national territory for up to $8,482,200 Colombian pesos . The process is done when you leave the country. Before checking the baggage, the person must go to the DIAN offices, where they will receive attention from the company Global Blue Sucursal Colombia.s.

Additionally, all purchases eligible for a tax refund must have been paid for in person with a debit or credit card. Cash payments for purchases are not eligible for a tax refund.

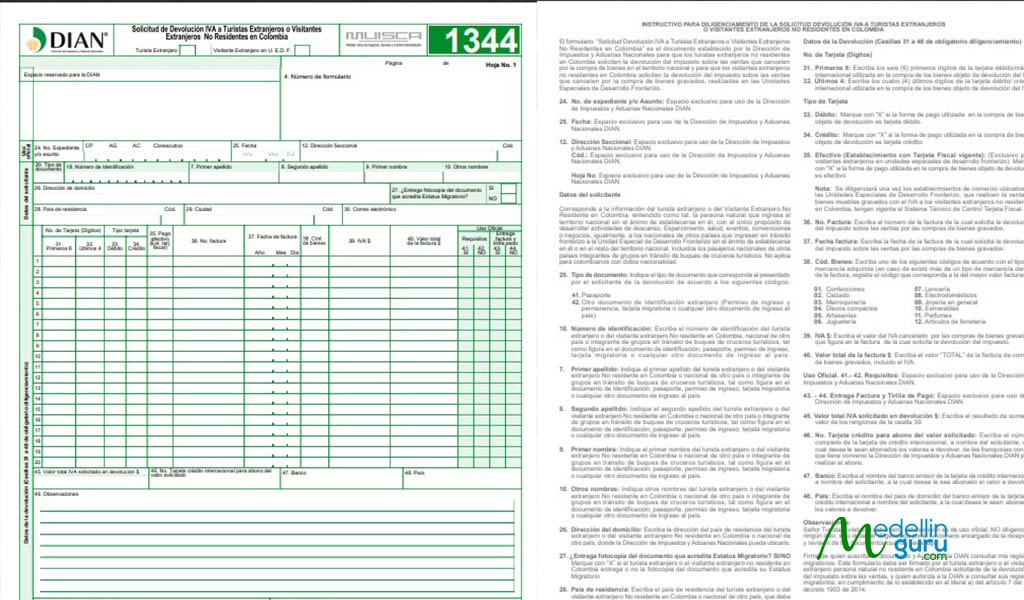

Form 1344 used to apply for the tax refund (form has been updated and is found in DIAN offices at airports).

Requirements for the VAT Tax Refund Application

The following are the requirements for an IVA Tax Refund according to DIAN:

- Complete Form 1344.

- Present Form 1344 to DIAN when exiting the country and before checking in with your airline.

- Show your original passport and submit a copy of the passport’s data page and the page with your most recent tourist stamp in your passport.

- Submit photocopies of sales receipt(s). The receipts must be no more than six months old.

- The purchase of taxed goods in Colombia must be done in person by a card payment terminal with an international credit and/or debit card issued outside of the country. And make sure to keep a copy of the credit card voucher and the additional receipt you get that has the IVA information on it for each purchase.

- The purchase of taxed goods must be done from merchants registered in the common sales tax system in Colombia and be supported by sales receipts that contain the breakdown of the IVA tax.

- Goods acquired with the right to IVA refund must effectively exit the country.

- No more than one refund application may be submitted per quarter.

However, note that Medellin Guru readers reported in November 2023 that the form has changed and if you download the form from the DIAN website before showing up at the DIAN office at an airport it can’t be used. So, budget some time at the DIAN office to fill out the form and make sure have copies of everything ready before you get to the airport.

Three months from the date the form is registered at a DIAN office located in an international airport or port, a credit will be issued to the international credit card indicated on the Form 1344 application form. The financial costs and notification expenses incurred will be deducted from the value refunded.

If you haven’t received your refund after three months, you can contact DIAN via email at [email protected].

