The Colombia economic outlook for the first semester of 2025 presents very interesting data for expats interested in bringing their foreign direct investment, exploring markets that can generate returns, and making informed decisions that will continue to position Colombia as one of the main capital spending destinations in Latin America. However, this economic outlook is not oblivious to the global economic situation, current political realities, and many other topics that we will analyze below so that you can make informed decisions with confidence.

How Was the Colombia Economic Outlook in the First Semester of 2025?

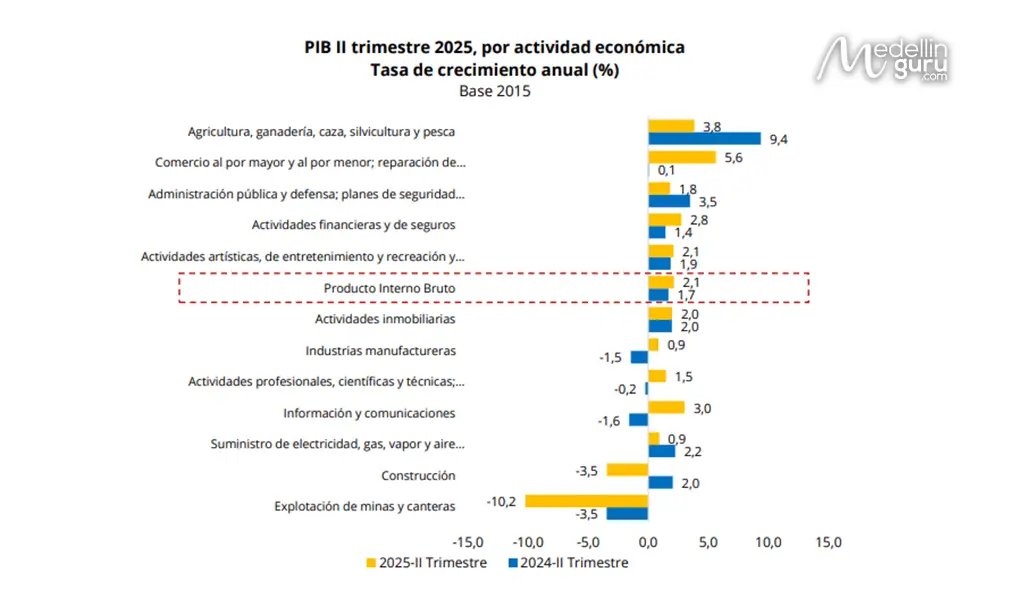

The Colombian economy showed significant recovery in the second quarter of 2025, with GDP growing by 2.1% year-on-year and 0.5% quarter-on-quarter, driven primarily by strong performance in commerce, agriculture, public services, and information and communications, according to DANE’s reports. This positive trend, with an accumulated growth of 2.4% in the first half of the year, signals a rebound after previous slowdowns, with key sectors such as wholesale and retail trade, as well as agriculture, contributing substantially to the expansion and macroeconomic stability.

Colombia’s Gross Domestic Product (GDP) increased by 2.1% in the second quarter of 2025 compared to the same period last year, driven mainly by the dynamism in commerce, agriculture, and public services, according to official figures released on Friday, August 15, in the report prepared by the National Administrative Department of Statistics (DANE), reflecting a trend of recovery for the national economy after several periods of slowdown.

The DANE report indicates that Colombia closed the first half of the year with an accumulated economic growth of 2.4% compared to the same period in 2024. The figures reveal an acceleration in productive activity, led by key sectors such as wholesale and retail trade, as well as transport and storage, accommodation, and food services. In the second quarter, these sectors experienced a 5.6% expansion, contributing 1.1 percentage points to the annual variation in GDP.

The data provided by the director of DANE, Piedad Urdinola, shows that the rebound in GDP is also attributed to the good performance of agriculture, livestock, hunting, forestry, and fishing, which grew 3.8% and represented a contribution of 0.4 percentage points. In addition, activities related to public administration, defense, education, and social services reported an advance of 1.8%, with a contribution of 0.3 percentage points to the global indicator.

When comparing the second quarter of 2025 with the first three months of the same year and after adjusting for seasonal and calendar effects, Colombia's GDP grew by 0.5%.

This quarterly result reaffirms the pace of economic recovery observed since the beginning of the year and is supported by increased activity in strategic sectors, given the performance of other productive branches with a strong impact on GDP during the second quarter of 2025, such as the information and communications segment, which registered an expansion of 2.3%. Meanwhile, the manufacturing industry grew by 1.0%, while the agricultural sector maintained an advance of 1.5% compared to the immediately preceding quarter.

The analysis highlights that during the first half of 2025, the Colombian economy was sustained by its commercial and agricultural activities. Trade, along with the repair of motor vehicles and motorcycles, achieved a 4.8% increase between January and June, contributing 1 percentage point to the year-on-year variation.

At the same time, the 5.3% growth in agriculture, livestock, and fishing added 0.5 percentage points. Artistic, entertainment, and recreation activities, along with household activities as employers and producers of goods and services for own use, increased by 11.4%, generating an impact of 0.5 percentage points on the semi-annual balance.

The DANE report emphasizes that the positive performance of the main sectors translates into greater value-added generation and contributes to maintaining macroeconomic stability. According to the report, the combined effect of these activities contrasts with recent periods, in which indicators had shown signs of stagnation.

What Experts Think About Colombian Economy Growth?

Opinions regarding Colombia’s economic growth are varied and are based on diverse points of view, all of which are considered in relation to the country’s economic performance and foreign direct investment, so that there are not only perceptions but also solutions and proposals that continue to consolidate Colombia as one of the most recommended countries for investing in various economic sectors.

International Monetary Fund:

A team from the International Monetary Fund (IMF) technical staff concluded its visit to Bogotá in early August after a series of constructive conversations with Colombian authorities regarding recent economic developments, outlook, risks, and policy priorities. This visit follows up on those conducted earlier in the year and the ongoing dialogue between the entity and the authorities.

The Colombian economy is navigating a complex landscape, characterized by both progress and growing challenges. Although growth has strengthened and inflation has decreased, fiscal challenges persist, and private investment remains contained. Adverse external factors also cloud the outlook.

The IMF staff team reports that Colombia’s economy is showing signs of growth, with a 1.7% rise in 2024 and an impressive 2.7% increase in the first quarter of 2025. This growth has been fueled primarily by robust private consumption, a healthy labor market, and a thriving services sector. In June, inflation eased to 4.8%, while the current account deficit improved to 1.7% of GDP in 2024, thanks in part to strong remittances.

