Colombia is home to one of the world’s top healthcare systems, offering high-quality medical services at a fraction of the cost compared to many other countries. Whether you’re an expat, retiree, or digital nomad, understanding how to sign up for health insurance in Colombia is essential for accessing affordable and reliable healthcare.

In this updated guide for 2025, we’ll walk you through the process of enrolling in Colombia’s health insurance system, covering both public (EPS) and private options. Medellín, in particular, has become a top retirement destination, renowned for its excellent healthcare facilities—including nine of the best-ranked hospitals in Latin America.

Some of the most frequently asked questions on the Medellin Guru site by foreigners considering moving to Colombia have been about health insurance. So, we now cover health insurance in Colombia.

Many Medellin Guru readers have asked about health insurance and other types of insurance. So, we partnered to offer Colombian insurance services to readers, which has helped many Medellin Guru readers obtain insurance.

Medellin Guru Insurance Service

The insurance agency we partnered with has helped 1.893 Medellin Guru readers.

Colombia's Healthcare System

The World Health Organization (WHO) ranks Colombia’s healthcare system as #22 out of 191 countries it ranked. Also, no other countries in Latin America were ranked higher than Colombia. So, according to WHO, Colombia has the best healthcare system in Latin America.

In addition, Colombia’s healthcare system is ranked higher than many wealthier countries like the United States (#37), Germany (#25), Canada (#30) and Australia (#32).

In Colombia, it is possible to have access to world-class healthcare at a fraction of the cost compared to the healthcare costs in the U.S. or Europe. Furthermore, the costs for healthcare in Colombia can be significantly lower than the costs found in the U.S.

It is possible to find costs that are from 50 percent to even over 70 percent less expensive in Colombia compared to the U.S. And medical insurance is also relatively inexpensive in Colombia in comparison to the U.S. and Europe.

With lower medical costs than many other countries, Colombia is experiencing an increase in medical tourism each year. Foreigners are coming to Colombia for dental care, eye surgery, cosmetic surgery and other surgeries due to the lower costs in Colombia. So, many hospitals in Colombia have some bilingual staff.

Colombia has the Best Hospitals in Latin America

Colombia has 24 of the best hospitals in Latin America, according to a study in late 2019 by América Economia that looked at the top 58 hospitals in Latin America. So, 41 percent of the best clinics and hospitals in Latin America are found in Colombia.

Medellín has nine hospitals that are on the list of the top 58 hospitals in Latin America as follows with their 2019 Latin American rankings:

- 1. Hospital Pablo Tobón Uribe (#9)

- 2. Hospital Universitario San Vicente Fundación (#16)

- 3. Clínica las Américas (#26)

- 4. Clínica Universitaria Bolivariana (#28)

- 5. Hospital General de Medellín (#33)

- 6. Clínica El Rosario (#41)

- 7. Clínica Cardio Vid (#42)

- 8. Clínica Medellín (#43)

- 8. Clínica Las Vegas (#53)

Also, Bogotá has nine hospitals that are on the list of the top 58 hospitals in Latin America as follows with their 2019 Latin American rankings:

- 1. Fundación Cardioinfantil (#3)

- 2. Clínica Universidad de La Sabana (#25)

- 3. Clínica del Occidente (#31)

- 4. Méderi (#32)

- 5. Hospital Universitario Infantil de San José (#49)

- 6. Clinica de Marly (#50)

- 7. Clínica los Nogales (#51)

- 8. Hospital Universitario Infantil de San José (#49)

- 8. Centro Policlínico del Olaya (#57)

In addition, Cali has two hospitals on the top 58 hospitals list, Pasto has two, Bucaramanga has one and Manizales has one.

We also looked at these top 24 hospitals in Colombia in more detail. The best healthcare in Colombia is found in the largest cities in Colombia.

Health Insurance Options in Colombia

One of the reasons that Colombia has such a highly rated healthcare system is due to a new constitution that Colombia drafted in 1991 that made access to healthcare a basic human right to all citizens of Colombia, as well as foreign residents of Colombia.

There are three types of health insurance available in Colombia:

This is the public health insurance that is mandatory for everybody who is a resident of Colombia. The monthly premium is calculated as 12.5 percent of the 40 percent of monthly gross income that you declare to the EPS.

This is private healthcare insurance in Colombia. The monthly premium for Prepagada varies depending on your age, the plan you choose and any pre-existing conditions.

This is a free government subsidized healthcare system, which is only for colombians with low economic resources .

Medellin Guru partnered with an insurance agent that can help sign up for Prepagada health insurance, auto insurance, homeowners insurance, travel insurance and life insurance.

Medellin Guru Insurance Service

The insurance agency we partnered with has helped 1.893 Medellin Guru readers.

Health Insurance Providers in Colombia

There are several providers in Colombia offering private health insurance including:

Axxa Colpatria

Axxa Colpatria is a financial institution in Colombia that offers various financial products and services, including savings accounts, credit cards, loans, insurance, and investment services. It is part of the Grupo Aval, Colombia’s most prominent financial conglomerates.