The Bottom Line: Colombia’s IVA Tax

Colombia has a relatively high VAT tax at 19 percent, which is a downside for living in the country. But several other countries in Latin America also have a relatively high VAT. So, Colombia isn’t unique in the region.

Fortunately for tourists, Colombia offers an IVA tax refund. The refund is straightforward to apply for. Most notably, I have talked to some tourists recently who received their tax refunds in about the three months, as promised by DIAN.

In addition, “How to get a Colombia IVA tax refund?” is a common question asked by expats visiting Colombia. So, we included this question in our list of Medellín frequently asked questions (FAQ).

Editors note: updated on June 13, 2023 With information on the new VAT refund categories, the new refund method and price updates.

57 thoughts on “Colombia’s IVA Tax & How Tourists Can Get an IVA Tax Refund – Update 2024”

Hey!

Thank you for all this good information. I leave Colombia by boat to Panama (departure Capurgana, Sapzurro). Is there an office here where I can arrange the IVA?

Thank you!

Lisanne

Airports have Dian offices for filing for the IVA tax refund. But since leaving by boat you will have to contact Dian to find out how and where to file – https://www.dian.gov.co/atencionciudadano/Naf/Lugares_de_atencion/Paginas/default.aspx

What about purchases made online? Cant hey be reimbursed?

Can you receive the refund if you are leaving Colombia via a bus?

I departed MDE 8 Nov and received my refund on 17 Feb. The DIAN office was open and manned at that time (6:30 am).

Two important notes:

1) Make sure you apply for the refund BEFORE you check-in for your flight.

2) Make sure the items that you are requesting a refund for are easily accessible. You will have to produce/show the items and it sucks if they are deeply packed.

Other than the above, the agent was very helpful and it was a pleasant experience.

Forgot to go to the DIAN office until I was through security (they would not allow me back out!). Is there any way to apply for the tax back after leaving Colombia?

Thanks for your help!!

Unfortunately I am not aware of a way to apply for the tax refund after leaving Colombia.

Hey Jeff,

my case might be a bit more complicated… I imported an Laptop from the US. When arrived they chared my 29% Tax (10% for Import, 19% IVA). Can I apply for a refund for the IVA? Theoratically I should be able, but I also don’t have a copy rom a local seller. Just from Amazon in US and some ducuments for the transport etc.

Appreciate if you answer by E-Mail: [email protected]

I sent a reply via email as follows: To be eligible for an Colombia IVA tax refund the item must be purchased in Colombia with an international credit card. And as far as I know there is no way to get a refund for IVA tax paid on an item imported.

Hi Jeff – this is a great article! I’ve sent this to all my friends visiting. Do you know if: gym/fitness expenses are considered entertainment? Also, what about household goods (kitchen supplies etc) and arts supplies? Thank you!

Thanks. Household goods (kitchen supplies etc) and arts supplies aren’t on the list of goods from DIAN eligible for the IVA tax refund but appliances are.

Ok, I just left from Medellin last night. I stopped off at the DIAN office in the MDE airport. It appears that the English language form for reimbursement obtained from the DIAN website is NOT, I repeat is NOT the correct English form. Apparently, the correct English form of this document is available at their counter exclusively. I advised the attendant at the DIAN counter that I obtained the DIAN form directly from their website. She insisted that it’s not the correct form and pointed out some minor changes in the differences. This means that you cannot prefill your form if the original was obtained from the DIAN website. You must complete your English language form at the counter or go with the Spanish language version. I pleaded my case to the attendant to no avail and with .

Also, be advised that when you pay for your items with your credit card it’s important that you keep EVERYTHING regarding that transaction. Not just the long form receipt. At the credit card point of sale you will receive a little 2 inch piece of paper along with your receipt-KEEP THIS. If you didn’t get it, then ask for it. It has the IVA information on it. If you just submit the long form receipt for reimbursement you will be denied(as I was).

