We provide an updated 2024 guide for tourists to get an IVA tax refund. One of the downsides of living in Medellín or Colombia is that Colombia has a 19 percent IVA tax (a.k.a. value-added tax or VAT) on many products. This tax makes buying many things in Colombia more expensive than in some other countries.

The IVA tax in Colombia used to be 16 percent but was increased to 19 percent in February 2017. However, if you are a foreign tourist visiting and not residing in Colombia you can get a 100 percent IVA tax refund for many products purchased in Colombia, up to a limit.

Many countries in Latin America tend to have a VAT. Colombia’s 19 percent VAT tax is the same rate as in Chile. In Mexico, the VAT is 16 percent, in Peru, it’s 18 percent, in Brazil, the tax is 17 percent but can go as high as 25 percent, in Argentina, it’s 21 percent, in Uruguay, it’s 22 percent, and in Ecuador, the tax is 12 percent for standard goods and 15 percent for luxury goods.

The Colombia IVA tax refund is intended to encourage tourists to buy things in Colombia to bring back to their home country. But if you were born in Colombia but are a citizen of another country (a dual-citizen) and traveling to Colombia, the IVA tax refund doesn’t apply.

In this article, we’ll look at the IVA tax in Colombia in more detail, which has been updated for 2024. Also, we show how tourists can get an refund of this IVA tax for many items purchased in Colombia

Colombia's IVA Tax

Colombia VAT, which is known as the IVA tax, is the country’s main indirect tax, which is collected by DIAN. And it is levied at 19 percent on most goods and services sold in Colombia. However, there are some things that are exempt from the IVA tax. And some things are taxed at lower rates.

Among items that are taxed at the full 19 percent IVA tax are clothing, personal and household toiletries, movies, airline tickets, appliances, footwear, jewelry, oils, margarine, condiments (spices, sauces and dressings), spare parts for cars and vehicles (except electric ones, which have a 5 percent tax).

Also, it is important to take into account that, in November 2023, sugary drinks and ultra-processed foods such as cereals, cookies, breads, among others, will also begin to have a VAT tax.

Some electronic products will only be taxed beyond a certain price. For example, there are exemptions for lower-priced computers and tablets. For example, computers that have a value equal to or less than $1,900,000 are excluded from VAT, this applies to desktop computers (PCs), and laptops. Computers that exceed that value are taxed with VAT at the general VAT rate, today at 19%.

The IVA tax is 14 percent on domestic and imported beers. Also, there is a 5 percent IVA tax on several products such as coffee, toilet paper, lower cost bicycles, among others.

In addition, for some services the IVA tax is the lower 5 percent including prepaid medicine plans, surgery and hospitalization insurance policies and health insurance policies.

Medellin Guru Insurance Service

The insurance agency we partnered with has helped 1.377 Medellin Guru readers

Furthermore, some grocery items such as milk, eggs and fruits and vegetables and several other items are exempt from the IVA tax in Colombia.

The IVA tax is included in prices you see posted on items in stores. But your receipt will break out the IVA tax into the different categories, such as 19 percent, 5 percent or exempt (zero percent).

Colombia’s IVA Tax Refund

Foreign tourists not residing in Colombia have the right to a 100 percent refund of the IVA tax paid on several types of goods purchased in Colombia.

For this 2023. the regulations contemplate that a refund may be requested on all products taxed with VAT. Previously, only 12 product categories were contemplated for this procedure.

Likewise, foreign tourists may request a VAT refund when their purchases of goods, including sales tax, VAT, are for an amount equal to or greater than 3 UVT (Tax Value Unit), that is, a total of $108,924. With the previous regulations, purchases must be of a minimum of 10 UVT.

In addition, Colombian nationals who hold dual nationality are not considered to be foreign tourists or non-resident foreign visitors in Colombia. So, they do not have the right to the IVA tax refund.

How to Request a Refund

They can request a refund of VAT on taxed assets within the national territory for up to $8,482,200. The process is done when you leave the country. Before checking the baggage, the person must go to the DIAN offices, where they will receive attention from the company Global Blue Sucursal Colombia.s.

Additionally, all purchases eligible for a tax refund must have been paid for in person with a debit or credit card. Cash payments for purchases are not eligible for a tax refund.