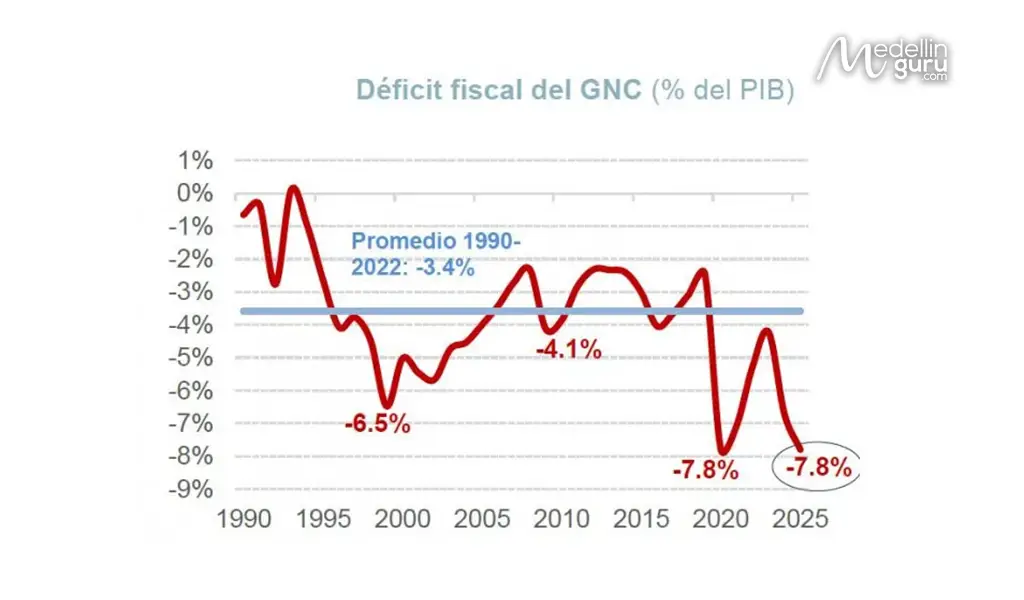

The financial system remains stable, with adequate international reserves. However, it’s worth noting that the central government’s fiscal deficit has increased to 6.7% of GDP in 2024, contributing to a rise in gross public debt to 61.2% of GDP. Looking forward, the draft budget for 2026 aims for a slightly reduced deficit of 6.2%.

For 2025, real GDP growth is projected to stabilize around 2.5%, with inflation expected to reach 3% by early 2027. Nevertheless, the current account deficit is anticipated to widen to approximately 2.5% of GDP in 2025, while the fiscal deficit may rise to 7.1% of GDP. Several risks threaten this positive outlook, including global uncertainties, geopolitical tensions, stricter immigration policies, and potential challenges in implementing domestic policies.

What Does It Mean That Colombia Has a Projected Fiscal Deficit Above 7% of GDP for 2025?

A fiscal deficit is a situation in which the State spends more money than it receives through taxes, natural resources, or loans, and presenting a deficit of 7% of GDP in Colombia for 2025 means that the government will spend significantly more than it collects in revenue, a situation that could be historic and represents a risk to fiscal sustainability, public investment, social programs, and could lead to a downgrade in the country’s credit rating, in addition to a potential concern for international markets.

Thus, the fiscal balance for the first half of 2025 is atypically high. The Autonomous Committee on the Fiscal Rule (CARF) reports a deficit close to 3.7% of GDP and warns that revenue fell short of the target, while figures from the Ministry of Finance show a wide gap between income (approximately 8.7% of GDP) and expenditure (approximately 12.5% of GDP). This dynamic confirms that the deterioration is not isolated but persistent, and it is concentrated in the insufficiency of income compared to unyielding expenditure.

In this way, the adjustment the Government must make should be credible, gradual, and verifiable, focusing on stabilizing debt and rebuilding the primary balance without hindering growth. This becomes the biggest challenge for the Government in the coming months and, almost as a first major conclusion, demonstrates that the current government and its decisions influence a large part of the country's economic performance in this regard.

The Colombian-American Chamber of Commerce AMCHAM

The Colombian-American Chamber of Commerce, AmCham Colombia, promotes trade, investment, and business between Colombia and the United States. It offers member companies opportunities to boost their businesses, reach new markets, and strengthen themselves through privileged access to information and analysis on relevant topics. Regarding the Q2 2025 GDP data released by DANE, the president of the Colombian-American Chamber, María Claudia Lacouture, commented:

"GDP is growing and reflects a dynamic domestic market, but without solid medium and long-term foundations, the momentum will not be sustainable. The second quarter confirms Colombia's resilience, with trade, transport, and tourism leading the growth. However, this pattern relies on fragile bases: consumption drives activity, but it does not, by itself, build the necessary foundations to sustain growth over time. Investment — in infrastructure, innovation, human capital, and industry — is key to strengthening productivity, diversifying exports, and consolidating sectors such as industry and construction. Only then can balanced growth be guaranteed, resilient to global volatility, and generate sustainable well-being for Colombians."

Other Declarations

From the Colombian Center for Economic Studies (ANIF), led by its president, José Ignacio López, and the group of researchers from said entity, they indicated that given this increase compared to last year, something key for us stands out: a lot of consumption, little investment, making the following clear:

"Investment shows mixed trends: machinery and equipment, which represent 47.5% of Gross Fixed Capital Formation (GFCF), grew by 11.6%, while investment in housing contracted by 10.6% and in other buildings and structures fell by 1.2%. This composition indicates that, although companies are investing in equipment, weakness persists in the real estate and infrastructure sectors.

Regarding supply, the 9.6% growth in road construction and civil works did not offset the 9.7% decline in residential and non-residential buildings, resulting in a 3.5% decrease in overall construction activity. The results of the second quarter of 2025 indicate an economic rebalancing where private and public consumption partly compensate for weak investment. For more robust growth, the recovery in consumption must be complemented by sustained investment."

Similarly, Daniel Velandia, chief economist at Credicorp, reaffirmed what ANIF mentioned, emphasizing that investment is key for the country’s growth:

"The economy maintains a recovery pace. This is reflected in the seasonally adjusted figures; when these items are observed, the economy experienced a real increase of 2.5%, accelerating compared to the results in the first quarter. However, investment does not show a solid recovery. Although it grew by 6%, this is due to inventory accumulation. In the case of productive investment, the increase was 1.7%, and therein lies the challenge, as investment is key to growth."

With these statements, we enter another crucial facet of the colombia economic outlook, as investment, represented by foreign direct investment (FDI), encompasses statistics and sectors that are more consolidated than others. After understanding this general panorama of the country, they will become your most reliable source when deciding where to invest your money in Colombia and make you a protagonist in the country’s economic future, as has been clearly evidenced by expert voices on the subject and the statistics presented.

Take the First Step and Invest in Colombia

Our reliable partner expatgroup.co offers a wide range of services for Foreign Investors:

How Colombia’s Economic Indicators and Market Performance Benefit FDI?