SURA

Grupo SURA is Colombian company based in Medellín that was started in 1944. Grupo SURA is a multinational company that does business in Colombia and several other countries in Latin America.

In addition, Grupo SURA is part of Grupo Empresarial Antioqueño also known as Sindicato Antioqueño, which is a large Colombian conglomerate composed of about 125 companies including owning a large percentage of shares in Bancolombia, Grupo Nutresa and Grupo Argos.

SURA’s primary businesses are health insurance, life insurance, investment banking and asset management. Also, SURA reportedly has over 4,600 doctors and over 400 hospitals and medical centers in their network.

Coomeva

Coomeva is a Colombia cooperative that provides its members healthcare services, insurance, financial products, and other services. It operates in various sectors, including healthcare, insurance, finance, and recreation.

Seguros Bolivar

Seguros Bolivar is an insurance company based in Colombia. It offers a wide range of insurance products, including life, health, property, and automobile insurance. Seguros Bolivar is known for its strong presence in the Colombian insurance market and its focus on providing its clients comprehensive coverage and excellent customer service.

Seguros Falabella

Seguros Falabella is an insurance company affiliated with the Falabella Group, a prominent retail conglomerate in Latin America. It offers a variety of insurance products, including automobile insurance, life insurance, health insurance, and travel insurance.

In addition, there are many providers offering EPS health insurance including:

- Nueva EPS

- EPS Suramericana (EPS SURA)

- Sanitas EPS

- Salud Total EPS

- Famisanar EPS

- Aliansalud EPS

- Compensar EPS

- Coomeva EPS

- Servicio Occidental de Salud SOS EPS

- Comfenalco Valle EPS

- Cafesalud EPS which is now called Medimás EPS

SaludVida EPS and Cruz Blanca used to provide the service but are no longer in operation. Here’s an article (in Spanish) ranking the 5th EPS providers in Colombia..

EPS Health Insurance in Colombia

EPS is the government health insurance in Colombia that is available to everyone with a cedula (local ID), Colombian citizens as well as foreigners with a visa and cedula.

The EPS health insurance in Colombia is available to everyone who is a resident, including people that are not eligible for private health insurance due to age or pre-existing conditions.

In an EPS plan, the delivery of services is through a network of public health providers/facilities. Keep in mind that the EPS plans cover everyone. So, it means longer waiting times to see doctors and receive medical care. Also, EPS plans include dental insurance.

In addition, to see a specialist, run diagnostic exams like blood tests or x-rays or to get a surgical procedure, with an EPS plan you will need a referral from your general practitioner.

Also, family members and dependents can be added to an EPS plan. These include:

In an EPS plan you will be assigned an IPS (Instituto Prestador de Salud), which is basically a health center, which will be your primary care location.

In addition, one thing to be careful with is that some of the EPS providers in Colombia aren’t in great financial shape. So, they are slow in paying medical providers leaving thousands of Colombians without health care services.

Medellin Guru Insurance Service

The insurance agency we partnered with has helped 1.893 Medellin Guru readers.

Prepagada Health Insurance in Colombia

In comparison, a prepagada health insurance plan in Colombia is private health insurance. Prepagada plans use private networks of health care facilities and medical providers. The focus of prepagada plans is to offer high-quality care in a timely manner.

The key benefits of a prepagada plan include:

Referrals

Referrals are not needed for diagnostics, specialists and procedures. You can just book an appointment.

Premium health services

You get access to the best doctors and health care providers in Colombia with preferential treatment.

Travel Insurances

Travel insurance is included for up to 90 days on each trip (is not included in an EPS plan).

Prepagada expands EPS benefits

Prepagada plans are available as a supplemental of EPS, offering an expanded availability of hospitals and specialists and shorter waiting times.

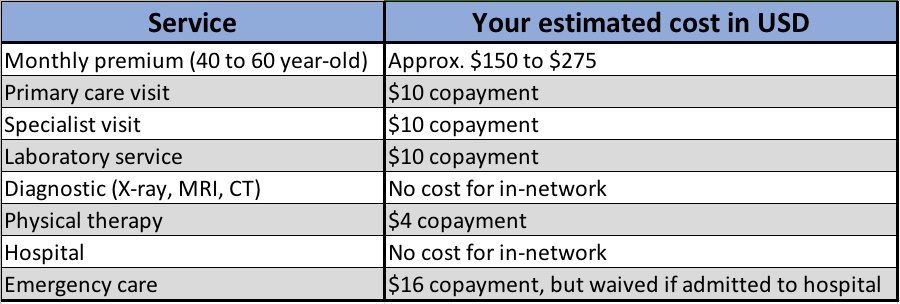

In addition, Prepagada plans have no deductible but have small copayments, as seen in the following table of costs:

EPS plans also have small copayments that are normally slightly lower than the prepagada copayments.

