Looking to reduce your tax burden?

Contact Tax Strategy One to set up a call with our experienced experts

International & US taxes

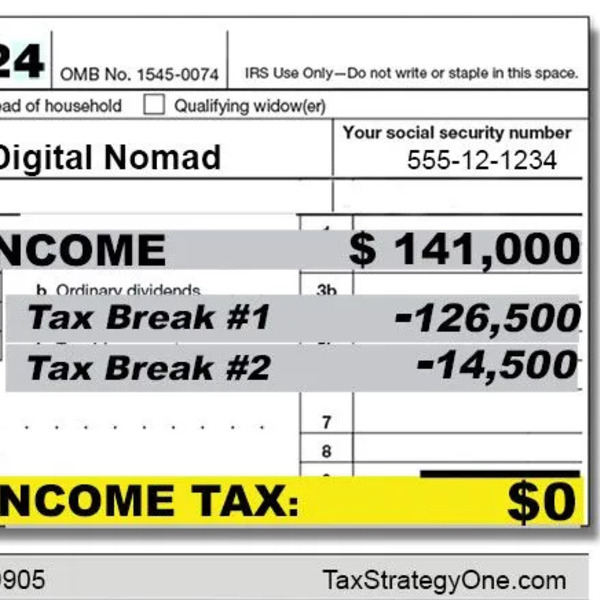

Tax Plans for Expats/Digital Nomads

Our expat/digital nomad tax strategies provide a holistic approach for ‘Living better Abroad’ and reveal the generous tax breaks available for expats.

International & US taxes

Strategic Tax Plans for Individuals

Our professionals tax strategists will assess your current situation and help you with proven approaches that help you permanently reduce your taxes and build generational wealth.

International & US taxes

Strategic Tax Plans for Companies

Our business tax strategies are designed to help you build long-term value with a clear roadmap to reduce taxes and greatly improve cash flow

Business Creation

Tax Strategy One & New Business

We simplifie business creation with expert guidance, helping you navigate the complexities of taxation and legal requirements.

Tax filing deadlines for US Taxes

March 15

U.S. Partnerships, U.S. Multi-Member LLCs, and Foreign Trusts

April 5

This is a standard tax deadline for those with a U.S. tax home

June 15

If you're living abroad, this is your extended deadline, no form required

October 15

With a simple extension form, this can be your new deadline.

December 15

A special extension for Americans abroad

Tax Strategy One recommends you be aware of these dates and ensure you're not hit with late penalties.

Extensions are only for filing your tax return. It doesn't provide an extension for any payments due, so it’s best to at least estimate and pay your US Taxes on or before the deadline.

Get professional advice

Scale up your savings with your own tax-smart plan by Tax Strategy One

Our expert strategies empower you to optimize your financial decisions, ensuring you keep more of your hard-earned money while staying compliant with tax regulations. Scale up your savings and secure your financial future.

US Taxes Expat’s Guide: Foreign Financial Reporting -Tax Strategy One

Embracing the nomadic lifestyle or settling as an expat in...

Read More