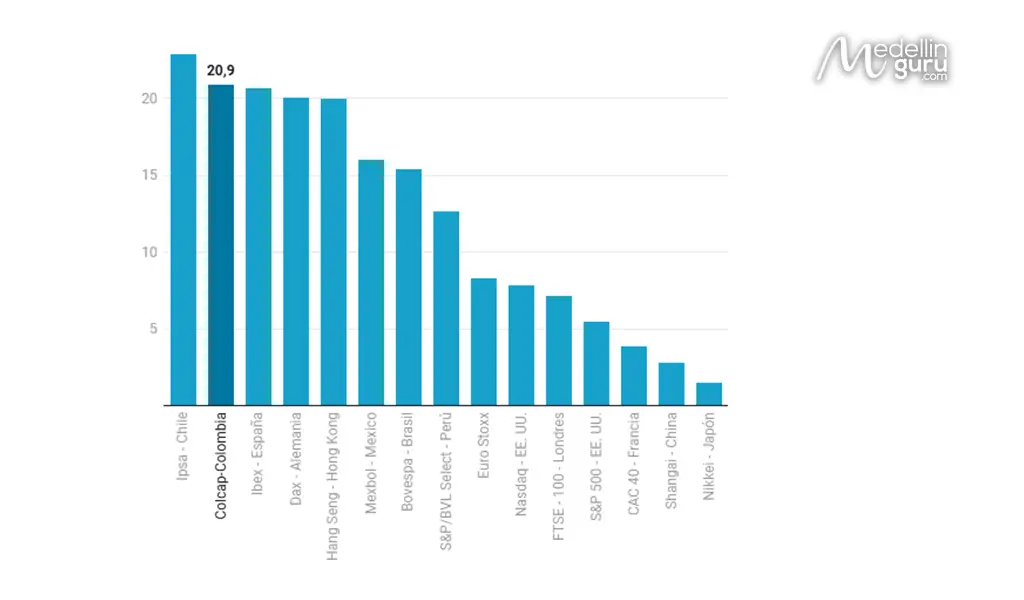

Foreign investment manifests itself in various ways in Colombia, with the notable performance of the Colombian Stock Exchange in the first half of 2025 standing out, positioning it among the most profitable globally. This achievement consolidates the Colombian capital market as one of the most dynamic in the region, driven by significant growth in traded volumes in both local equities (64%) and the Colombian Global Market (113%), according to reports. These advances reinforce Colombia’s position as a relevant player in the regional landscape, with a constantly evolving market that fundamentally contributes to the country’s economic development and the deepening of its financial system, as we will see below:

The Colombian Stock Exchange (BVC) as a Global Highlight

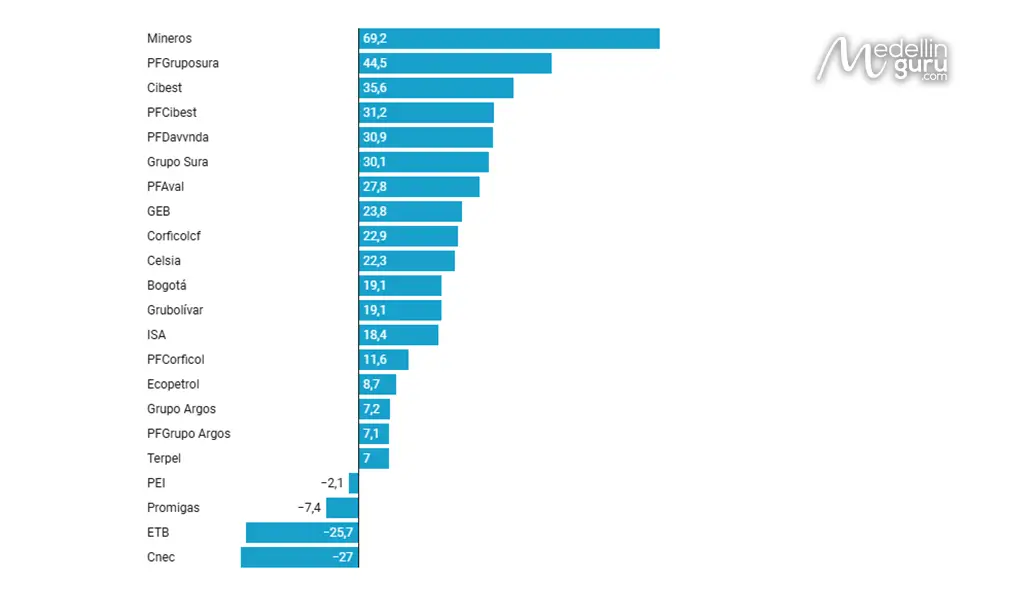

The Colombian Stock Exchange (BVC) is ranked among the most profitable stock exchanges globally, while several of its indicators showed a remarkable recovery in the first half of the year, according to information revealed by the entity’s directors. They reported that its leading indicator, the MSCI Colcap, accumulated a price return of 20.9 percent and a ‘dividend yield’ —the dividend profitability received by shareholders — of 7.4 percent, surpassing several of its peers in Latin America and emerging markets.

The balance presented by the entity indicates that the Equity, Fixed Income, and Derivatives markets registered growth of 64%, 39%, and 7%, respectively, compared to the first half of 2024.

In terms of traded volumes, the country's stock market reported that the daily average reached 127,833 million pesos, which allowed the total amount traded in the first six months to exceed 15.3 trillion pesos.

Regarding the performance of the Colombian Global Market (MGC), the daily average trading grew 113 percent in the same period to close to 14 billion pesos and totaled 1.7 trillion in the first half of 2025. The stock exchange also indicated that funding operations grew by 30%, reflecting greater dynamism in financing strategies through equity securities, a behavior that helps reaffirm the strengthening of the Colombian stock market and its ability to attract local and international investors.

The balance of the stock market also highlights the dynamism of digital platforms, through which a greater number of natural persons are gaining access to the market. During the first six months of the year, so-called e-trading grew by 77%, while accounts with balances in the deposits of these individuals increased at a rate of 5.2% and totaled 1,050,990 accounts, of which 552,639 are active.

What are the Most Traded Stocks on the Colombian Stock Exchange?

According to the BVC, among the most traded shares in the local market were Grupo Cibest, which is made up of Bancolombia’s banking business, its financial and service companies such as Nequi, Wompi, Renting Colombia, and Wenia, and the international banks Banistmo (Panama), BAM (Guatemala), and Bancoagrícola (El Salvador) preferred shares, with an average daily trading volume of 31,267 million pesos, followed by Ecopetrol (27,518 million), Grupo Cibest ordinary (10,514 million), Grupo Sura preferred (8,123 million), and ISA (6,996 million).

The growth in trading was driven by different types of investors, with a notable increase in participation for stockbrokerage firms in their own position (+140 percent), AFPs (+70 percent), foreign investors (+44 percent), and natural persons (+60 percent).

The entity states that these increases demonstrate a transversal strengthening of the stock market, in which institutional and retail investors, national and foreign, converge. Together, these results reaffirm the solidity of the Colombian equity market, which combines attractive valuations, growing liquidity, sectoral diversification, and increasingly broad access thanks to the use of digital platforms.

The solid results of the Colombian Stock Exchange (BVC) in the first half of 2025, positioning it among the most profitable globally with an impressive price return of 20.9% on its MSCI Colcap index and a dividend yield of 7.4%, demonstrate the growing strength and attractiveness of the Colombian market for foreign investment. This dynamism, driven by a 64% increase in the trading volume of local equities and 113% in the Colombian Global Market (MGC), along with the growth of e-trading and an increase in active accounts, creates a robust and accessible financial ecosystem for investors of all types.

However, for foreign investors seeking to capitalize on Colombia’s promising economic landscape and diversify their portfolios beyond the stock market, the real estate sector offers an unparalleled opportunity. While the BVC exhibits impressive liquidity and growth, the real estate market provides a tangible investment, often with lower volatility and long-term appreciation potential, especially in a country with a recovering economy and growing demand for housing and commercial spaces.

Considering GDP growth projections and experts’ emphasis on the need to complement consumption with sustained investment, the real estate sector aligns perfectly with a balanced investment strategy. If you are a foreign investor looking to maximize your return and secure your capital in a vibrant and promising market, Real Estate by expatgroup is your strategic ally.

With the stability offered by the BVC and the tangible opportunities of the real estate market, Colombia is the ideal destination for your next investment, where Real Estate by Expatgroup is the bridge to the success of your real estate investments in Colombia.