Bottom line: It seems to me that the Colombian government either does not want you to be reimbursed or simply makes the process for you(the foreigner) as difficult as possible. Such is the nature of government I suppose.

Hi Jeff, thanks. Things change all the time in Colombia. I will update the article so that people know to fill out the form at the DIAN office not the one from the DIAN website.

I think this is the nature of the bureaucratic beast in Colombia. My wife got all kinds of grief for not having her Colombian passport. Her cedula was old and not valid anymore. She contacts the government they said she needed a Colombian bank account to pay for her papers. She told them, I’m in the US, I don’t have a US bank account. They replied. Don’t tell us where you are, we need a Colombian bank account. The consulate is very difficult to deal with too. Reminds me of dealing w/ DMV here. LOL

If I am purchasing an item with two different credit cards does that make a difference?

Ok everyone. I purchased a watch and it IS NOT OR DOES NOT participate in the reimbursement of the VAT. When I arrived at the DIAN office they have a list that tells you what can be included and what is not included and it specifically states that watches are not included.

I assumed that the word “jewelry” meant watches but it does not.

Hi Minh, thanks. I updated the article to add information that watches are not included in the IVA tax refund.

#7. Good must effectively leave the country

I assume this means that went home with us? Do you need to provide proof? If so how? For example one of our purchases was a 50″ 4K TV I use as a computer monitor.

It’s all in the documentation. It needs to leave the country with you. They will possibly ask you to produce the items. You will have to provide receipts as well.

If you were borne in Colombia but a citizen of another country, the refund does not apply. This is the first thing agents at the DIAN check to avoid the refund.

Thanks Luis, I updated the article with this information.

I returned from Colombia in early Jan. At the Cartagena airport I handed over my pre-filled forms with duplicates of everything for VAT refund on one purchase (an emerald). Fast forward to May, I got an email saying the paperwork was fine and I should have a refund shortly. Forward to August, I got an email that the deposit could not be made, and the account number was included. I realized there was a duplicate number in the credit card, so that is why it would fail. Replied with that info by email. Finally, unbelievably, the money was deposited in my account today, 13 Sept.

I never received a direct reply when contacting DIAN. The email mentioned above came to me but no response to my inquiries. Also no one answers the phone. Good luck all!

Are services for repairs (I.e., boat repairs) able to be refunded?

That is not on the list from DIAN so very doubtful. Only products are on the list in the article that came from a DIAN document.

Hi, Is the minimum of 10 UVT for each receipt or is it the minimum total across all purchases submitted on the form?

Hi David, it’s the total of all purchases.

hello

im yosef elyahu

On February 26, 2008, I returned from a vacation in Colombia at Medellin Airport. I filled all the requisitions that were requested and I still did not receive a refund or a response.

Hi Yosef, I assume you mean February 26, 2018 and not 2008? It takes 3 months or longer to get the refund. If you haven’t received your refund after three months, you can contact DIAN via email at [email protected].

I’ve see that you can not get a refund of the tax on lodging, but I’ve read we are not required to pay it. Does this mean to just make sure we aren’t being charged it at the time of check in / check out

HI there,

In my experience I have shown the hotel the regulation on my phone (in Spanish… it can be downloaded) and that has sufficed.

-Ty

The link to the form didn’t work. Can you repost the link to the form?

Unfortunately it looks like they have removed the form from their website. And I can no longer find the form online. So, I’ll remove the link and you will have to get the form at their office.

Hi Jeff,

I received an email from DIAN a couple of weeks back indicating that my refund has been approved. When should I expect to see the refund on my credit card statement?

Thanks,

Mukarram

I purchased jewelry in Cartagena and was told by jeweler to get IVA tax form at airport. At airport I was directed to wrong line to obtain form and I went through immigration by mistake. After I went through and explained by problem, they would no let me return to get form. Do I have any recourse?

Sorry, no recourse that I am aware of.