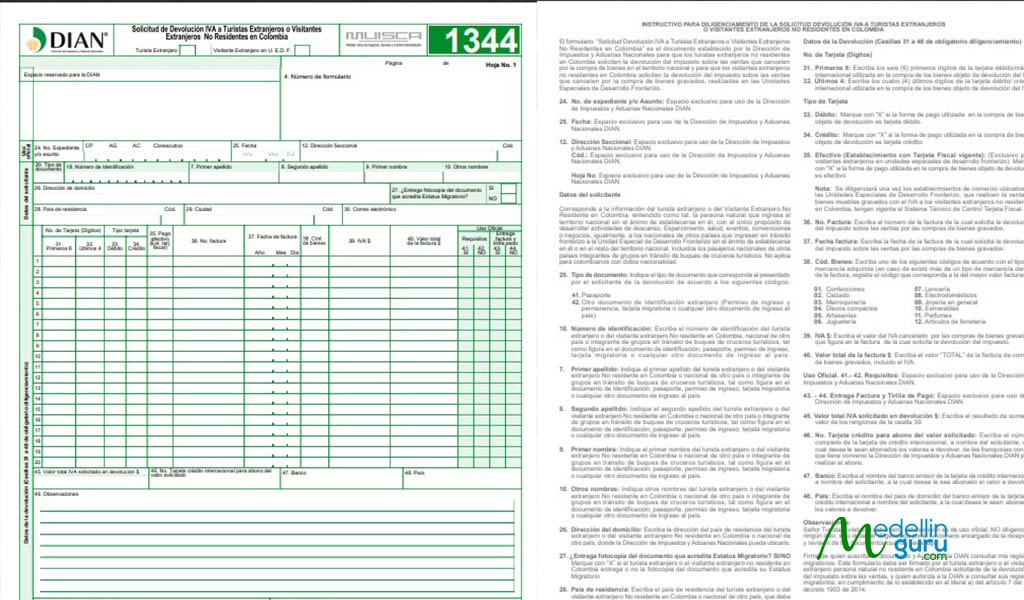

Form 1344 used to apply for the tax refund (form has been updated and is found in DIAN offices at airports).

Requirements for the VAT Tax Refund Application

The following are the requirements for an IVA Tax Refund according to DIAN:

- Complete Form 1344.

- Present Form 1344 to DIAN when exiting the country and before checking in with your airline.

- Show your original passport and submit a copy of the passport’s data page and the page with your most recent tourist stamp in your passport.

- Submit photocopies of sales receipt(s). The receipts must be no more than six months old.

- The purchase of taxed goods in Colombia must be done in person by a card payment terminal with an international credit and/or debit card issued outside of the country. And make sure to keep a copy of the credit card voucher and the additional receipt you get that has the IVA information on it for each purchase.

- The purchase of taxed goods must be done from merchants registered in the common sales tax system in Colombia and be supported by sales receipts that contain the breakdown of the IVA tax.

- Goods acquired with the right to IVA refund must effectively exit the country.

- No more than one refund application may be submitted per quarter.

However, note that Medellin Guru readers reported in November 2023 that the form has changed and if you download the form from the DIAN website before showing up at the DIAN office at an airport it can’t be used. So, budget some time at the DIAN office to fill out the form and make sure have copies of everything ready before you get to the airport.

Three months from the date the form is registered at a DIAN office located in an international airport or port, a credit will be issued to the international credit card indicated on the Form 1344 application form. The financial costs and notification expenses incurred will be deducted from the value refunded.

If you haven’t received your refund after three months, you can contact DIAN via email at devolucion_iva_turistas@dian.gov.co.

The Bottom Line: Colombia’s IVA Tax

Colombia has a relatively high VAT tax at 19 percent, which is a downside for living in the country. But several other countries in Latin America also have a relatively high VAT. So, Colombia isn’t unique in the region.

Fortunately for tourists, Colombia offers an IVA tax refund. The refund is straightforward to apply for. Most notably, I have talked to some tourists recently who received their tax refunds in about the three months, as promised by DIAN.

In addition, “How to get a Colombia IVA tax refund?” is a common question asked by expats visiting Colombia. So, we included this question in our list of Medellín frequently asked questions (FAQ).

Editors note: updated on June 13, 2023 With information on the new VAT refund categories, the new refund method and price updates.