Medellin Guru Real Estate Service

Our reliable partner, a leading real estate company, offers a wide range of services:

- Transfer funds to Colombia

- Legal analysis property background checks

- Sales agreement

- Deed registration

- Legal representation

- Investment visa

GET 40% OFF IN REAL ESTATE SERVICES

The expatgroup.co anniversary offer is now open! Our partner, expatgroup.co, is offering high-quality Real Estate services with incredible limited-time offers. Invest in Colombia today!

*Offer available until January 30th.

*Apply terms and conditions.

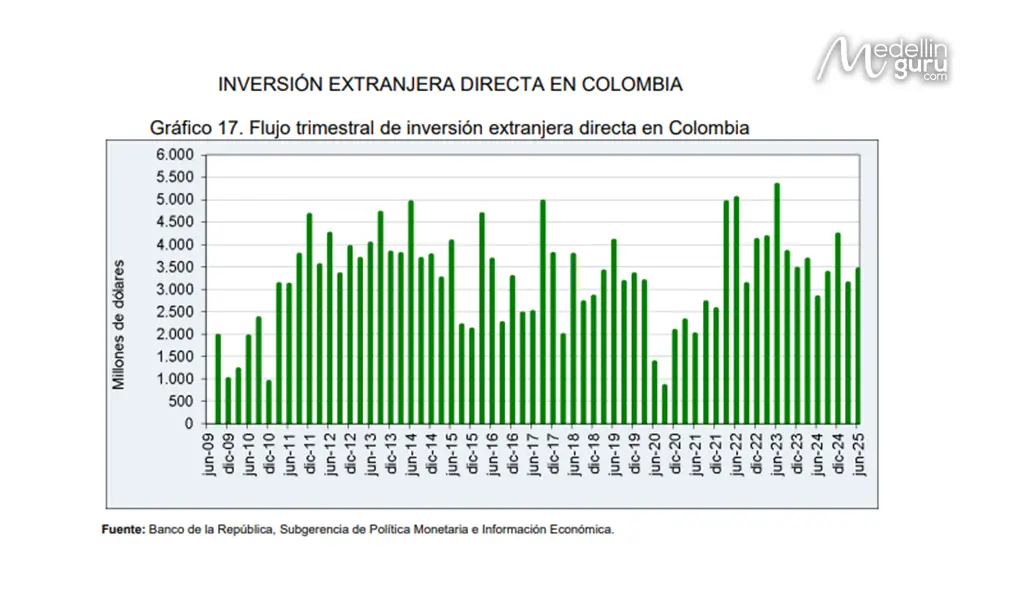

How is the Foreign Direct Investment in the Colombia Economic Outlook?

Colombia received Foreign Direct Investment (FDI) flows totaling USD 3,443.8 million during the second quarter of 2025, according to provisional balance of payments figures published by the Banco de la República, where this amount represents a year-on-year growth of 22%, consolidating a sign of recovery in the confidence of international investors. The figure is also 9.8% higher than the USD 3,135 million recorded in the first quarter of the same year, suggesting an acceleration in the arrival of long-term capital to the country, despite the bittersweet outlook, where investors from other countries entrusted less capital to the country, resulting in a 15% decline in that money flow between 2023 and 2024.

Considering this entire landscape, Colombia is objectively safe for foreign investors, even in the face of external factors that have not only affected this behavior in Colombia but also in its South American counterparts.

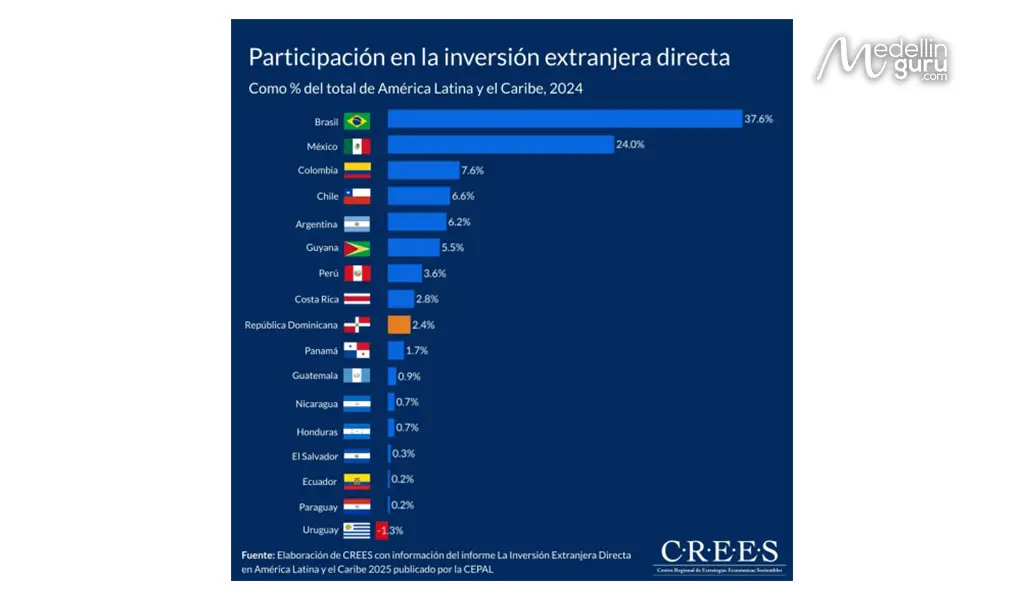

This outlook is observed in one of the latest reports from the Economic Commission for Latin America and the Caribbean (CEPAL): Foreign Direct Investment in Latin America and the Caribbean 2025. According to this document, the country received 14.269 billion dollars in FDI, a figure that kept it as the second recipient of foreign capital in Latin America and the Caribbean, after Brazil and Mexico. Thus, it seems like a good balance, and upon reviewing the figures in greater detail, despite the challenges, the country demonstrates resilience and potential for recovery in investment.

A heterogeneous performance across economic sectors, marked by a revitalization in non-mining-energy items and a plummeting in mining investment, suggests a shift in Foreign Direct Investment (FDI) composition towards domestic demand and services, away from traditional extractive industries. This trend is significant for Colombia’s economic landscape, as FDI consistently constituted an average of 4% of its GDP between 2021 and 2024, a regional high surpassed only by Chile’s 5.1%, underscoring its fundamental role in the country’s economic growth.

What Are The Best Foreign Direct Investments (FDI) in Colombia during 2025?