With a prepagada plan, you can get an appointment with a specialist within days and to get a surgery approved typically takes only 48 hours. In comparison, with an EPS plan in Colombia, it can take up to a few months to get an appointment with a specialist and it can take months to get a surgery approved.

Also, with a prepagada plan you can use out-of-network doctors and pay the difference between the standard reimbursement from the insurance plan and the doctor’s fees.

How to Sign Up for a Health Insurance in Colombia

It is possible to sign up for a health insurance yourself. But the forms are in Spanish and can be complicated and difficult for foreigners who don’t speak Spanish.

So, we recommend working with an insurance agent who is bilingual. The insurance agent we partnered with offers a service to help expats sign up for a health insurance in Colombia.

Using an Insurance Agent to Obtain Health Insurance in Colombia

Medellin Guru has partnered with an insurance agent to offer health insurance and other insurance products to foreigners and Colombians.

Features of the Medellín Guru Insurance Service

Bilingual Assistance

English & Spanish speakers

Online Quotes

Get immediate estimates

Free Consultations

Get advice on your needs

Business Partners

We recommend only verified companies

Medellin Guru partnered with an insurance agent to offer Colombian insurance services to foreigners including health insurance, auto insurance, homeowners’ insurance, travel insurance and life insurance. You can get any type of insurance in Colombia from this partnership.

Medellin Guru Insurance Service

The insurance agency we partnered with has helped 1.893 Medellin Guru readers.

Colombia Health Insurance Frequently Asked Questions (FAQ)

The following are three of the most common questions about health insurance in Colombia.

To sign up for an EPS plan in Colombia, you will need to have a visa and a cedula. and to sign up for a prepagada plan in Colombia, you need eps . So, a foreigner without a visa cannot obtain health insurance in Colombia.

After age 69, it is almost impossible to sign up for most prepagada plans. Sura now offers prepagada plans to aget 69 up from age 61., Also, Bolivar provides private health insurance for up to age 74 and must also have EPS and premiums will be higher. Also, an EPS plan will still accept you regardless of age.

Between age 60-69, there is an additional premium for a prepagada plan at SURA. So, it’s best to sign up for a prepagada plan before age 60.

Also, it is possible to get inexpensive travel insurance if you are over 75, see our article about inexpensive travel insurance.

The cost of an EPS plan is 12.5 percent of the 40 percent of monthly gross income that you declare to the EPS.

The cost of a prepagada plan is based on your age, pre-existing conditions and the specific plan you choose. And the premiums fall in age brackets: from age 0-14, 14 to 40, 40 to 60 and 60 and up.

In example, for a 60-year-old, SURA’s prepagada plan premium is approximately 800,000 pesos ($277 USD) per month.

Young kids are relatively inexpensive and the premium increases by age. In addition, the premium is increased each year by the annual inflation in Colombia.

Colombia requires health insurance when applying for Colombian visas with minimum coverage of:

- $35,000 USD for Visitor (V) visas

- $60,000 to $70,000 USD for Migrant (M) visas

- $100,000 USD for Resident (R) visas

You can use travel insurance or comprehensive health insurance plans (prepagada) or EPS insurance to meet this insurance requirement.

Travel insurance can meet the health insurance requirement for visas. Many Medellin Guru readers have asked about health insurance needed for visas.

The insurance agent we partnered offers a relatively inexpensive travel insurance policy from ASSIST CARD that meets the health insurance requirement for Colombian visas. See our article about travel insurance for details.

Medellin Guru's Colombian insurance and healthcare articles

- Get Insurance in Colombia

- Assist Card: Why is the Best Health Insurance for Colombian Visas

- Continental Assist: A vital ally to apply for a visa in Colombia

- Travel Insurance: Meets the Heath Insurance Requirement for Colombia Visas

- Auto Insurance in Colombia: A Guide to Colombian Auto Insurance

- Homeowners Insurance in Colombia: A Guide to Colombian Homeowner Insurance

- Medellin Guru Insurance Service: Providing Colombian Insurance

- Colombia has 24 of the Best Hospitals in Latin America

- Emergency Surgery: Expat Experience in Clínica León XIII in Medellín

- Healthcare Colombia: HCA Clinic Offers Services to U.S. Veterans in Colombia

The Bottom Line: Health Insurance in Colombia

In Colombia, it is possible to have access to world-class healthcare at a fraction of the cost compared to healthcare costs in North America or Europe.

Health insurance is also relatively inexpensive in Colombia in comparison to health insurance costs in the U.S. and many countries in Europe. In addition, it’s fairly easy for a foreigner to sign up for health insurance in Colombia.

Also, “How to sign up with Colombian Health insurance?” is a common question asked by expats moving to Colombia. So, we included this question in our list of Medellín frequently asked questions (FAQ).

Many Medellin Guru readers have obtained insurance in Colombia through our insurance agent partnership including health insurance, auto insurance, homeowners insurance, life insurance and travel insurance.

Medellin Guru Social media

Be part of our community. Find out about news, participate in events and enjoy the best of the city.