What are the opening times of the office in cartagena please? I have a flight at 9am and even with an early attendance I’m worried the office will be closed.

Hi Nisha, sorry I don’t know the DIAN office hours at the Cartagena airport. But you can try calling DIAN at +57 (1) 5462200 to ask.

Hi – was the office open before your flight? Thanks?

Hi Jeff. As a foreign citizen, do I pay the 19% VAT while staying at a hotel for a 21 day vacation trip? Thank you very much for your cooperation

Last year I talked to an foreigner tourist staying at a hotel he said he showed his passport with entry stamp and the tax was waived.

This was my experience last summer as well. We just showed our US Passports to the front desk and paid no tax.

I recently visited Columbia and purchased some jewelry in Cartagena. The jewelry store filled in the paperwork, and I was prepared for my DIAN refund. My flight left Cartagena at 5:30 am and because the DIAN office was closed then, I was advised to go to DIAN at the Bogata airport where we had a stopover before leaving the country. Unfortunately, the plane landed very late in Bogata, and we were rushed to our connecting flight without being able to visit the DIAN office. How can I now receive the tax rebate, which is still due to me? It is over $300.00 in American money. I have contacted Avianca for advice , but no one has helped me.

Try contacting DIAN via email at [email protected] to ask what to do. I recommend translating your email to Spanish.

Hi Jeff,

I would like to know if the VAT exemption for tourists apply to a car rental.

Also, does it apply to a tour purchased with a travel agency (3 days/2 nigths La Guajira including accomodation and food).

Thanks in advance!

Hi Marie-Lise, sorry no. You can only get a VAT refund for the goods listed in the article (clothing, compact discs, linens and underwear, emeralds, footwear, handicrafts, appliances, perfumes, leather products, toys, general jewelry and hardware items). And that list of goods came from DIAN the IRS of Colombia.

Hi Jeff, very helpful blog, however today I asked at Medellín airport but the refund cannot be requested for technology, such as mobile phones or laptops. Could you change this in your blog?

Hi Marten, thanks. Technology items are not on the list if items in the article that are eligible for the IVA refund. But I added that you can’t get an IVA tax refund for “technology items like laptops or cell phones” to make this clear.

Hi Jeff,

Excellent and very relevant blog. We were at the DIAN kiosk one morning on our last trip going out, filled the paperwork as you have outlined, but have not gotten the refund in over 11 months.

Will they honor the receipt when we return, do you think? The refund was for just under $100 USD, but that was secondary to the fun we had on our trip.

Keep up the good work, and stay safe.

Regards, Ant

In the article above is an email address that you can use to follow up on tax refunds. Also when you return, you could stop at the airport office to check.

The staff at the DIAN office at the airport was very helpful when I stopped in with another expat looking to turn in his tax refund paperwork. Good luck!

Thanks, Jeff…

Enjoy the nice weather… Ant

Thanks for posting this. I have a friend visiting from the US and she was wondering about how to get the tax refund. This is very helpful information.

We do not use credit cards. We have all of our receipts, but they were paid for in cash. Can we be reimbursed?

Unfortunately not according to DIAN’s instructions. This is a quote from DIAN’s instructions for the tax refund in English:

“The purchase of taxed goods must be done in person by a card payment terminal with an international credit and/or debit card issued outside of the country.”

Thanks Jeff, doesn’t look too bad. Seems like a pain in the butt though, getting the refund. I was not aware of this, so big thank you!

Cheers, Brock

I have been waiting for 4 months for a refund. This is a scam. What a royal pain. Is there any recourse? No one responds to the email address.

Hi Julie, I have talked to some expats that told me it took them over 4 months to get a refund and others about 3 months.

You can also try calling DIAN at +57 1 546 2200 or +57 1 605 9830 on Monday to Friday from 7:30 a.m to 5:00 p.m.

I ran out of time and had to catch my flight. I had my VAT refund form all filled out. Can I mail it to DIAN in Colombia from the US?