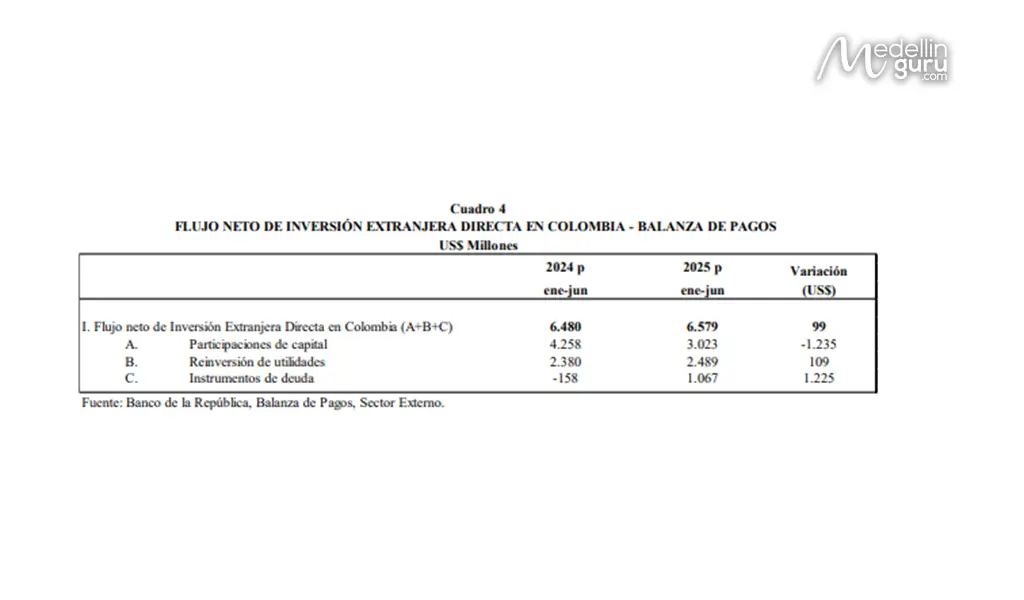

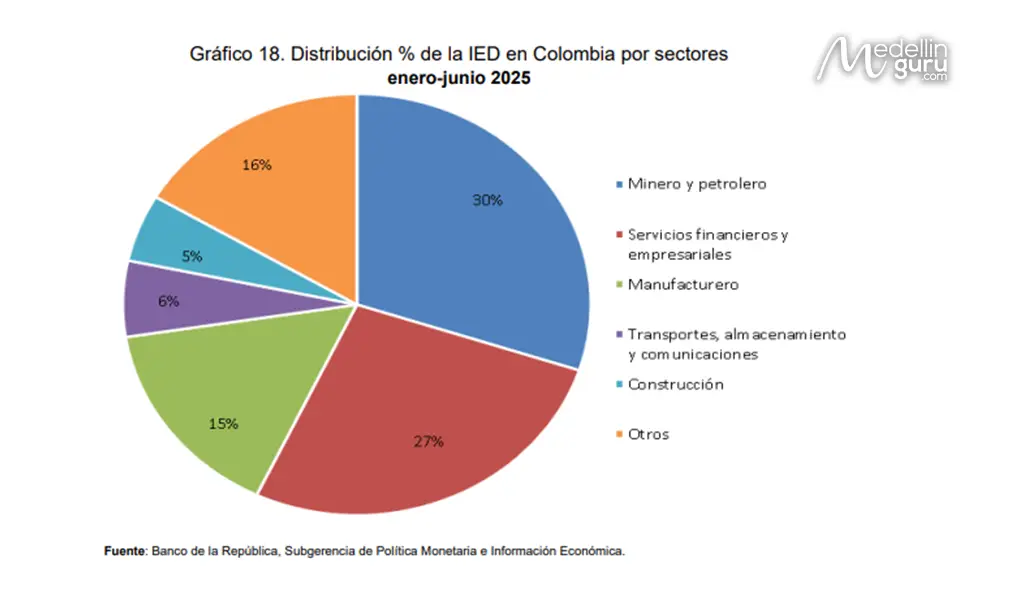

During the first half of 2025, US$6,579 million (3.1% of semi-annual GDP) was received in FDI, an amount US$99 million (1.5%) higher than that received a year earlier. Its distribution by economic activity was as follows: mining and oil (30%), financial and business services (27%), manufacturing industry (15%), transport and communications (6%), electricity (4%), and the remaining sectors (18%). By type of capital contribution, it is estimated that of the total income received from FDI in the analysis period, US$3,023 million corresponds to equity participations, US$2,489 million to reinvestment of profits, and US$1,067 million to net disbursements for debts between companies with direct investment relationships.

The main driver of FDI recovery in the second quarter was the “Financial and Business Services” sector. This category attracted USD 967.5 million, more than double the USD 464 million captured in the same period of 2024. This robust increase, exceeding 108%, positions services as the leading destination for foreign capital in the quarter and suggests renewed optimism about the stability of the financial system and the business environment in Colombia.

A second key factor was the drastic change in the “Transport, storage, and communications” sector. This transitioned from a net disinvestment of USD 272.3 million in the second quarter of 2024 to a positive flow of USD 154.7 million in 2025. A negative flow, according to the methodology of the Banco de la República, occurs when outflows, such as the cancellation of investments or the payment of loans to parent companies, exceed inflows. The reversal of this trend indicates the finalization of capital repatriation processes and the possible implementation of new infrastructure and logistics projects.

Other sectors that contributed positively were "Trade, restaurants and hotels," which grew by 48% from USD 271.4 million to USD 402.8 million, and "Manufacturing industries," which increased by 8% to USD 730.4 million.

The positive performance of total FDI occurred despite a drastic contraction in the “Mining and Quarrying (includes coal)” sector. Investment in this category plummeted by 79.4%, decreasing from USD 394.8 million in the second quarter of 2024 to just USD 81.4 million in the same period of 2025. This sharp decline could be related to regulatory uncertainty, international prices of certain minerals, or a strategic reorientation of large global mining companies.

Meanwhile, the “Oil sector,” although remaining one of the main recipients of capital, showed more moderate growth. Investment in this sector increased by 19.3%, from USD 630.1 million in the second quarter of 2024 to USD 751.8 million in the second quarter of 2025. While the figure is positive, its relative weight in total growth was smaller compared to the dynamism observed in the services and transport sectors, which reinforces the idea of diversification in investment sources.

Having this context of foreign direct investment in the colombia economic outlook, we can mention the most prominent sectors for all expats interested in investing in the country:

Mining and Oil

Despite a drop in Foreign Direct Investment (FDI) for the mining and oil sector during the first half of 2025, it continued to be the main recipient of foreign capital in Colombia. This trend reflects a gradual diversification of foreign investment towards other sectors, although oil and mining remain fundamental to the Colombian economy and an attractive sector for international investors.

Particularly, the CEPAL has placed FDI in the region at the center of its most recent report, focusing particularly on mining and the potential of critical minerals, as this issue transcends the economic sphere because it has become a priority for government public policies, given its strategic relevance towards 2050.

In the global context, critical minerals—such as lithium, copper, and nickel—are considered essential for the energy transition and clean technologies. Latin America and the Caribbean hold a significant portion of these reserves, positioning the region as a key player in global supply chains for renewable energy and electric mobility.

Within the CEPAL report, it is highlighted that FDI trends in the mining sector are marked by announcements of new projects, variable investment dynamics, and the emergence of national strategies for attracting foreign capital.

Financial and Business Services

It was the second sector with the highest investment reception, capturing 27% of the total in the first semester, highlighting investor confidence in the growth potential and the soundness of the Colombian financial and business market. Within this dynamic sector, several areas are emerging as the most profitable for investment, driven by an expanding economic environment and the growing demand for specialized services:

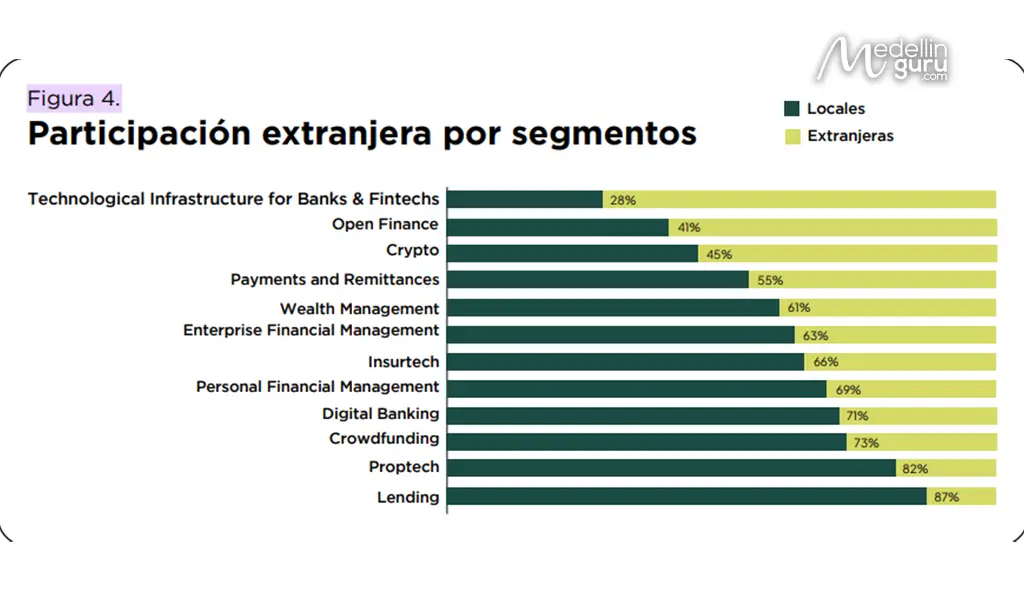

In 2025, Colombia remains an attractive market for foreign investment in the fintech sector, with 39% of fintech solutions in the country originating from abroad and 268 foreign companies operating within the ecosystem as of July 2025. Investment in this sector has shown dynamism, with a total of 678 fintech companies, and revenue growth for these companies is projected to exceed $3.5 billion by 2025. The main countries of origin for these foreign fintech companies are Mexico, Chile, and the United States.

Likewise, Colombia is consolidating its position as the leading destination for insurtech in Latin America, standing out for its openness to foreign capital, its mature digital environment, and the growing interest in technological solutions applied to the insurance sector, as the main protagonist within insurtech financing in Latin America, which surged by 370% in the first half of 2025 compared to the same period in 2024, reaching US$121 million, surpassing the total investment of the entire previous year by 32%.

This is revealed in the report “Latam Insurtech Journey 2025,” prepared by Digital Insurance Latam with the sponsorship of MAPFRE. With 66% of insurtechs in Colombia being of foreign origin, the country widely surpasses other economies in the region, such as Peru (53%) and Mexico (42%), positioning itself as the most attractive market for international insurance startups.

This progress has also been accompanied by greater diversification of business models. Solutions focused on Life & Care (life insurance, health and well-being) and mobility are those that have captured the most attention from investors, accumulating 65% and 33% of the financing, respectively.

Manufacturing Sector

Colombia’s manufacturing sector has also been a key player in foreign direct investment in 2025, undergoing strategic diversification. Notably, the aeronautics, automotive, and construction materials industries, as well as food and beverage production, and other specialized industries involved in the production of consumer and intermediate goods, demonstrate that the manufacturing industry is a significant destination for foreign capital.

In addition to these highlighted areas, the manufacturing sector in general underwent modernization and technological advancements. The adoption of Industry 4.0 technologies, such as artificial intelligence, the “internet of things”, and robotics, allowed Colombian companies to optimize their production processes, increase efficiency, and improve the quality of their products. This not only attracted more investment but also strengthened the country’s export capacity and its integration into global value chains.

Transportation and Communications Sector

The transportation and communications sector emerged as a fundamental driver for Colombia’s economic growth. Within this, the communications sector experienced an unprecedented boom, driven by a wave of significant investments. Projects estimated at 2.5 million dollars were announced, marking a milestone in the expansion of the country’s digital infrastructure.

These investments were primarily concentrated in the development of data processing centers (DPC) and digital hosting services. The growing demand for cloud solutions, the increase in e-commerce, and the need for greater data storage and processing capacity by businesses and users were key factors driving this growth.

It’s important to highlight that e-commerce in Colombia grew 3% in the second quarter of 2025 and reached sales of $26.9 billion, according to the latest report from the Colombian Chamber of Electronic Commerce (CCCE), where the strongest sales categories were technology: 19.9%, other retail: 17.9%, and entertainment: 13.4%. In terms of growth, the biggest surprises were in other retail: +112.6%, entertainment: +38.8%, and tourism: +19.6%.

Non-mining goods exports

These closed the first half with a growth rate of 21.7% and accounted for 52.7% of total global sales. The country sold US$12,857.6 million in these types of products (agricultural, agro-industrial, and industrial), representing a 21.7% increase compared to the same period in 2024. This value also represented more than half, 52.7%, of everything Colombia sold to the world in those six months.

Within the non-mining basket, the agricultural sector’s exports had the largest weight during the analysis period, representing 43.7% (US$5,615.9 million) and growing by 36%. Products such as coffee, whose exports rose 81.3% in the first six months; flowers, 9.9%; bananas, 6.2%; Hass avocados, 27.6%; Tahiti limes, 15.7%; and gulupa, 23.3%, among others, stand out in this group.

The second most representative product group of non-mining goods exports during the period was industry, which accounted for 40.8% (US$5,252 million) of this basket, representing a 5% growth. In this sector, exports of aluminum doors, windows, and their frames stood out, among others, with an increase of 9.5%; insecticides, 18.8%; electrical transformers, 12.9%; medicines, 9.3% and beauty preparations, 3.7%.

Likewise, 90.4% of non-mining energy product exports originated from 9 regions: Antioquia, which grew by 25.9%; Bogotá, which increased by 16.5%; Cundinamarca, 16.5%; Valle del Cauca, 14.8%; Atlántico, 6.6%; Bolívar, 9%; Caldas, 47.3%; Magdalena, 45%; and Huila, 50%.

What Are The Best Investment Opportunities by Region In Colombia?

When considering safer investments within Colombia economic outlook, looking beyond national averages and identifying specific regional opportunities that offer stability and growth potential is crucial. Several factors contribute to a region’s attractiveness for investment, including robust local industries, governmental support for economic development, a skilled workforce, and well-developed infrastructure, and these are some of the key items that surround foreign direct investment in cities such as Medellín, Bogotá, Boyacá, and Cali, to name a few, as you’ll see next:

Medellín, The Top Spot for Foreign Direct Investment

Medellín is experiencing a good moment in terms of foreign capital arrival. The Agency for Cooperation and Investment of Medellín and the Metropolitan Area (ACI) managed 18 projects totaling 168.11 million dollars and will generate more than 8,100 jobs in the city. What is revealing is that this result is 378% larger than that reported in the same period last year, when the Antioquian capital captured 35.16 million dollars through seven investment projects. The ACI’s projection is to move some 400 million dollars this year, representing a much juicier figure than the 150.58 million moved in 2024.

In 2025, the United States has been the main source of investment, with six of the new projects. Initiatives from Puerto Rico, the United Kingdom, New Zealand, Brazil, France, and China also stand out. Historically, 28% of FDI in Medellín comes from the United States, followed by Spain (8%), Chile (8%), France (6%), and Mexico (6%).

The technology services sector continues to be the largest recipient of investment, with 10 of the 18 projects in 2025 and 135 historical projects, representing 35% of the total, along with other key sectors such as commerce, creative industries, agribusiness, energy, infrastructure, and manufacturing.

This year, reinvestments from TaskUs, Accenture, and Poma are notable, as well as the arrival of new companies like Abatech, Indie Company, Iqor, Recurly, and Health Prime. Historical investments include giants such as Pepsico, Globant, Sofasa-Renault, Mercado Libre, and Marriott.

Bogotá, Digital Economy Epicenter in 2025

Bogota continues to strengthen its position as a technology and innovation hub in Latin America. This is revealed by the results of the event “Bogotá: technology and innovation hub”, organized by Invest in Bogotá and Michael Page. There, the findings of the sectoral study “TI Talent 2025. Investment, innovation and productivity” were released, which confirm that the city concentrates 60 percent of foreign direct investment projects in software and information technologies (IT) that have arrived in the country in the last six years, where the most important findings of said report were:

- Bogotá is in the top 3 cities with the most FDI projects in software and services in LATAM.

- It is the Latin American city with the most jobs generated associated with investment projects.

- National leader in business sophistication, innovation, and competitiveness (CPC 2024).

- It is the 5th most important talent source in LATAM and contributes: 39% of graduates in systems engineering and related fields (2019 – 2023), 34% of graduates in STEM careers nationwide, 3 of the 15 best universities in LATAM are in Bogotá (QS Ranking 2025) and 41% of graduates with B1-B2 English level (Saber Pro 2023)

- Bogotá was responsible for 74% of national service exports in 2024.

- According to ICT, 78% of the country's exports come from Bogotá.

- Business services (consulting, call centers, advertising) generated USD 2,388 for the same year.

Cali, Leader in Environmental Sustainability in 2025

Cali is emerging as an ideal destination for foreign direct investment, with Invest Pacific facilitating 32 projects that have attracted USD$164 million and created 3,854 jobs as of the first five months of this year. Notably, 18 of these projects have settled in Cali, contributing USD 121.8 million and creating 3,180 formal jobs. Additionally, Valle del Cauca’s ranking as the third most competitive department in Colombia further highlights its investment potential.

The projects supported by Invest Pacific this year are new investments (two) and reinvestments (nine) from companies from the United States, Mexico, Chile, Costa Rica, France, Germany, the United Kingdom, and South Korea, with a presence in the IT & software, BPO, personal care, logistics, health, manufacturing, trade, agro-inputs, and food and beverage sectors, several of them with a high impact on decarbonization.

Highlighted is the reinvestment by Fleischmann Colombia, a UK-based leader in the food sector, which has strengthened its commitment to sustainability in Valle by inaugurating its new effluent treatment plant in Palmira. From there, it reuses water in production processes, reducing the pollutant load by 92%, and also transforms waste into green fertilizers for soil regeneration and aquifer care. Also noteworthy is the renowned German company Bayer, which confirmed its new iHub La Tupia Research Center, located in Pradera, which will incentivize the development of regenerative agriculture, making it more efficient and sustainable, with less use of fertilizers.

Among the new projects in Cali for 2025 are: Intelicolab, a Costa Rican company that landed in Cali and attracted local talent for its IT & Software operations; and NovePharma – Hermosa, a South Korean company dedicated to cosmetics and personal care that also confirmed its first investment in Cali.

Boyacá, One of The Most Promising Places for Foreign Investment

Boyacá officially presented the Boyacá 2050 Master Plan, a comprehensive 25-year strategy that projects the economic, social, and environmental development of the department, with a projection to Casanare. The initiative seeks to triple regional GDP, attract foreign investment, generate quality employment, retain young talent, and ensure sustainable growth based on innovation and business transformation.

The plan, developed with the firm KPMG, is based on building a shared vision among entrepreneurs, government, academia, and civil society, in order to position Boyacá as the railway heart of Colombia and a national logistics platform. Casanare is integrated as a strategic partner, expanding the region’s productive, energy, and infrastructure capabilities.

The 2050 Master Plan is structured around four strategic pillars:

- Connectivity: Railway reactivation and digital coverage.

- Employment and well-being: Generation of quality employment and promotion of human development.

- Environmental sustainability: Preservation of the páramos, which represent almost a quarter of those existing in Colombia.

- Happiness and quality of life: Strengthening of social capital and community cohesion.

To guarantee the execution of the plan, principles such as strengthening public-private partnerships, integrating the diaspora as a source of investment and knowledge, and structuring profitable, sustainable, and market-oriented projects are proposed, with a view to sustainable and competitive development in the long term, which makes Boyacá a key and solid place for foreign direct investment that impacts the Colombia Economic Outlook.

Caribbean Region, an attractive region for investment

The Colombian Caribbean region combines advantages that make it attractive for investment, according to Juliana Méndez Aguilera, executive director of Pro Santa Marta Vital, for whom strategic sectors include tourism, with potential in sun and beach, ecotourism, cultural, wellness, and nautical destinations, where cities like Cartagena, Santa Marta, and San Andrés lead this sector with opportunities in hospitality, infrastructure, and service training.

While in renewable energies, in La Guajira, wind and solar projects with high potential are being developed. There are opportunities in generation, storage, and productive linkages; logistics and foreign trade, with key ports in Cartagena, Barranquilla, and Santa Marta; while opportunities open up in logistics platforms, free trade zones, and intermodal transport.

“To this we add agribusiness, with products such as bananas, palm oil, cocoa, coffee, and avocado. Transformation with added value and export are areas with great possibilities; global services (BPO/ITO/KPO), a sector in which Barranquilla, Cartagena, and Santa Marta attract call centers, software development, and back-office operations due to their human talent and free trade zones; light industry and manufacturing, in categories such as food, cosmetics, and construction materials, with logistical advantages and access to raw materials.”

Juliana Méndez Aguilera

In addition to the above, the so-called blue economy (sustainable fishing, aquaculture, and coastal tourism, with opportunities in fishing value chains and sustainable projects in marine areas); construction and infrastructure, key for investment in housing, health, education, tourism, and mobility, supported by public-private partnerships and regional plans; technology and innovation (emerging ecosystems in startups, EdTech, and AgTech with institutional support and acceleration programs), and health and wellness, where medical tourism, wellness, aesthetic medicine, and specialized clinical services stand out due to competitive costs and trained talent.

Thus, between January and July 2025, ProBarranquilla has supported the materialization of nine investment projects for more than US$312 million, generating 3,437 formal jobs. 78% of these investments are of foreign origin and 75% are export-oriented, ratifying the city’s role as a platform for accessing international markets. Cases such as the expansion of Coca-Cola Femsa, the arrival of TaskUs as a new player in digital services, or the development of Enel’s Guayepo III solar park, demonstrate the diversity and potential of strategic sectors such as energy, industry, agro-industry, and BPO services, making the Caribbean region a strategic point for foreign direct investment in Colombia.

When considering foreign direct investment (FDI) in Colombia, cities like Medellín, Bogotá, Boyacá, Cali or Caribbean Region offer key items that attract foreign direct investment, including robust local industries, governmental support, a skilled workforce, and well-developed infrastructure. However, to ensure you invest correctly and receive the best advice, you can seek professional guidance in investments through our reliable partner, expatgroup.co, which specializes in assisting with foreign direct investments and obtaining the Colombia Investment Visa with the best assistance and the correct guidance.

Medellin Guru Business Creation Service

- Statutes and shareholding composition

- Initial accountant documents (Opening balance and financial statements)

- NIT and business RUT

- Company registration in the Chamber of Commerce

- Capital injection and money legalization

- Business visa

What are the Main Challenges Facing the Colombia Economy Outlook?

The Colombian economy, while showing resilience and potential, faces several significant challenges that could impact its growth trajectory and investor confidence. Understanding these hurdles is crucial for a comprehensive economic outlook.

Security Issues and Internal Conflicts

Colombia has a long history of internal conflicts and security challenges, which continue to pose a risk to economic stability. While significant progress has been made in peace processes, residual groups and organized crime still operate in certain regions. These security issues can deter foreign investment, disrupt supply chains, and reduce productivity in affected areas. Furthermore, the allocation of government resources to address these issues can divert funds from other crucial areas like infrastructure development or social programs. Regions with high crime rates such as Cauca and Amazonas, with the presence of illegal armed groups or social conflicts, such as the transportation sector in some areas, may present greater security risks for investments.

Colombia Travel Advisory & Warnings: Places to Avoid in 2025

For expatriates and travelers, staying informed about Colombia travel warnings is crucial. The U.S. Embassy has issued updated travel advisory guidance for Colombia. This vital report identifies specific "red" and...

Read MoreSociopolitical Events Impacting Investor Confidence

The political landscape in Colombia is dynamic and even more nowadays, with the current President Gustavo Petro, where sociopolitical events can significantly influence investor sentiment. Changes in government policies, social unrest, or even the rhetoric of political leaders can create uncertainty for both domestic and international investors. For instance, debates surrounding tax reforms, land redistribution, or environmental regulations can lead to a wait-and-see approach, slowing down investment decisions and potentially leading to capital flight.

International Landscape

The rector of EIA University, José Manuel Restrepo (Colombian economist and politician, who served as Minister of Finance and Public Credit of Colombia), explained that the decline in foreign investment in Colombia cannot be analyzed in isolation, but within a complex international scenario. As he pointed out, there is deep global uncertainty affecting most countries, marked by economic slowdown, institutional instability, and tensions derived from new tariff measures that have impacted international trade. This is due to the trade war that the United States declared against several countries, especially those with which it had differences in customs duties.

For his part, César Pabón, director of Economic Research at Corficolombiana, agrees with the reading that the fall in investment is generalized in Latin America. CEPAL data show that the most significant contraction occurred in Argentina, where that flow plummeted 53% from 11,644 million dollars to 14,269 million between 2023, and where the largest drop was in Uruguay with 54.3%.

Foreign Investment Could Be Most Sensitive to Decertification from the U.S.

The Colombian government seeks to maintain its certification from the United States in the fight against drugs, a mechanism implemented to evaluate the cooperation of drug-producing or transit countries in the eradication of illicit crops and the fight against drug trafficking. But the figures for cultivation, production, and trafficking leave Colombia in a scenario where it could stop receiving significant assistance in the fight against drug trafficking and give the country a bad reputation for future foreign investments: decertification.

The certification process in the fight against drug trafficking by the United States originated with the Foreign Assistance Act of 1961, amended by the Anti-Drug Abuse Acts of 1986 and 1988. According to these regulations, the President of the U.S. must annually inform Congress about the efforts of countries involved in drug treatment and determine if they remain effective allies in the fight, in accordance with DEA reports between 1986 and 1990.

When a country is decertified, it is considered to be failing to meet its commitments in the fight against drug trafficking. As a consequence, restrictions are imposed:

- Suspension of up to 50% of foreign assistance granted by the U.S.

- U.S. opposition to loans from international organizations such as the International Monetary Fund (IMF).

- Suspension of most forms of foreign assistance, with exceptions for humanitarian aid and anti-narcotics programs, according to DEA guidelines.

The certification process is coordinated by the U.S. Department of State, with the participation of the Bureau of International Narcotics and Law Enforcement Affairs and other federal agencies, which annually publish the “International Narcotics Control Strategy” report, detailing the drug trafficking situation in each evaluated country, with the most recent report highlighting the challenges faced by the Colombian Government in combating drug trafficking.

Considering this context, the U.S. president, Donald Trump, must decide whether or not to decertify Colombia, with a maximum deadline of next September 15. Although this entails various challenges depending on the type of impact of the sanctions, if it is a case of severe decertification, foreign direct investment would be one of the most affected activities. The country knows the commitment it has with the United States as one of its greatest allies in the fight against drug trafficking, but also because 42% of FDI in Colombia originates from the American country, which could lead to a drop in flows that will have significant effects on employment, production chains, and economic growth, which is why it is expected that this certification will be extended.

According to the same CEPAL report, even amidst these aggravating factors that have harmed and that must be taken into account when it comes to foreign direct investment, Colombia ranks third as the country where foreigners invest the most, preceded only by Brazil and Mexico, highlighting its nature as a key point for investment and economic growth in the region and demonstrating that despite these inconveniences, it is possible, reliable and profitable to invest in the country, through informed decisions well supported by the knowledge of experts on the subject.

Medellin Guru's Comprehensive Business and Taxes Series

At Medellin Guru, we are passionate about Colombia and committed to providing valuable insights for the business community. Our page features a blog series dedicated to business and taxation in Colombia, offering expats essential guidance and pertinent information to navigate the local landscape. Discover our articles on business strategies, tax regulations, and best practices for operating in Colombia here:

- How to File Income Taxes (Declaración de Renta) in Colombia

- How to Start a Business in Colombia as a Foreigner

- How to Legalize Foreign Direct Investment in Colombia

- How to Obtain a Business Visa

- How to Obtain a Colombia Investment Visa

- Investments: Risks of Investing in Real Estate in Colombia

- Santa Marta: The Current Top Choice for Property Investment

- Colombia’s IVA Tax & How Tourists Can Get an IVA Tax Refund

- US Taxes Expat’s Guide: Foreign Financial Reporting -Tax Strategy One

The Bottom Line: 2025 Colombia Economic Outlook: Indicators and Growth During the Year

Colombia continues to stand out as a promising market for foreign direct investment (FDI), even amidst global uncertainties and domestic challenges. The economic outlook for 2025 presents several challenges to recovering GDP, which can be mitigated through a strong performance by the Colombian Stock Exchange and significant investment flows into key sectors, including mining and oil, financial and business services (such as booming fintech and insurtech), manufacturing, and transportation and communications. While sectors like mining and oil remain dominant, a clear trend of diversification is evident, with notable growth in non-mining exports and a strategic focus on modernizing industries.

However, a realistic consideration of the Colombian economic landscape acknowledges challenges such as security issues, sociopolitical events, and the broader international economic context. Despite these hurdles, Colombia’s resilience is evident, as it remains the third-largest recipient of foreign capital in Latin America and the Caribbean, demonstrating its fundamental importance for the region’s economic growth.

Ultimately, Colombia is strengthening its position as a destination for future investments. With attractive valuations, growing liquidity, and sectoral diversification, the country offers a robust environment for foreign capital. For those looking to capitalize on these opportunities, particularly in the tangible and appreciating real estate sector, Real Estate by expatgroup.co serves as a strategic ally. They provide the best advice and correct guidance, assisting foreign investors in making informed decisions, navigating the market effectively. Or, if you’d like to start a business and even obtaining the Colombia Investment Visa, thereby bridging the path to successful investments in Colombia, expatgroup.co, is the best ally you’ll have.

Medellin Guru Social media

Be part of our community. Find out about news, participate in events and enjoy the best of the city.